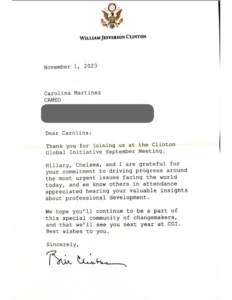

At the Clinton Global Initiative (CGI) 2022 Meeting, CAMEO committed to launch a National Community Development Financial Institution (CDFI) Academy to provide professional training and resources to thousands of CDFI staff members.

Microlending CDFIs around the nation need access to robust, best-in-class training specific to their impactful work providing lending capital to under-resourced entrepreneurs. However, few (if any) resources exist that provide ongoing educational opportunities and skill development to staff and board members of microlenders.

CAMEO is in an ideal position to fulfill this need given our track record delivering training. For the past five years, CAMEO has developed training as part of its CDFI Incubator for California microlending organizations that consistently sell out and have waiting lists. Each year an increasing number of microlenders around the country register for our classes and reach out to us for additional training resources to start new CDFIs or grow existing ones.

CAMEO committed at CGI to provide microlending best practices information, education, and training to more than 5,000 staff members of more than 400 CDFIs over three years. CAMEO anticipates that this professional training will allow CDFIs to increase their lending five-fold—deploying $500 million to 20,000 entrepreneurs over the three-year commitment period.

CAMEO is partnering on this project with Appalachian Community Capital (ACC), led by Donna Gambrell, a former CDFI Fund Director. ACC is a membership network of 30 CDFIs in 13 states which has invested $20 million in micro/small business CDFIs.

Sponsorship Opportunities

CAMEO seeks sponsors for course development and delivery to be created and implemented by CDFI experts and

consultants using the latest technology. The catalog is comprised of 45 courses. The budget to build out the new courses and deliver them at least once exceeds $1 million. Each course is a 2–3-hour session with an initial investment from CAMEO.

Our investment: CAMEO has invested over $500K the past 5 years to develop curriculum, consulting, and resources for CAMEO’s Academy including its signature Microlending Essentials (underwriting training) and CDFI Essentials (a year-long training cohort introducing key microlending and risk mitigation topics). This includes investment in our online Learning Management System. We are poised to include new courses that are vital to the sustainability and impact of microlending in the U.S. We invested additional funds in 2022 to develop and offer the first two new courses of the Academy.

Sponsor Levels

|  |  |

| LEAD SPONSOR: $300,000 | VISIONARY SPONSOR: $100,000 | COURSE SPONSOR: $15,000 |

| – Support the Academy’s outreach, promotion, and delivery infrastructure plus course evaluation, ongoing trainer recruitment, training, and onboarding and participant certification. – Discounted course pricing and access to advance registration before it’s made available to the public. – Listing as a Lead Sponsor. | – Sponsor one full set of one functional series in a course catalog including any additional new courses within the same series. – Discounted course pricing and access to advance registration before it’s made available to the public. – Listing as a Visionary Sponsor. | – One or more courses in the course catalog may be sponsored for $15K per course. – Sponsoring a course supports the curriculum development and first-time delivery of the course. – Listing as a Course Sponsor. |

COURSES

Upcoming Courses

- HR Series – August 21 & 28, 2025

REGISTER HERE

Join CAMEO’s National CDFI Academy for this two-part training series designed specifically for CDFIs ready to strengthen their internal HR practices. Led by veteran HR executive Shannon Mick, this practical and engaging course covers the building blocks of human resources management through a mission-aligned, equity-informed lens.

Past Courses

All past courses can be found and purchased via CAMEO Academy, our online learning platform.

- CDFI Fund Certification Basics 101 – Delivered August 24, 2022

- Learn the basics about the CDFI Fund including an overview of the CDFI industry and a deep dive into CDFI Fund certification requirements, benefits of becoming certified, CDFI grants and awards opportunities, and compliance and reporting.

- SBA Microloan Program Basics 101 – Delivered September 28, 2022 and November 2, 2023

- Learn about the benefits of becoming an intermediary lender in the SBA Microloan Program. We share what you need to know about the application process to the SBA, lending capital loans, and technical assistance (TA) grants.

- Strategic Management Framework Series – Delivered March 15 – April 5, 2023

- SMF 101: Overview of a Strategic Management Framework for CDFIs

- SMF 102: Strategic Goal Setting

- SMF 103: Multi-year Projections

- SMF 104: Annual Operating Plan & Functional Feedback Loop

- CDFI Governance Structure – Delivered November 28, December 5, and December 12, 2023

- Session 1: Governance Structure Overview

- Session 2: Board and Committee Practices

- Session 3: Recruitment, Orientation and Accountability

- Strategic Management Framework Series – Delivered February 8 – February 29, 2024

- SMF 101: Overview of a Strategic Management Framework for CDFIs

- SMF 102: Strategic Goal Setting

- SMF 103: Multi-year Projections

- SMF 104: Annual Operating Plan & Functional Feedback Loop

- SBA 102: Microloan Program Compliance and Reporting – Delivered March 21

Learn the basics of SBA Microloan program lending compliance and reporting, equipping each participant with the knowledge and skills to navigate organizational policies, intermediary relationships with SBA, and TA grants successfully. - CDFI 102: Understanding the 7 Tests of CDFI Certification – Delivered April 3

This course will provide in-depth guidance on the seven essential criteria required for financial institutions seeking certification as CDFIs. Developed in collaboration with industry experts and tailored to meet the standards set by the CDFI fund, this course offers a detailed examination of each test, ensuring participants gain a thorough understanding of the certification process. This session is intended for organizations seeking certification for the first time or are currently certified and in need of re-certification. - CDFI 103: Understanding the CDFI Certification Application – Delivered April 10

Join CAMEO as we navigate the revised CDFI Certification Application process, whether you are seeking certification for the first time or are currently certified and in need of re-certification. Gain valuable insights into the revised application, including updated FAQs, important dates, and timelines. - CDFI Microloan Origination & Portfolio Management Series-

- Series 1: CDFI Microloan Origination Overview

- Overview of Lending Functional Alignment: April 18

- Define core functions within a lending program.

