Reports: Hispanic Women and Rural Entrepreneurs

This week, I want to share two recent reports that give insight into the landscape of the entrepreneurs that we serve.

First, celebrate Hispanic women entrepreneurs for Hispanic Heritage Month. In 2016, about 1.9 million Hispanic women-owned firms employed 550,400 workers and generated $97 billion in revenues in the US. The number of Hispanic women entrepreneurs grew 137 percent between 2007 and 2016, faster than any group. The US Census Bureau projects the number of Hispanic women to nearly double by 2050 and with it the number of Hispanic women-owned businesses.

First, celebrate Hispanic women entrepreneurs for Hispanic Heritage Month. In 2016, about 1.9 million Hispanic women-owned firms employed 550,400 workers and generated $97 billion in revenues in the US. The number of Hispanic women entrepreneurs grew 137 percent between 2007 and 2016, faster than any group. The US Census Bureau projects the number of Hispanic women to nearly double by 2050 and with it the number of Hispanic women-owned businesses.

Despite the growing number of Hispanic women entrepreneurs, they are still underrepresented, which means they are an untapped source of economic growth. The National Women’s Business Council recently issued Hispanic Women Entrepreneurship: Understanding Diversity Among Hispanic Women Entrepreneurs, which identifies the unique characteristics of Hispanic women entrepreneurs, reviews entrepreneurship training practices that work to encourage successful business, highlights specific programs that exemplify these practices, and suggests targeted tactics to unlock their entrepreneurial potential.

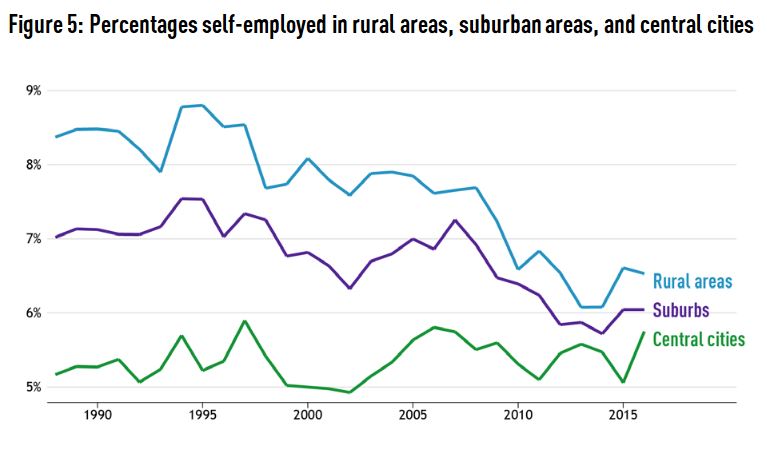

Second, the SBA issued The Retreat of the Rural Entrepreneur. In 1988, more than a fourth of the self-employed lived in rural areas. By 2016, that share had fallen to less than 1 in 6 as the US population shifted away from rural areas and the rural rate of self-employment fell. In fact, between 1988 and 2016, the rural rate of self-employment fell by over 20 percent. Despite that decline, the rate of self-employment has remained higher in rural areas than in urban and suburban areas. This speaks to the necessity of our work!

Second, the SBA issued The Retreat of the Rural Entrepreneur. In 1988, more than a fourth of the self-employed lived in rural areas. By 2016, that share had fallen to less than 1 in 6 as the US population shifted away from rural areas and the rural rate of self-employment fell. In fact, between 1988 and 2016, the rural rate of self-employment fell by over 20 percent. Despite that decline, the rate of self-employment has remained higher in rural areas than in urban and suburban areas. This speaks to the necessity of our work!

CDFI Fund Awards!

Congrats to the following members who received a 2017 CDFI Award!

- ACCION San Diego

- California FarmLink

- Economic Development and Financing Corporation

- Main Street Launch

- Mission Community Loan Fund LLC

- Opportunity Fund Northern California

- PACE Finance Corporation

- Pacific Coast Regional, Small Business Development Corp.

- Pacific Community Ventures

- Santa Cruz Community Credit Union

- Women’s Economic Ventures

And a shout out to our friends who also received a CDFI Award: Beneficial State Bancorp, Fund Good Jobs, Mission Asset Fund, Fresno Area Hispanic Foundation, Northern California Community Loan Fund, Rural Community Assistance Corporation. A total of 28 California CDFIs received about $20 million for small business and housing loans.

And…Action! – Quick Actions

Earlier this year, we started this section — And…Action! — because the current political reality demands that we participate more fully in the budget and legislative process. We’re going to take a month’s break from the formal efforts so that all of us are ready to support CAMEO’s FY2018 Appropriations request in the federal budget and engage in the looming tax reform debate. For the next few weeks, we’ll list some relevant actions that are easy to do so we conserve our energy for the budget and tax reform advocacy.

Support Women’s Entrepreneurship: A bipartisan bill Senators Joni Ernst (R-IA) and Kirsten Gillibrand (D-NY) introduced in response to a WIPP report about women being shut out of government contracts has been approved by the Senate. The bill (S. 1038) asks the Small Business Administration to conduct a comprehensive study on all socio-economic group participation, including women, in these contracts. This is an important step to ensure that all small businesses have equal access to contracts, increasing opportunities for women-owned small businesses. Our colleagues at WIPP are asking you to thank Sen. Ernst and Gillibrand for spearheading this effort and standing up for women-owned small businesses!

Survey: CalNonprofits are again asking “How are California nonprofits responding to the Trump administration?” Shortly after the presidential election, more than 800 nonprofits reported on changes they were seeing and anticipating. Many of the same matters — funding, immigration, healthcare, environment — are still in flux. They have a new survey and will compare results. Take the quick survey by October 9, 2017

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last Must Know. I have posted a running tab of current Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

CAMEO Tool: Susan Brown, our microlending expert, created Phase I of a Community Loan Policy Manual Workbook to assist community lenders to create fully developed loan policies manual. Lenders of every stripe that address each topic and answer all the questions will have a complete loan manual that reflects a comprehensive approach to the details of running a high-quality program.

Member in the News: Fresno EOC, parent of Access Plus Capital, started “Van y Vienan” (“They Come and Go”), one of the first rural ride-share programs in the country operating with an electric car.

Industry News: The SBA launched Lender Match, the SBA’s online referral tool connecting small business borrowers with participating SBA lenders. Lender Match is an upgrade to LINC (Leveraging Information and Networks to access Capital), introduced as a pilot in 2015.

New Toolkit: Credit Builders Alliance has developed a new toolkit that provides a primer on the importance of credit building to establish businesses as financial assets for returning citizens, followed by a comprehensive and dynamic set of tools and resources to help practitioners work one-on-one with their clients to build credit in pursuit of their entrepreneurial goals. Download the executive summary – Achieving Credit Strength: A Toolkit for Supporting Returning Citizen Entrepreneurs.

For Your Clients: Small Business Majority has several free webinars on access to capital and retirement: “Access to Capital 101: Funding Options to Start and Grow Your Business” is on October 18 at 11:00 AM PD // 2:00 PM EDT and “Money Now, Money Later: The ABCs of Financing Your Small Business and Building Your Retirement” is on October 10, and October 24 at 11:00 AM PST // 2:00 PM EDT.

Financial Inclusion Webinar: Organizations across the country are developing solutions to address volatility and financial inclusion and to support households in managing cash flow and building savings, increasing credit and confidence along the way. Tune in on October 12 at 12noon to this free, one-hour Connecting Communities webinar to hear from leading experts as they engage in dialogue about research, current initiatives and best practices to help address the challenges low-income households face in the financial marketplace.

New Report: Prosperity Now and the Institute for Policy Studies look at the racial wealth divide at the median over the next four and eight years in The Road to Zero Wealth. They find that if you examine median wealth trends over the past three decades, the racial wealth divide will only continue to grow—into perpetuity—and it will do so at an accelerated rate. Join them for a webinar on October 17, 2017 at 11:00am-12:30pm PDT to discuss this crucial issue and what can be done to address this problem.

Professional Meeting: Registration is now open for CRC Member Meetings. Connect with colleagues about experiences in the field and to share updates on CRC campaigns and recent policy changes that impact communities. Lunch will be provided and registration is now open. If you have any questions, please contact Liana Molina.

- Register for Bay Area Member Meeting: Friday, October 20, 2017

- Register for Los Angeles Member Meeting: Thursday October 26, 2017

- Register for Sacramento Member Meeting: Tuesday, November 14, 2017

For Your Clients: The California Hispanic Chamber of Commerce and Small Business Majority Access are presenting an access to capital webinar in Spanish on October 24, November 21, and December 14 at 10:00am PT // 1:00pm ET. Click the links for registration and information in Spanish.

Economic Policy Event: Join UC-Riverside School of Business Center for Economic Forecasting & Development for “Re-imagining Economic Growth in the Inland Empire” on October 25, 2017from 12:00-4:00pm. CAMEO members receive a $25 discount with the code “cameo17.”

Industry Conference: OFN will hold the 2017 Western Regional Meeting Wednesday, November 1 in San Francisco at the Federal Reserve Bank of San Francisco.

Industry Conference: Join Bay Area funders, nonprofits, public agencies, and policymakers on November 2, 2017 in Oakland for a day of ideas, information-sharing and connecting with other innovators in the asset building field. Register for 2017 Assets Matter Symposium.

New Report: The California Reinvestment Coalition released Small Business Owners Struggle to Access Affordable Credit, a new report focused on the challenges small business owners and entrepreneurs face when trying to get a loan to start, maintain, or grow their businesses.

]]>