- Microbusiness Leaders Promote Inclusion at AEO

- Faces Winner Sacred Mountain Spa

- The Goodies – This week’s highlight is Wells Fargo Diverse Community Capital round 2 applications are open. Interest forms are due June 1, 2016.

- Watch and share our WOVEN Video.

- Read Claudia’s piece: “Business Ownership Will Close the Wealth Gap“.

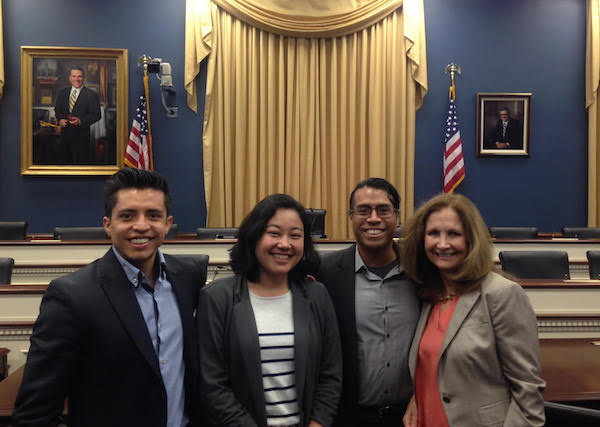

Microbusiness Leaders Promote Inclusion at AEO

From the first speaker to the last, this year’s conference was all about inclusion. I gathered some snapshots and impressions of the themes that were presented. Check out the story on our blog, but included are some provocative ideas and questions, such as:

- Traditional banking will continue but will continue to perpetuate inequalities.

- “It’s not just that we’re tolerating wealth inequality, we invest in it. And it’s high time we stop.”

-

1) Algorithms know a mac from a PC; 2) mac users=better credit risks; 3) mac users are mostly white. Good underwriting criteria?? #microbiz

— CAMEO (@CAMEOMicro) May 25, 2016

Speaking of small business lending… Earlier this week, Opportunity Fund released a very important research report, “Unaffordable and Unsustainable: The New Business Lending on Main Street.” Until now, we have been relying on stories to explain what’s happening with online lending. Now we’ve got some data on the loans and cash advances being offered to small businesses by short-term, high-cost alternative lenders.

Cliff notes on findings: 94% interest rates; average payment is 1.78x income -YIKES.

Faces Winner Sacred Mountain Spa

Register for CAMEO’s Annual Member Meeting and Advocacy Day – June 7, 2016 at the Sacramento Sheraton. Our Faces of Awards winners will be presented during lunch by the winners’ legislators. Check out the Annual Meeting webpage for more information on the day’s agenda.

This week, we feature Rebecca Weston, owner of Sacred Mountain Spa, nominated by Jefferson Economic Development Institute. 2012 was a rough year for Rebecca Weston. Not only did she turn 50, an often dreaded milestone in anyone’s life, but the coffee shop she’d been managing for years shut down. Read how Rebecca turned a crisis into an opportunity.

This week, we feature Rebecca Weston, owner of Sacred Mountain Spa, nominated by Jefferson Economic Development Institute. 2012 was a rough year for Rebecca Weston. Not only did she turn 50, an often dreaded milestone in anyone’s life, but the coffee shop she’d been managing for years shut down. Read how Rebecca turned a crisis into an opportunity.

The other two winners are:

- Bethany Smith, B Team Solutions, LLC, nominated by Coachella Valley Women’s Business Center; and

- Vincent Quintana, El Nopalito Produce, nominated by El Pajaro CDC

Note that June 7 is California’s primary election day, so vote by mail!

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last Must Know. I have posted a running tab of current Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

Member Kudos: Congrats to Inner City Advisors who received their CDFI certification.

Free Webinar: Register for Helping Small Businesses Become ADA Compliant Webinar on June 2, 2016 10:00am PT. The California Pollution Control Financing Authority (CPCFA), chaired by State Treasurer John Chiang, is pleased to introduce California Capital Access Program (CalCAP) Americans with Disabilities (ADA) Financing Program (CalCAP/ADA). The CalCAP/ADA Financing Program encourages lenders to provide financing for small businesses to complete retrofits and modifications necessary for ADA compliance. For questions, contact program staff via e-mail.