- Identify effective alignment using a functional organizational chart.

- Learn assessment processes to evaluate current staff structure.

- Understand implementation steps to migrate staffing structure.

- Explore key elements of job postings and descriptions.

- Pipeline Development and Mission Driven Sales Team: April 25

- Define key terms in the CDFI Industry and related certification requirements.

- Learn strategies to identify target market characteristics and needs.

- Assess staff alignment to support target market characteristics.

- Understand components of pipeline development and tracking.

- Explore continuous improvement strategies for increased results.

- Intake, Application, Loan Packaging/Pre-Loan TA: May 2

- Define the role and importance of the intake function.

- Understand prequalification requirements and underwriting criteria.

- Identify elements of successful loan application and required documents.

- Explore efficient loan packaging processes.

- Differentiate pre-loan technical assistance from loan packaging.

- Microloan Underwriting I: May 9

- Understand prequalification requirements and underwriting criteria.

- Learn predictors or repayments for microloans.

- Assess credit and repayment for microloans.

- Evaluate cash flow through Global Debt Service Coverage.

- Microloan Underwriting II: May 16

- Revisit key content from Microloan Underwriting I.

- Define roles of co-signers and guarantors.

- Explore predictors of repayment for larger loans.

- Identify successful underwriting approaches.

- Strategies for staffing the underwriting function.

- Approval and Loan Committee: May 23

- Identify key elements of a loan approval authority policy.

- Define responsibilities and structure of a loan committee.

- Understand required loan committee skills for risk management.

- Define core elements of an effective loan committee charter.

- Overview of Lending Functional Alignment: April 18

- Series 1: CDFI Microloan Origination Overview

- CDFI Microloan Origination & Portfolio Management Series-

- Series 2: Portfolio Management Overview

- Overview of Portfolio Management: July 11

- Understand portfolio management functions and industry standards.

- Identify essential loan policies for portfolio management.

- Loan Closing, Servicing and Annual Loan Reviews: July 18

- Explore elements of a complete loan closing process.

- Understand loan disbursement policies and loan servicing.

- Define core elements of the annual loan review.

- Delinquency Management: July 25

- Understand delinquency management and repayment psychology.

- Define key industry terms and policies.

- Identify chronology and related activities of delinquency management.

- Define staff roles and responsibilities for effective collections.

- Portfolio Performance Oversight and Review: August 1

- Understand portfolio performance oversight goals and policies.

- Identify activities for effect portfolio management oversight.

- Define roles and responsibilities in portfolio management.

- Learn about portfolio management reporting.

- Overview of Portfolio Management: July 11

- Series 2: Portfolio Management Overview

- CDFI History and Impact – Delivered September 18

Join CAMEO’s National CDFI Academy for an in-depth session exploring the history and current state of non-traditional lending in the United States. We’ll discuss how these themes influence CDFIs and the Community Reinvestment Act (CRA). You’ll learn what is a CDFI and why CDFIs are important in our community. This is a perfect opportunity for your new staff and new board members to learn about our impactful industry. You will also gain insights into the CDFI industry today, including the types of work being done, and learn how to define and differentiate CDFIs. - SBA Microloan Program 101 – Delivered September 18

Join CAMEO Network’s National CDFI Academy to learn about becoming an intermediary lender in the SBA Microloan Program. We’ll break down the program’s structure and functionality, guiding you through the loan application process and its key requirements. You will also gain insights into the performance of applications and learn how to better support the small business owners you work with through this program. - Technology Training Series – Delivered May 15 – May 29

The Technology Series is designed to help CDFIs build strategic, effective, and sustainable technology systems. Each session will offer practical tools and insights to strengthen operations and support long-term growth through tech-driven solutions. - Overview of Lending Functional Alignment – Delivered June 3

Join CAMEO’s National CDFI Academy for Lending Functional Alignment, a training session for building effective, mission-aligned microlending operations. This session offers tools to strengthen your internal operations while deepening trust and collaboration across your local ecosystem. - CDFI Foundations: History, Certification Criteria, and Application Process – Delivered June 5, 18, and 26

CAMEO’s National CDFI Academy is offering a powerful series of trainings this June to strengthen your team’s understanding of the CDFI field from historical roots to certification eligibility requirements. Whether you’re onboarding new staff and board members or preparing for CDFI Certification/Recertification, these courses are timely and essential. - Intake, Application, and Loan Packaging/Pre-Loan Technical Assistance – Delivered June 24

In this interactive session we will explore the building blocks of intake, loan application, and packaging, and how to set up a mission-driven process that moves borrowers through intake toward approval. This session will also explore the difference between technical assistance and loan packaging, a distinction that can save your team time and build strong relationships with clients.

For more information, including a copy of the course catalog, please email Douglas Craven.