CAMEO members that fill out the Census by tomorrow, July 14, 2017, will receive $100 toward lunch for their staff.

Save the Date: Microlending Essentials Training, November 7-9, 2017 in Los Angeles. This new training program is for staff who want to learn the difference between micro and small business lending and do it right.

FY 2018 Federal Budget Update – House Version

Reports: Women and Generational Mindsets

And…Action! – Collect Data!

The Goodies – This week’s highlight is that July 21, 2017 is the deadline to nominate someone the Ned Gramlich Lifetime Achievement Award for Responsible Finance.

FY 2018 Federal Budget Update – House Version

FY 2018 Federal Budget

The House Appropriations Committee marked up the agriculture and financial services appropriations. It was a mixed bag. As we have mentioned before, we have a bunch of work to do in the Senate for the CDFI Fund, it took a major hit. The SBA programs mainly stood still or had small cuts, except for PRIME which the committee eliminated. As I type, our team in DC is working hard to make an amendment to the bill to fund PRIME (this has happened before). And for rural, the appropriations were swapped from business development to lending. Funding Levels included in package (changes from FY2017 where readily available):

| Program |

Amount |

| Treasury CDFI Fund |

$190M (23% decrease from FY2017) |

| SBA Microloan – Lending |

tbd |

| SBA Microloan – Technical Assistance |

$31M (same as 2017, 24% increase from FY2016) |

| SBA PRIME |

$0M (eliminated in the House budget) |

| SBA WBC |

$17M (5.5% decrease from FY 2017, same FY2016) |

| SBA SBDCs |

$120M (4% decrease from FY2017) |

| Office of Advocacy |

$9.1M (1% decrease from FY 2017) |

| 7(a) and 504 Loan Program |

$156M (0.6% decrease from FY 2017 |

| Veteran Outreachtd> |

$12.3M (same as FY 2017) |

| HUBZone Program |

$3M (same as FY 2017) |

| Rural Business Development Grant Program |

$20M (17% decrease from FY 2017) |

| Intermediary Relending Program |

$17.5M (86% increase from FY2017) |

| Value Added Producer Grants |

$10M (33% decrease from FY2017) |

If you haven’t already, let our senators know how much these programs mean to you –

Senator Feinstein and

Senator Harris.

Reports: Women and Generational Mindsets

Women

The National Women’s Business Council (NWBC) released

“Necessity as a Driver of Women’s Entrepreneurship” this week. The report examines whether and how women turn to entrepreneurship to address potential market failures that limit their ability to attain or maintain economic self-sufficiency, or as an avenue to overcome flexibility bias and potential stigma in balancing work-life conflict assumed in traditional gendered roles and social norms. Join the conversation online using

#NWBCResearch.

Generational Mindsets

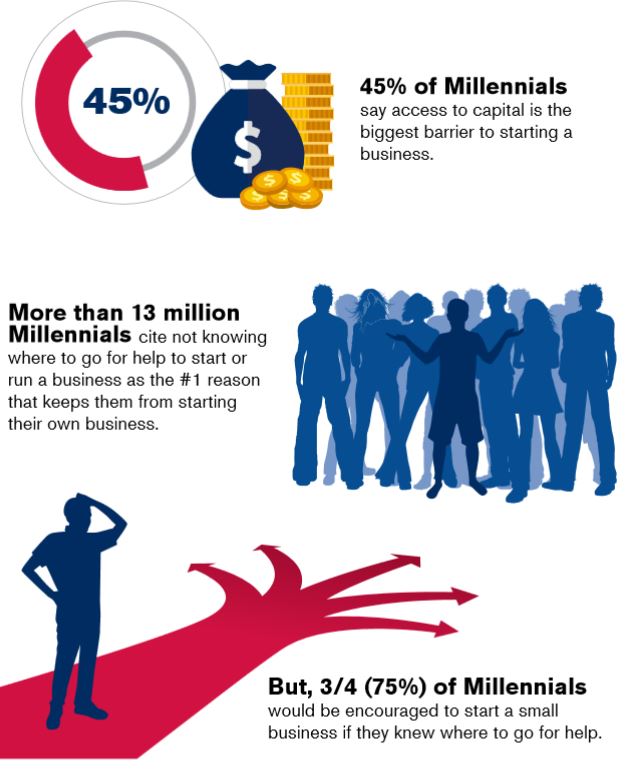

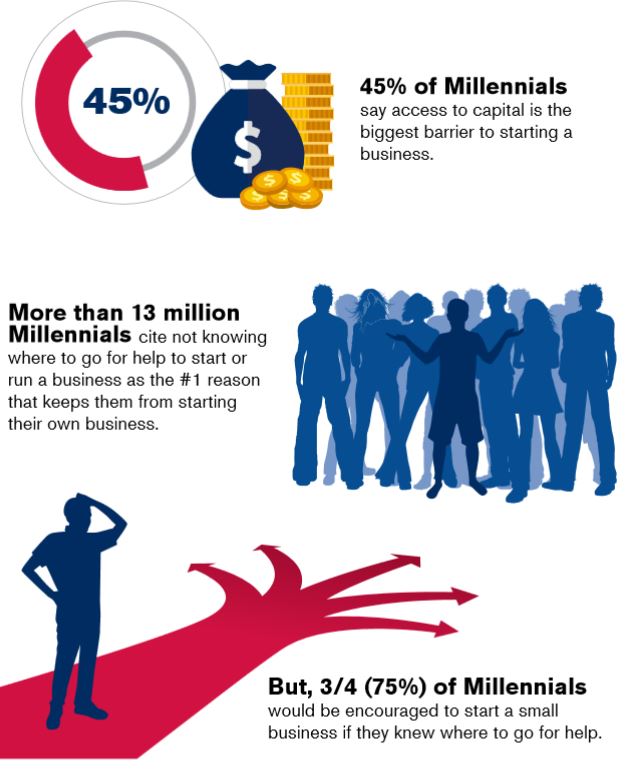

America’s SBDCs did a study into the entrepreneurial mindsets of different generations of Americans. The findings reinforced previously held beliefs such as a strong entrepreneurial inclination among millennials, while challenging preconceived notions about their motivations for starting a business. One third of Americans (34 percent), have worked in a small business and nearly a quarter (24 percent) of both millennials and GenXers own or have owned a small business.

The study found that the entrepreneurial spirit is alive and well with 41 percent of Americans saying they would quit their job and start a business in the next 6 months if they had the tools and resources they needed. This number is higher for millennials with more than half of those surveyed stating that they would be willing to take the entrepreneurial leap in the next 6 months with the right tools and resources.

All generations surveyed lived through the great recession, yet seemingly this hasn’t dampened entrepreneurial willingness for most. The study cites that 62 percent of Americans have a dream business in mind that they would love to start, and close to half (49 percent) of millennials, intend to start their own business in the next three years.

Download the white paper –

America’s Voice on Small Business – to find out the number one catalyst to start a small business and how much opportunity there is for your organizations to help the untapped entrepreneurial potential

And…Action! – Collect Data!

The new section of the

Must Know — And…Action! — is in response to the current political reality that demands that we participate more fully in the state and the federal legislative processes. We urge you to assign a staff person to be responsible for taking action.

Did you know that there is

no national data collection on small business lending that could help see where there are gaps and/or discriminatory practices? The Consumer Financial Protection Bureau will begin

collecting information on small business lending practices from lenders across the U.S. and are asking for input about how and why this information should be collected.

Significant political opposition to this important issue exists. Recently, the House passed the Financial Choice Act, which included the repeal of collecting small business lending data (among other bad provisions). The Treasury Department and the Acting OCC Comptroller also questioned the benefit of collecting small business loan information.

Such data have existed for home mortgage lending for years and that data transparency has led to better and more fair lending by mortgage lenders. The purpose of small business lending data will identify lending needs, help local governments to allocate resources, and to help identify possible discrimination.

Ways business assistance providers and microlenders can be involved:

- Submit a comment directly to the CFPB before the deadline on September 14, 2017.

- The California Reinvestment Coalition has a survey – CRC Small Business Lending Survey – that will help develop a letter to send to the powers that be.

- It is critical that your client’s voices are heard! Ask your clients to weigh in – you can reach out to them directly or ask them to complete these brief surveys by Opportunity Fund (English, Spanish)

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last

Must Know. I have posted a running tab of current

Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

Member Kudos: Congrats to Liz Perez, who has been appointed to the

California Veterans Board by Governor Brown.

Member Kudos:

Accion San Diego was awarded four stars by Charity Navigator!

Open for business:

GrantAdvisor, a Yelp! for grant makers is now open for you to hare your experiences of working with a foundation. The program is sponsored by CalNonprofits, GreatNonprofits, and Minnesota Council of Nonprofits. Join them for a webinar – “

The Who, What, and Why of GrantAdvisor” on

July 19, 2017 at 9:00am PT to get a tour of the site and learn how it works.

Professional Developmentt: Professor John Taylor of Stanford University will launched a new session of his free online course,

Principles of Economics on

July 17, 2017. No prior economics knowledge needed! Get everything you need to understand how a modern market economy works and learn how to “think like an economist.”

Professional Award: OFN is accepting nominations for the

Ned Gramlich Lifetime Achievement Award for Responsible Finance. Please consider nominating an industry leader who has dedicated her or his life to aligning capital with justice. Nominations are due

July 21, 2017. All nominations require two seconds; between the nominator and the seconds, two must come from outside the nominee’s organization.

Grant Opportunity: The USDA is seeking applications for

technical assistance and training grants in the Community Facilities program. Learn more from the

Federal Register Notice. The deadline is

July 24, 2017.

Free Webinar: Cutting Edge Capital hosts “

Economic Activism Starts at Home: The Impact of Community Investment Funds” on

July 27, 2017 at 11:00am PT. What if your community can come together to fund local ventures? Join Cutting Edge Capital’s Kim and Brian to find out how to utilize community investment funds.

For Your Clients:The

Census Business Builder is an easy to use, mobile-optimized tool that provides access to selected demographic and economic data from the U.S. Census Bureau tailored to business owners and regional planners.]]>

The National Women’s Business Council (NWBC) released “Necessity as a Driver of Women’s Entrepreneurship” this week. The report examines whether and how women turn to entrepreneurship to address potential market failures that limit their ability to attain or maintain economic self-sufficiency, or as an avenue to overcome flexibility bias and potential stigma in balancing work-life conflict assumed in traditional gendered roles and social norms. Join the conversation online using #NWBCResearch.

Generational Mindsets

The National Women’s Business Council (NWBC) released “Necessity as a Driver of Women’s Entrepreneurship” this week. The report examines whether and how women turn to entrepreneurship to address potential market failures that limit their ability to attain or maintain economic self-sufficiency, or as an avenue to overcome flexibility bias and potential stigma in balancing work-life conflict assumed in traditional gendered roles and social norms. Join the conversation online using #NWBCResearch.

Generational Mindsets

America’s SBDCs did a study into the entrepreneurial mindsets of different generations of Americans. The findings reinforced previously held beliefs such as a strong entrepreneurial inclination among millennials, while challenging preconceived notions about their motivations for starting a business. One third of Americans (34 percent), have worked in a small business and nearly a quarter (24 percent) of both millennials and GenXers own or have owned a small business.

The study found that the entrepreneurial spirit is alive and well with 41 percent of Americans saying they would quit their job and start a business in the next 6 months if they had the tools and resources they needed. This number is higher for millennials with more than half of those surveyed stating that they would be willing to take the entrepreneurial leap in the next 6 months with the right tools and resources.

All generations surveyed lived through the great recession, yet seemingly this hasn’t dampened entrepreneurial willingness for most. The study cites that 62 percent of Americans have a dream business in mind that they would love to start, and close to half (49 percent) of millennials, intend to start their own business in the next three years.

Download the white paper – America’s Voice on Small Business – to find out the number one catalyst to start a small business and how much opportunity there is for your organizations to help the untapped entrepreneurial potential

America’s SBDCs did a study into the entrepreneurial mindsets of different generations of Americans. The findings reinforced previously held beliefs such as a strong entrepreneurial inclination among millennials, while challenging preconceived notions about their motivations for starting a business. One third of Americans (34 percent), have worked in a small business and nearly a quarter (24 percent) of both millennials and GenXers own or have owned a small business.

The study found that the entrepreneurial spirit is alive and well with 41 percent of Americans saying they would quit their job and start a business in the next 6 months if they had the tools and resources they needed. This number is higher for millennials with more than half of those surveyed stating that they would be willing to take the entrepreneurial leap in the next 6 months with the right tools and resources.

All generations surveyed lived through the great recession, yet seemingly this hasn’t dampened entrepreneurial willingness for most. The study cites that 62 percent of Americans have a dream business in mind that they would love to start, and close to half (49 percent) of millennials, intend to start their own business in the next three years.

Download the white paper – America’s Voice on Small Business – to find out the number one catalyst to start a small business and how much opportunity there is for your organizations to help the untapped entrepreneurial potential