- Join/Renew Your CAMEO membership now! Membership drive extended to February 15.

- MicroLenders Forum Recap

- CFED Microbiz Scorecard

- The Goodies – This week’s highlight is Renaissance Entrepreneurship Center’s new online quarterly magazine – ReSource.

MicroLenders Forum Recap

What a day Tuesday! The 2016 MicroLender’s Forum, co-hosted by the Federal Reserve Bank of San Francisco (thanks Lena Robinson!), was sold out with over 70 participants that included our microlenders, regulatory friends and other colleagues. As Claudia said in the beginning, “It’s the engagement, caring, and wholeheartedness that sets our sector apart.” That engagement is as important to CAMEO and the network as it is to your clients. We thank everyone who participated for the rich discussions on sustainability and the landscape of small business lending.

What a day Tuesday! The 2016 MicroLender’s Forum, co-hosted by the Federal Reserve Bank of San Francisco (thanks Lena Robinson!), was sold out with over 70 participants that included our microlenders, regulatory friends and other colleagues. As Claudia said in the beginning, “It’s the engagement, caring, and wholeheartedness that sets our sector apart.” That engagement is as important to CAMEO and the network as it is to your clients. We thank everyone who participated for the rich discussions on sustainability and the landscape of small business lending.

During the morning session, we talked about guideposts for sustainability and how our members are moving toward sustainability. Guideposts included: finding a balance between ‘high touch’ and ‘transactional’ business models, tensions in scaling, increasing earned revenue/decreasing costs, strategic partnerships, finding new sources of subsidy, and using subsidies to build the borrower pipeline. Generally speaking, a 50% self-sufficiency ratio helps balance mission and revenues. The Treasury’s minimum prudent standard is 40%, while the median CAMEO microlender had a self-sufficiency of 30%. We had a big conversation about self-sufficiency ratios and how to move toward the 50%. And one microlender challenged us to rethink the way we operate and move toward 100% self-sufficiency, which he believes is possible with tremendous efficiency gains.

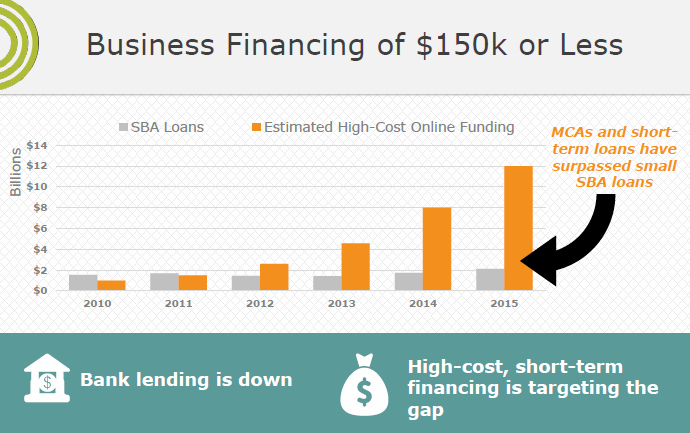

Ami Kassar, founder of Multifunding, calls the small business lending landscape the ‘wild west’. He told us all about the biggest online lending segment for small business loans and they aren’t loans at all, they’re Merchant Cash Advances (MCA). MCAs outweigh other lending by a factor of six (see graph). Often MCAs are high-cost and short-term and can easily put a small business into bankruptcy. He also said that it’s difficult to work with CDFIs because his firm is a national referral firm and CDFIs vary too much in product and process. He’d like to see a standardized product with a streamlined process put out by the CDFIs so that his firm could refer borrowers.

Ami Kassar, founder of Multifunding, calls the small business lending landscape the ‘wild west’. He told us all about the biggest online lending segment for small business loans and they aren’t loans at all, they’re Merchant Cash Advances (MCA). MCAs outweigh other lending by a factor of six (see graph). Often MCAs are high-cost and short-term and can easily put a small business into bankruptcy. He also said that it’s difficult to work with CDFIs because his firm is a national referral firm and CDFIs vary too much in product and process. He’d like to see a standardized product with a streamlined process put out by the CDFIs so that his firm could refer borrowers.

CAMEO is launching an educational campaign to inform California’s small business leaders and elected officials on what good capital looks like and the Small Business Borrower’s Bill of Rights. We’re asking all of our members to hold district meetings with their California state representatives during the March 18-25 break. We’ll follow up with meetings in Sacramento at our annual meeting. We’ll be holding a preparation webinar on February 23. Stay tuned for details. You can read the full press release – CAMEO Launches Campaign For BBOR. TA providers – this is an issue that your clients need to know about, whether or not you do loan packaging.

Also, a big shout out to our friends. First, Small Business Majority for holding a legislative staff briefing in DC today on the opportunities and challenges presented by the growing alternative lending space for small businesses. Second, CFED, who held a webinar about “The Impact of Predatory Lending on Small Businesses.” Both are educating audiences about the capital challenges facing small businesses and efforts to promote the BBOR.

CFED Microbiz Scorecard

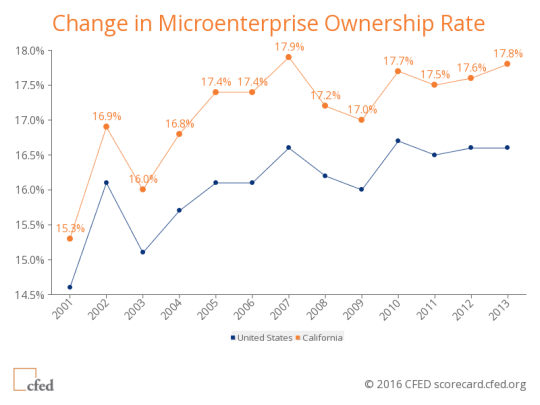

California Receives a ‘C’ Grade for Microbusiness from CFED’s 2016 Assets & Opportunity Scorecard. The Assets & Opportunity Scorecard is a comprehensive look at Americans’ financial security, The Scorecard enables states to benchmark their outcomes and policies against other states in five issue areas: Financial Assets & Income, Businesses & Jobs, Housing & Homeownership, Health Care, and Education.

California Receives a ‘C’ Grade for Microbusiness from CFED’s 2016 Assets & Opportunity Scorecard. The Assets & Opportunity Scorecard is a comprehensive look at Americans’ financial security, The Scorecard enables states to benchmark their outcomes and policies against other states in five issue areas: Financial Assets & Income, Businesses & Jobs, Housing & Homeownership, Health Care, and Education.

If we tease out businesses from jobs, California is a mixed bag. We rank 9th in microbusiness ownership (1-4 employees), but 39th in small business ownership (5-99 employees). We do better on business ownership by gender than the national average, but are more unequal when it comes to race. We’re in the bottom half of states of business creation and small business loans.

Read the rest of our blog post – California Receives a ‘C’ Grade for Microbusiness

- Download the full California Assets & Opportunity Scorecard.

- Download the estimated impacts for California (if they performed as well as the best state.)

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last Must Know. I have posted a running tab of current Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

New Member Magazine: Renaissance Entrepreneurship Center recently published a quarterly magazine online -download ReSource and share with your networks.

Industry News: Business Forward hosted a conference call with Sebastian Gomez, Chief of the Office of Small Business Policy at the Securities and Exchange Commission (SEC) to discuss implementation of SEC’s crowdfunding rule (read our blog post).

Industry News: The Office of Small Business Advocate (OSBA) has released the 2014-15 Annual Report to Governor Jerry Brown and the California State Legislature. The report can give you an idea of what the state’s priorities will be for the coming year.

Free Webinar: Are you looking for ways to help small and microbusiness owners build financial capability? Join CFED on February 10 from 11:00am-12:00noon PST // 2:00-3:00pm EST to learn about three creative approaches to teaching business financial management and the client insights that shaped the way these organizations designed their programs.

CDFI Fund Applications: The Department of Treasury announced that they are now accepting applications for the CDFI Fund. CDFI Certification Applications must be received by the CDFI Fund by February 12, 2016. Qualified Issuer Applications must be submitted by March 4, 2016. Guarantee Applications must be submitted by March 18, 2016. Friedman and Associates is accepting requests to write CDFI FA and TA applications. E-mail Jason by February 1 to discuss your needs.

Non-Profit Technology Conference: If you’re interested in learning about how you and your organization can stay on top of technology trends – not to mention learn best practices, and get the support you need to use technology in a way that will truly fulfill your mission – then have a staff member or two attend the2016 Nonprofit Technology Conference (16NTC). This year it’s in San Jose, California from March 23 – 25. Over 2,000 non-profit professionals will gather to share ideas, tactics, and strategies on using tech – in your communications efforts, as well as your programming. I’ll be going. If you have any questions about the conference, reach out to the organizers at NTEN: Nonprofit Technology Network. Don’t forget that we offer professional development assistance.

AEO National Conference: Save the date May 18-20, 2016 in Washington, DC to celebrate 25 years! EconoCon25 gathers actors in the small business space who impact America’s smallest businesses and underserved entrepreneurs — lenders, nonprofit and for-profit service providers, advocates and policy makers, entrepreneurs, funders and investors — for meaningful dialogue about how to innovate faster, partner smarter, and execute better.