Update – implications of President Obama’s SOTU remarks for small business

I attended the call following the SOTU and not much new came out. The Administration’s efforts that will affect small business include:

- Infrastructure – improve so that goods can more easily go to market

- Regulatory Environment – reduce redundancy while leveling playing field between small and large businesses

- Political Life – how can we come together with different opinions and engage in discourse to solve problems

- ACA enrollment – locking in healthcare benefits

- Imperatives of New Economy – research the flexibility and portability of benefits such as retirement and other components of the safety net

- President Obama’s Last State of the Union

- Five Things for 2016 – Join/Renew Your CAMEO Membership

- The Goodies – This week’s highlight is next Tuesday, January 19. Claudia speaks at a Go-Biz event in San Francisco; Go-Biz holds a California Competes webinar; and WIPP holds a call with the SBA to talk about women’s entrepreneurship. (Scroll to Goodies for details.)

President Obama’s Last State of the Union

President Obama gave his 8th and final State of the Union address on Tuesday night. He urged us to look into the future and choose hope instead of fear, but what does this mean for small and microbusinesses?

President Obama gave his 8th and final State of the Union address on Tuesday night. He urged us to look into the future and choose hope instead of fear, but what does this mean for small and microbusinesses?

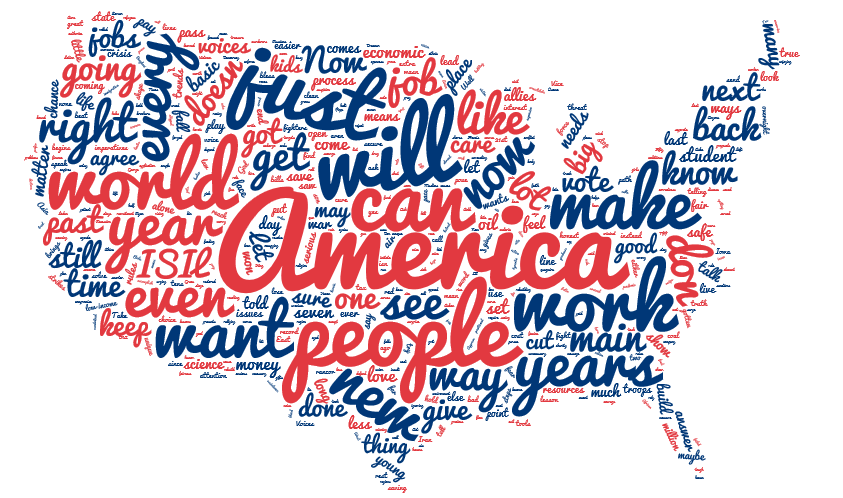

As you can tell from the above diagram, ‘small business’ was not a focus of his speech. His first mention of business is about one-third of the way into his speech:

That, by the way, is what the Affordable Care Act is all about. It’s about filling the gaps in employer based care so that when you lose a job, or you go back to school, or you strike out and launch that new business you’ll still have coverage.

President Obama talked about education, healthcare, wage insurance and other ways to help inequality. He brought up many issues that hold opportunities for small business, but he didn’t mention any specifics on what he would do for our sector. For example, he voiced his support for the clean energy, but in the context of energy production and not the opportunities that it affords small business. Clean energy jobs such as solar installation and energy efficiency audits are local jobs that pay good wages and contribute to local economies. Many of the companies that do the work are very small businesses with fewer than five employees.

An analysis of the words President Obama used found that ‘business/es’ was mentioned nine times; that ranks alongside security and workers, and higher than families, kids, energy, democracy, planet and military. That, and something else that he said give us hope that the administration will support our sector – if only for the next 18 months.

…in this new economy, workers and start-ups and small businesses need more of a voice, not less. The rules should work for them.

Small Business Majority will hold a call with the White House today, January 14, 2016 at 11:30am PST // 2:30pm EST to discuss the implications of the president’s remarks for small business. Register for this call and receive call-in information. I will be on the call so if you can’t make it, I’ll recap you next week.

Three Things for 2016 – Join Us!

As President Obama said, “We live in a time of extraordinary change – change that’s reshaping the way we live, the way we work, our planet, our place in the world.”

CAMEO is excited to be front and center of that change and is ready for 2016! Come along with us for the ride – join/renew your CAMEO membership.

We start the year off with our MicroLenders Forum on January 26, co-hosted by the Federal Reserve Bank, San Francisco. Ami Kassar, a prominent thought leader in the online lending sphere and our keynote speaker, will discuss the disruption happening in small business lending. His discussion will lead into to our plans to educate our legislators on responsible lending practices and online lending. Many thanks to Lena Robinson from the Federal Reserve for her support of the micro sector.

CAMEO will continue to champion women’s entrepreneurship. We’ll advocate in Washington and Sacramento for more resources. And starting in the spring our WOVEN program will expand to at least three locations in Southern California: Inland Empire WBC (San Bernardino), RISE Financial Pathways (Los Angeles) and South San Diego SBDC.

Shufina English, our program director, is working with the Specialty Foods Association to offer up a full day of learning about the food industry: business and marketing opportunities, how to stay viable and competitive, and financing. This time, our Go-to-Market program will take place in Chico in April.

That’s just the start. We’re excited to bring you more training on current issues that affect small business, capacity building, regional meetings, and more. We’ll be advocating on behalf of the self-employed, microbusiness and the D-I-Y economy with our elected officials, our colleagues, and other stakeholders. Be a part of our dynamic network and join/renew your CAMEO membership before February 1.

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last Must Know. I have posted a running tab of current Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

Member Kudos: Jenny Kassan, formerly of Cutting Edge Capital, was appointed to the SEC’s small business advisory committee. She’s also written a free e-book – How to Get a YES! from Investors.

For Your Clients: The Governor’s Office of Business and Economic Development (GO-Biz) announced a series of 15 workshops across California designed to help businesses apply for the California Competes Tax Credit (CCTC). Your clients can benefit from the $75 million in tax credits available to business that want to come to California or stay and grow in California. The next application session is from January 4-25, 2016. A number of very small businesses have received tax credits of $20,000 or more, including an accounting services firm, a commercial printer and an animal memorial services company. Go-Biz is hosting a webinar on Tuesday, January 19, 2016 at 10:30am.

CAMEO Speaking: Claudia will talk about microbusiness on an access to capital panel during the Small Business Summit put on by the Governor’s Office of Business and Economic Development (GO-Biz) on January 19, 2016. All small businesses are welcome – tell your clients about it! There will be presentations on the new California Business Portal, small business financing, trade and export resources, state tax credits and incentives, and much more. The details: free to attend, 8:00am – 3:00pm at Milton Marks Auditorium, 455 Golden Gate Ave, San Francisco, CA 94102.

Women-Owned Small Business Chat: Join WIPP for an online chat with Sean Crean and Alison Mueller of the SBA to discuss the WOSB set aside program and its new legislation. Ann Sullivan will moderate the conversation insuring all points of interest are covered, and will field your questions from the audience. Register for the call on January 19, 2016 at 11:00am PST // 2:00pm EST. Contact Lin Stuart for questions.

Funding Opportunity: The U.S. SBA’s Office of Women’s Business Ownership announces a Women’s Business Center Grant Opportunity. The purpose of this grant is to provide funding for up to six (6) non-profit organizations that will provide services to the population of Alaska, California, Guam, Kentucky, Mississippi, Missouri, North Carolina, Oregon, Pennsylvania, Puerto Rico, South Carolina, Texas or West Virginia to start a new, community-based Women’s Business Center (WBC). Deadline is January 28, 2016.

CFED Scorecard: Join CFED at 9:00am PST // noon EST on Monday, January 25 for the webinar release of the 2016 Assets & Opportunity Scorecard. Each year, the Scorecard offers the most comprehensive look available at Americans’ financial security today and their opportunities to create a more prosperous future. One highlight is particularly concerning – the growing divide between white-owned and minority-owned businesses.

CDFI Fund Applications: The Department of Treasury announced that they are now accepting applications for the CDFI Fund. CDFI Certification Applications must be received by the CDFI Fund by February 12, 2016. Qualified Issuer Applications must be submitted by March 4, 2016. Guarantee Applications must be submitted by March 18, 2016. Friedman and Associates is accepting requests to write CDFI FA and TA applications. E-mail Jason by February 1 to discuss your needs.

AEO National Conference: Save the date May 18-20, 2016 in Washington, DC to celebrate 25 years! EconoCon25 gathers actors in the small business space who impact America’s smallest businesses and underserved entrepreneurs — lenders, nonprofit and for-profit service providers, advocates and policy makers, entrepreneurs, funders and investors — for meaningful dialogue about how to innovate faster, partner smarter, and execute better.