National Women’s Business Council

First published June 2013

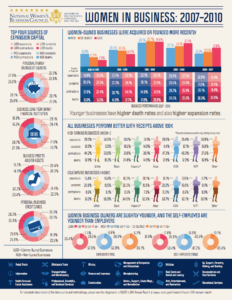

Despite the difficult economic climate during the Great Recession, women-owned businesses performed just as well as men-owned businesses during the period 2007 – 2010, and in many cases outperformed their peers.

In its latest infographic, ‘Women in Business: 2007 – 2010’, the National Women’s Business Council (NWBC) builds off its previous analysis in the 2012 annual report to track the performance outcomes of approximately 98% of employer establishments identified in the 2007 Survey of Business Owners. Using the data sources available to the Census Bureau, NWBC and the Census Bureau have tracked the expansions and contractions in employment, as well as the closing or sale of businesses, through 2010. This is the most recent government data available on women business owners.

Throughout the recession, women-owned businesses were active in the largest industries and have a greater percentage of firms making more than $1M in revenue in several industries, including retail trade, wholesale trade, manufacturing, and construction. Women-owned businesses also lost a smaller share of jobs than their male counterparts. Both men- and women-owned businesses that used business loans or business profits to fund expansion during the recession did better than those businesses that used credit cards or personal savings.

Women-owned businesses using bank loans or business profits died slightly more frequently, but also expanded more frequently, than men-owned businesses. Overall, women-owned businesses tend to be founded or acquired more recently than men-owned businesses, with only 7.6% of women-owned businesses done so before 1980 (compared to 15% for men-owned businesses). It’s important to note because newer businesses were more likely to go out of business, but also more likely to hire new employees. In fact, of businesses that survived the recession, almost 50% hired new employees.

The challenge remains; the majority of women-owned firms are clustered in industries that have lower levels of revenue on average, which limits the economic impact these businesses owners can make. Men-owned businesses tend to proportionately outnumber WOBs in high-earning industries; similarly, the industries with high representations of women are also the five lowest-earning industries by measures of median revenue per business. This is an area of interest for NWBC because it indicates that some of the macro level gaps in business performance, most notably revenues, may be the result of these structural choices to enter certain industries, rather than the performance of individual firms.

Download Resource