- State of the Union, Wealth Inequality and Microbusiness

- Renew or Join CAMEO

- The Goodies – This week’s highlight includes CFED’s webinar release of the 2015 Assets and Opportunity Scorecard at 9:00am PST // noon EST on Thursday, January 29.

State of the Union, Wealth Inequality and Microbusiness

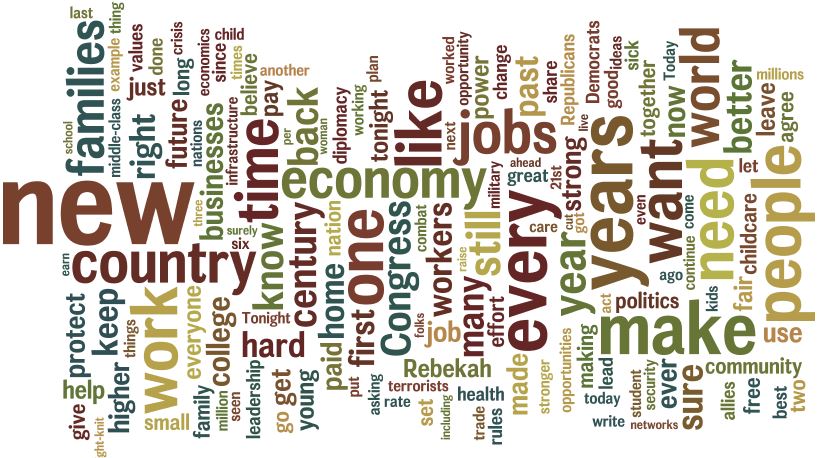

On Tuesday, President Obama’s State of the Union focused on middle-class economics.

On Tuesday, President Obama’s State of the Union focused on middle-class economics.

“Will we accept an economy where only a few of us do spectacularly well? Or will we commit ourselves to an economy that generates rising incomes and chances for everyone who makes the effort?”

Turns out that many Republicans agree with the President – that wealth inequality is a problem. However, most of the solutions that are offered – e.g. minimum wage, family leave – aren’t ones usually associated with Republicans. We’d like to offer them a solution that they can embrace – invest in small business ownership and the infrastructure that supports it. In March, when Claudia goes to Washington DC for the AEO board meeting, she’ll urge the new Republican leadership in the House and Senate to seize the opportunity that is #microbiz as a way to boost the middle class.

Renew or Join CAMEO

Give your organization everything CAMEO has to offer. Your membership dues easily pay for themselves with high quality programs, free trainings, individual training opportunities, discounts on professional communications tools, member meetings and the priceless intangible benefits of collaboration and support.

Give your organization everything CAMEO has to offer. Your membership dues easily pay for themselves with high quality programs, free trainings, individual training opportunities, discounts on professional communications tools, member meetings and the priceless intangible benefits of collaboration and support.

Renew your membership or join our dynamic network of organizations and individuals by February 1, 2015. Together, we build businesses that create local jobs and grow California’s economy. In 2015, we will bring you more exciting programs and resources – including an expanded advocacy effort in Sacramento to bolster women’s entrepreneurship and increase microlending.

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last Must Know. I have posted a running tab of current Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

Industry News: Janie Barrera, who helped found and has served as President and CEO of Accion Texas Inc. for more than 20 years, revealed that the nation’s largest nonprofit small business microlender will now operate under a new name – LiftFund. LiftFund provides startup and small business loans from $500 to $250,000 and partners with the U.S. SBA 504 loan program to service loans up to $5.5 million. It also offers counseling and financial education to help entrepreneurs learn how to start, grow and manage their businesses and to establish and maintain good credit.

Industry Trends Webinar: Join CFED at 9:00am PST // noon EST on Thursday, January 29 for the webinar release of the 2015 Assets and Opportunity Scorecard. Each year, the Scorecard offers the most comprehensive look available at American’s financial security today and their opportunity to create a more prosperous future. It is a powerful research and advocacy tool that helps paint the full picture of household financial insecurity in America. This year’s Scorecard brings together over 130 policy and outcome measures for all 50 states and the District of Columbia to help make the case for asset-based policy reform that expands economic opportunity for all Americans.

Funding Opportunity: The Walmart Foundation’s 2015 State Giving cycle is now open. The Foundation is also offering a webinar, Anatomy of a Grant, on February 3, 2015 from 1:00-2:00pm PT // 3:00-4:00pm CST to get deeper insight into the grant-making process.

For Your Clients: Now through February 6, 2015, businesses can enter the American Small Business Championship by sharing your story. Two small businesses per state will win training from SCORE, a $1,000 Sam’s Club Gift Card, publicity and more. Learn more about the American Small Business Championship.

For Your Clients: Our colleagues at ASBC invite you/your clients to attend Venture Summit West, the premier venture gathering in Silicon Valley. Come meet, interact and network with more than 500 VCs, Corporate VCs, angel investors, investment bankers and CEOs of early stage and emerging growth companies on February 10-11, 2015 at the Computer History Museum in Mountain View, CA.

2015 CDFI Coalition Institute: Registration is open for the Institute on February 24-25th in Washington, DC. The tentative agenda includes a discussion of the likely approaches of the new Congress to housing and community economic development programs, including tax expenditure programs like the LIHTC and NMTC. Early bird registration ends January 24, 2015.

Funding Opportunity: The CDFI Fund is providing an additional 45-day application submission window for any eligible organization that did not submit a SECA application by the original application deadline of November 24, 2014. Any new SECA applicant can also submit a HFFI application by following the instructions in the application guidance materials, which can be found on the CDFI Program pages of the CDFI Fund’s website and through Grants.gov. New SECA applicants must submit their applications through Grants.gov by 11:59 PM EST on March 5, 2015.

Funding Opportunity: The U.S. Department of Health and Human Services, Administration for Children and Families (ACF), Office of Community Services (OCS) today announced the next funding round for CED and CED-HFFI grants. These are extremely competitive grants that supports social enterprises that create jobs for low-income individuals and require a considerable amount of pre-planning. Friedman Associates will partner with a limited number of CDCs and CDFIs to write successful proposals. The grant deadlines are April 24, 2015.

New Essay: Joyce Klein of Aspen Institute’s FIELD program writes how impact investments can be used to scale microlending. The essay appears in a larger publication – Bottom Line – that addresses how impact investment can improve economic mobility in the U.S.

New Data Source: The Federal Reserve has put together some nifty data for the following counties: Alameda, Humboldt, Kern, Los Angeles, Riverside, San Francisco, and Tulare for their Vantage Point Community Indicators Project. Info includes demographic, educational, financial stability, employment, and housing measures for a sample of cities, towns, and/or zip codes in the county, with comparative measures included for the US, your state, and your county. The reports include presentation-ready graphs that you are welcome to use in your own work and share with your community.