Since 2009, the Federal Deposit Insurance Corporation (FDIC) has conducted a “Survey of Unbanked and Underbanked Households,” which estimates the proportion of households that do not fully participate in the banking system. These surveys are helpful to assess the inclusiveness of the current banking system across the country.

In the 2017 survey, the FDIC found that 6.5% of American households were unbanked while 18.7% were underbanked, meaning they have accounts with a federally insured institution but also turn to alternative financial service providers such as pawn shops, payday lenders, and non-bank check cashers. The unbanked rate for 2017 is the lowest since the survey began and fell 0.5% from 2015 when the survey was last conducted. This decline is the result of the improved socioeconomic status of many American households in recent years, according to the FDIC.

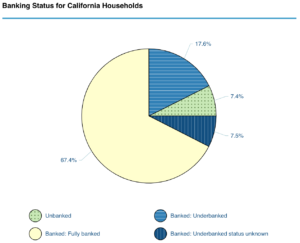

The unbanked and underbanked rates in California are similar to the national averages. 7.4% of Californian households were unbanked, while 17.6% were underbanked. The unbanked rate is higher than in most other states, which can be explained by the larger number of immigrants in California, whose access to financial institutions is hampered by irregular residence status and language barriers.

Of particular concern is the proportion of minority and low-income households that remain unbanked or underbanked. In California, 20.5% of black households and 14.5% of Hispanic households were unbanked, while 25.4% of black households and 26.6% of Hispanic households were underbanked. That is a stark contrast to the 77.2% of white households that are fully banked. Similarly, 46.3% of Californian households with a family income of less than $30,000 were unbanked, while 36.5% were underbanked. The figures for the nation as a whole reflected these same trends.

A lower participation in the mainstream financial system means that black, Hispanic, and low-income households can’t access fair and affordable credit, can’t save for emergencies or retirement, and are more vulnerable to predatory lending practices with no consumer protections. This economic exclusion further relegates these communities to the margins and widens the already alarming racial wealth gap.

It is imperative to understand the causes behind this lack of participation in the banking system so that we can devise solutions and advocate for policies that increase Americans’ access to safe financial institutions. The primary reason unbanked households give for not having a bank account is not having enough money to keep in it (34%). This is followed by a mistrust of banks (12.6%) and account fees that are too high (8.6%). Aside from general economic policies to improve people’s conditions so that they don’t live paycheck to paycheck, there are plenty of things we can do to change their perception of banking institutions while at the same time making these more accessible.