Take Action: Advocate for CDFI and Microloan Appropriations

Join Us for Microlenders Forum

MicroLending Essentials Wrap Up

BBOR Update

Research: New York Fed’s 2016 Small Business Credit Survey on District 12

New Small Business Credit Survey Needs Your Help

News

Gift your organization a year of training, advocacy and connections, renew your CAMEO membership –

CLICK here!

Take Action: Advocate for CDFI and Microloan Appropriations

The federal government is operating under a continuing resolution for FY 2018 appropriations until

December 22, 2017 (and will likely be extended until January 19, 2018). That means 1) appropriations are steady at FY 2017 levels and 2) the House and Senate need to reconcile their appropriations bills by that date to fund the government (else it shuts down.)

The House has appropriated $190 million for the CDFI Fund and the Senate $248 million. The CAMEO request is for $250 million.

Download our

Appropriations Request for FY 2018, then use the links below to

contact your congressmembers by December 21.

Join Us for the Microlenders Forum

February 13, 2017

9:30am to 3:30pm

Google Foundation

188 Embarcadero, San Francisco

Register for the Forum – Exploring Future Directions in a Fluid Environment.

With change as the new normal, this Microlenders Forum will explore how we can create stability and sustainability for our organizations, while serving California’s small and microbusinesses. What’s in store:

- The Fed Survey Results on Small Business Credit Needs in California – Jiwon Kim, SF Federal Reserve

- The Advantages of Community Advantage for Microlending – Mark Quinn

- Future of Partnerships with the CDFI Industry – Bankers Panel

- New Tech Tools: Lending Front and Pacific Community Ventures

Microlending Essentials Wrap Up

CAMEO held its inaugural three-day, hands-on training for business coaching and lending organizations on the theory and practice of microlending underwriting in Los Angeles in early November.

Susan Brown, CAMEO’s microloan specialist, developed the training which covered underwriting, global cash, credit history, debt-to-income and bank statement analyses. Participants applied underwriting criteria and wrote credit memos based on examples of real microloan applications, made recommendations, and structured each deal.

For business coaching organizations, this training helped staff think like a lender so that referrals to lenders experience a higher rate of success. In turn, these organizations will be able to train business clients in the key components most likely to get them qualified for financing. Finally, staff can now talk specific underwriting terms to lenders, to better discern how to channel referrals to the most appropriate lender. For community lenders the training provided a framework to make more consistent credit decisions for stronger portfolio performance and loan volume for greater impact.

Read what made this training valuable and what participants had to say in our

Microlending Essentials Wrap-Up. If you are interested in this training, please

contact us.

CAMEO is committed to seeing the sector grow and has developed new tools for microlenders to meet that goal. In addition to this training, we’ve started to develop the

Community Loan Policy Manual Workbook to create fully developed loan policies.

BBOR Update

In addition to a revised Small Business Borrowers Bill of Rights (BBoR), the Responsible Business Lending Coalition has crafted a policy platform that reinforce the six fundamental rights that all small business borrowers deserve.

The Coalition will host a webinar on January 31, 2018 at 11:00am PT for signatories, endorsers, and other stakeholders to share their ideas for state and federal policies that promote responsible lending. To rsvp please email

info@responsiblebusinesslending.org

If you haven’t already, affirm your commitment to the

Small Business Borrowers’ Bill of Rights by becoming a signatory or an endorser.

In related news, Small Business Majority recently released a new poll that shows small business owners are worried about predatory lending and agree there should be

stronger oversight of alternative lenders to help promote transparency and fairness.

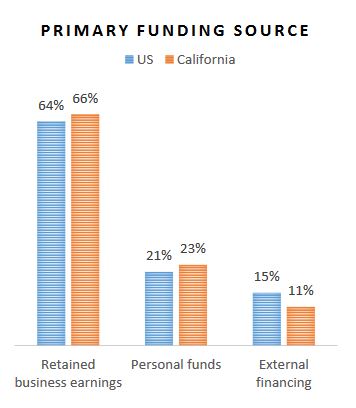

Research: New York Fed’s 2016 Small Business Credit Survey on District 12

The

2016 Small Business Credit Survey: Report on District 12, released in November by the Federal Reserve of San Francisco, takes an in-depth look at small business performance and debt at the state level for Arizona, California, Hawaii, Nevada, Oregon, and Washington to help policy makers, researchers, and service providers better understand their regional markets. Some key findings include:

- The greatest financial difficulties that businesses in California face are operating expenses and credit availability or funds for expansion.

- 51 percent of Californian firms did not apply for funding.

- The most common reason for not applying for funding is aversion to taking on more debt (30 percent of firms). 21

percent of firms also felt discouraged from applying, out of fear of being turned down.

New Small Business Credit Survey Needs Your Help

That great report that you just clicked on above is expanding. CAMEO is partnering with the

Federal Reserve on a Small Business Credit Survey for both pre-start and existing businesses to

help business service providers and lenders understand real-time business conditions. The deadline has been extended to December 31, 2017.

Reports planned for 2017 include: reports on minority-owned, women-owned, micro, and rural firms.

Right up our alley and important to our field! Help the Federal Reserve, the sector, and the clients you serve.

We are asking you to send an email to your client and have provided a draft below. Feel free to edit as necessary.

SUBJECT LINE: “How is your business doing?” Or “Small Business Owners: Make your voice heard!”

Dear Business Owner or Manager,

As a CAMEO member, [MYORGNAME] is partnering with the Federal Reserve on a Small Business Credit Survey for both pre-start and existing businesses, and we’d like you to participate. Your answers will help business service providers and lenders understand real-time business conditions. This short survey takes less than 9 minutes to complete. Individual responses are confidential and summary results will be shared with you.

Take the survey today!

Questions? Contact SmallBusinessResearch@atl.frb.org.

If you have problems with the link above, copy and paste the following URL into a new browser window: https://frbatlanta.co1.qualtrics.com/jfe/form/SV_0pQZOEEPPnpFNlj?orgid=CAMEO&parentid=&reserve_bank=SF.

News

Check out the following news stories:

]]>

Check out the following news stories:

Check out the following news stories: