- Read Claudia’s post Invest in Women Business Ownership for a Robust Economy on the ASBC website or in Huffington Post.

- State of Micro and Entrepreneurship

- CAMEO Training – District Legislative Meetings, Responsible Lending

- The Goodies – This week’s highlight is early-bird registration rates for AEO’s May 18-20 national convention are good for the month of February!

District Legislative Meetings, Responsible Lending

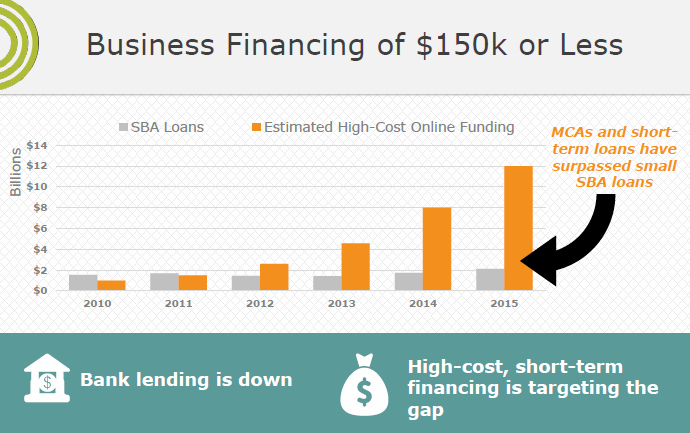

Online merchant cash advances dwarf SBA lending. Many times these online ‘loans’ will tank a business. CAMEO is launching an educational campaign to inform California’s small business leaders and elected officials on what good capital looks like. We’re asking all of our members to hold district meetings with their California state representatives during the March 18-25 break. We’ll follow up with meetings in Sacramento at our annual meeting. This is an issue that your clients need to know about, whether you are a lender or business assistance provider.

Online merchant cash advances dwarf SBA lending. Many times these online ‘loans’ will tank a business. CAMEO is launching an educational campaign to inform California’s small business leaders and elected officials on what good capital looks like. We’re asking all of our members to hold district meetings with their California state representatives during the March 18-25 break. We’ll follow up with meetings in Sacramento at our annual meeting. This is an issue that your clients need to know about, whether you are a lender or business assistance provider.

- Read the full press release – CAMEO Launches Campaign For BBOR.

- Learn more about the Small Business Borrower’s Bill of Rights.

Register for District Legislative Meetings for Responsible Lending webinar on February 23, 2016 at 3:00pm PT.

Personal visits are highly effective ways of helping legislators understand your position or program. Legislators welcome visits from constituents. They want you involved, even though they are busy people. Arranging these meetings is relatively easy and the meetings themselves are inexpensive and convenient. This webinar will walk you through logistics of setting up the meeting, how to prepare, what to do afterwards, and ground you in the Small Business Borrower’s Bill of Rights.

State of Micro and Entrepreneurship

State of Micro from FIELD

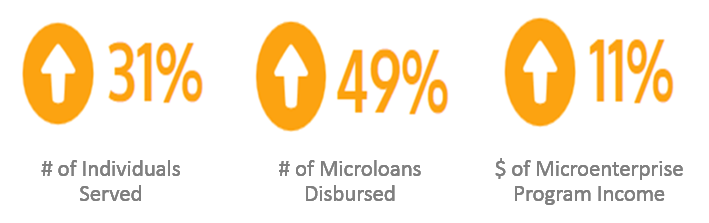

Every year, Aspen’s FIELD program collects data on the size and performance of the U.S. microbusiness sector (see chart for a selection of trends). CAMEO works with Aspen to gather the California data. We released the California Census numbers last year, but FIELD just published the aggregate data on their website. Here’s a brief look at how California compares to the rest of the country:

Every year, Aspen’s FIELD program collects data on the size and performance of the U.S. microbusiness sector (see chart for a selection of trends). CAMEO works with Aspen to gather the California data. We released the California Census numbers last year, but FIELD just published the aggregate data on their website. Here’s a brief look at how California compares to the rest of the country:

| U.S. | California | %CA of Total | |

| Clients served | 74,881 | 19,866 | 26.5% |

| Businesses served | 79,349 | 17,411 | 22% |

| Microloans disbursed | 57,095 | 3,134 | 5.5% |

Our state micro sector is serving more than our share (California’s population is 12% of the U.S. population), but our microlending sector, although it grew by 53%, has tremendous room to grow. The rich FIELD data goes deep into the sector and includes: industry trends on the field, program costs, efficiency, entrepreneur characteristics, etc. We encourage you to download their U.S. Microenterprise Census Highlights FY2014 to learn more and understand where the field is.