Funding Opportunity: Wells Fargo Diverse Community Capital round 2 applications are open. Launched last fall, this three-year initiative is delivering $75 million in grants and lending capital to CDFIs that serve diverse-owned small businesses with a particular focus on African-American owned businesses. The program also provides social capital programs to help CDFIs increase their capacity to lend to diverse small businesses, including knowledge networks, consulting, and other collaborative efforts. Interest forms for this are due June 1, 2016.

Funding Opportunity: The U.S. SBA announced the 2016 Growth Accelerator Fund Competition, pursuant to the America Competes Act, to identify the nation’s most innovative accelerators and similar organizations and award them cash prizes they may use to fund their operations costs and allow them to bring startup companies to scale and new ideas to life. We understand the amount to be $50,000. For more details on the competition, including competition rules and eligibility, please see the SBA’s announcement. Applications are due by June 3, 2016..

Professional Development Opportunity: You’re invited to join the CFED Assets & Opportunity Network and Center for Financial Security for a new four-part virtual Listening & Learning Series on Financial Coaching & Counseling. The are on the following Wednesdays from 12:-1:30pm PDT: June 8, July 13, August 10, and September 14. The A&O Network has also released Financial Coaching Census.

Get a Free App: PayPal is excited to host Opportunity Hack in San Jose for the 4th straight year. Last year, we had some amazing results from this event. We hope you will submit an application by June 8, 2016 to join us. Opportunity Hack strives to match highly-skilled volunteers (i.e. top-notch engineers and other professionals from PayPal, other local companies, and colleges) with nonprofit organizations (NPOs) that need technological solutions for critical challenges. Our goals for Opportunity Hack are to solve existing problems for NPOs and to foster a connection with technologists that can extend beyond a single weekend. This year we will be giving out prizes for ideas with the most opportunity for impact. Participants at the hackathon will vote to select the nonprofits with the best idea submission and the one that is the most engaged during the hackathon. Please email your questions to DL-PayPal-OpportunityHack-SanJose@paypal.com.

Free Webinar: Friedman and Associates will host De-Mystifying the CDFI Certification Process on Wednesday,June 8, 2016, 11:00am – 12:30pm PDT. This webinar will take you inside the certification process and answer key questions including: 1) What does it mean to become a CDFI? What are the benefits? 2) What are the 7 tests of certification and how do I know if my organization can be certified? 3) What is the process to prepare the application? 4) If we are not yet ready for certification, how do we prepare for it?

Funding Opportunity: The U.S. SBA Office of Veterans Business Development Service – Disabled Veteran Entrepreneurship Training Program has a total of $300,000 in funding is available for this program in FY 2016. SBA expects to make up to six (6) awards; minimum award of $50,000, maximum award of $150,000. Applications are due June 18, 2016.

OFN Western Regional Meeting: Save June 29, 2016. The meeting will take place in Los Angeles, CA at Federal Reserve Bank of San Francisco, Los Angeles Branch (950 S Grand Avenue, Los Angeles, CA 90015).

For Your Clients: The Governor signed SB 269 (Roth). The bill gives small businesses (less than 50 employees) that hire a Certified Access Specialist time to take care of problems related to disability access before a lawsuit can be filed in California courts. It also allows some time to take care of problems with signage and warning strips. Note a suit in Federal courts is still allowed because a state cannot preempt the Federal government. It is hoped the Federal Court will take this as a good faith effort on the part of small businesses.

For Your Clients: On Monday, May 16, new SEC rules became effective allowing businesses for the first time to provide equity to investors through crowdfunding platforms. Given uncertainty in the funding market for startups, these new rules could be extremely useful to entrepreneurs. (Click for infographic published by the SBA’s Office of Advocacy.)

Take Action: Our colleagues at Small Business Majority is gathering support to urge the Senate to fill the vacancy on the Supreme Court. If the Supreme Court continues to operate with a vacancy, many of its most important cases will almost undoubtedly result in a 4-4 split. This means that crucial issues facing the small business community could remain unresolved, and small business owners will face an uncertain business environment. If you believe it’s time for the Senate to do its job and hold a hearing, sign their pledge.

FIELD’s EntrepreneurTracker: FIELD worked with 19 microenterprise organizations in 2015 to collect data on the outcomes of 1,086 clients they had served in 2014. Each dollar spent on program costs generated between $8.96 and $9.45 in benefits. Learn more about EntrepreneurTracker.