State Entrepreneurship from the SBA

On a related note, the United States ranks 49th in a World Bank ranking of countries by ease of starting a business. Last week, SBA Administrator Maria Contreras-Sweet gave a ‘State of Entrepreneurship’ speech at NASDAQ and challenged different players to make it easier for people to start businesses.

To local government institutions: Get out those scissors, streamline, rethink outdated rules, make it easier for companies to start and easier to operate. To financial institutions: I challenge you to get off of the sidelines and into the game and restore small business credit in America. To investors on both coasts: Invest in new places and new people. Diversify your portfolio and your perspective. Spur entrepreneurship and innovation in unlikely places. To innovators: Take the risk. Hack, disrupt, and innovate your way into the history books.

Read the address for more details.

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last Must Know. I have posted a running tab of current Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

CBA Symposium Awards: Submit an entry to win $500 for your organization plus one complementary registration fee to CBA’s Credit Building Symposium on July 14th! The awards are a one-page submission on Most Innovative Credit Building Product and Most Successful Credit Building Initiative. Email CBA for more information.

Free Webinar: The CDFI Bond Guarantee Program is an innovative federal credit program that offers credit-worthy certified CDFIs access to affordable long-term capital. Learn how this unique program incentivizes and empowers CDFIs to execute large-scale projects. Speakers will discuss the practical “nuts and bolts” of accessing the Bond Guarantee Program. Register for the webinar on Thursday, February 18, 2016 at 12:00 pm PT // 3:00 pm ET.

Small Business Stakeholder Roundtable: GoBiz will host a roundtable to give small business stakeholders (e.g. chambers of commerce, economic development agencies, federal, state and local technical assistance partners, small business owners and others) the opportunity to give input and feedback on small business issues and hear from special guests on economic development initiatives. Join GoBiz on Thursday, February 25, 2016, 10:00am-12:00noon at the Office of Lewis Brisbois Bisgaard & Smith LLP, 633 West Fifth Street, Los Angeles.

CDFI Fund Applications: The U.S. Department of the Treasury’s Community Development Financial Institutions Fund (CDFI Fund) opened the fiscal year (FY) 2016 funding round for the Community Development Financial Institutions Program (CDFI Program) and Native American CDFI Assistance Program (NACA Program). Congress appropriated $153 million for CDFI Program awards; $22 million for Healthy Food Financing Initiative Financial Assistance (HFFI-FA) awards; and $15.5 million for NACA Program awards. Applications must be submitted by April 18, 2016.

Non-Profit Technology Conference: If you’re interested in learning about how you and your organization can stay on top of technology trends – not to mention learn best practices, and get the support you need to use technology in a way that will truly fulfill your mission – then have a staff member or two attend the 2016 Nonprofit Technology Conference (16NTC). This year it’s in San Jose, California from March 23 – 25. Over 2,000 non-profit professionals will gather to share ideas, tactics, and strategies on using tech – in your communications efforts, as well as your programming. I’ll be going. If you have any questions about the conference, reach out to the organizers at NTEN: Nonprofit Technology Network. Don’t forget that we offer professional development assistance. Early bird ends February 29.

AEO National Conference: Save the date May 18-20, 2016 in Washington, DC to celebrate 25 years! EconoCon25 gathers actors in the small business space who impact America’s smallest businesses and underserved entrepreneurs — lenders, nonprofit and for-profit service providers, advocates and policy makers, entrepreneurs, funders and investors — for meaningful dialogue about how to innovate faster, partner smarter, and execute better. Early-bird registration rates are good for the month of February!

For Your Clients: The U.S. Small Business Administration has launched the registration for its 2016 Emerging Leaders executive-level training series for Los Angeles, Ventura, and Santa Barbara counties. This is the fourth year the program has been held in Southern California and the second consecutive year that there will be two cohorts, one of only three SBA districts to do so. Sacramento area business owners may also participate. Rich Mostert of Valley Small Business Development Corporation will be teaching the class in Bakersfield.

WE Decide 2016: CAMEO has joined Women Impacting Public Policy (WIPP) for their campaign – WE Decide 2016 – to engage women in business in the 2016 election. WE Decide 2016 is a nonpartisan, no cost collaboration with a focus on education and engagement. Leveraging insight, secure poll data and participant feedback, WE Decide 2016 will publish a Women in Business Priorities report prior to the national conventions to encourage political parties and their candidates to prioritize and discuss issues of significance to women entrepreneurs. Please take a moment to sign up your organization to become a WE Decide 2016 Supporter.