- Annual Meeting Rocked and Pointed Towards CAMEO’s Future

- Tech and Lending with Robert Lopez, VEDC

- The Goodies – This week’s highlight is the SBA’s Service – Disabled Veteran Entrepreneurship Training Program that has a total of $300,000 in funding is available for this program in FY 2016. Applications are due June 18, 2016.

Annual Meeting Rocked and Pointed Towards CAMEO’s Future

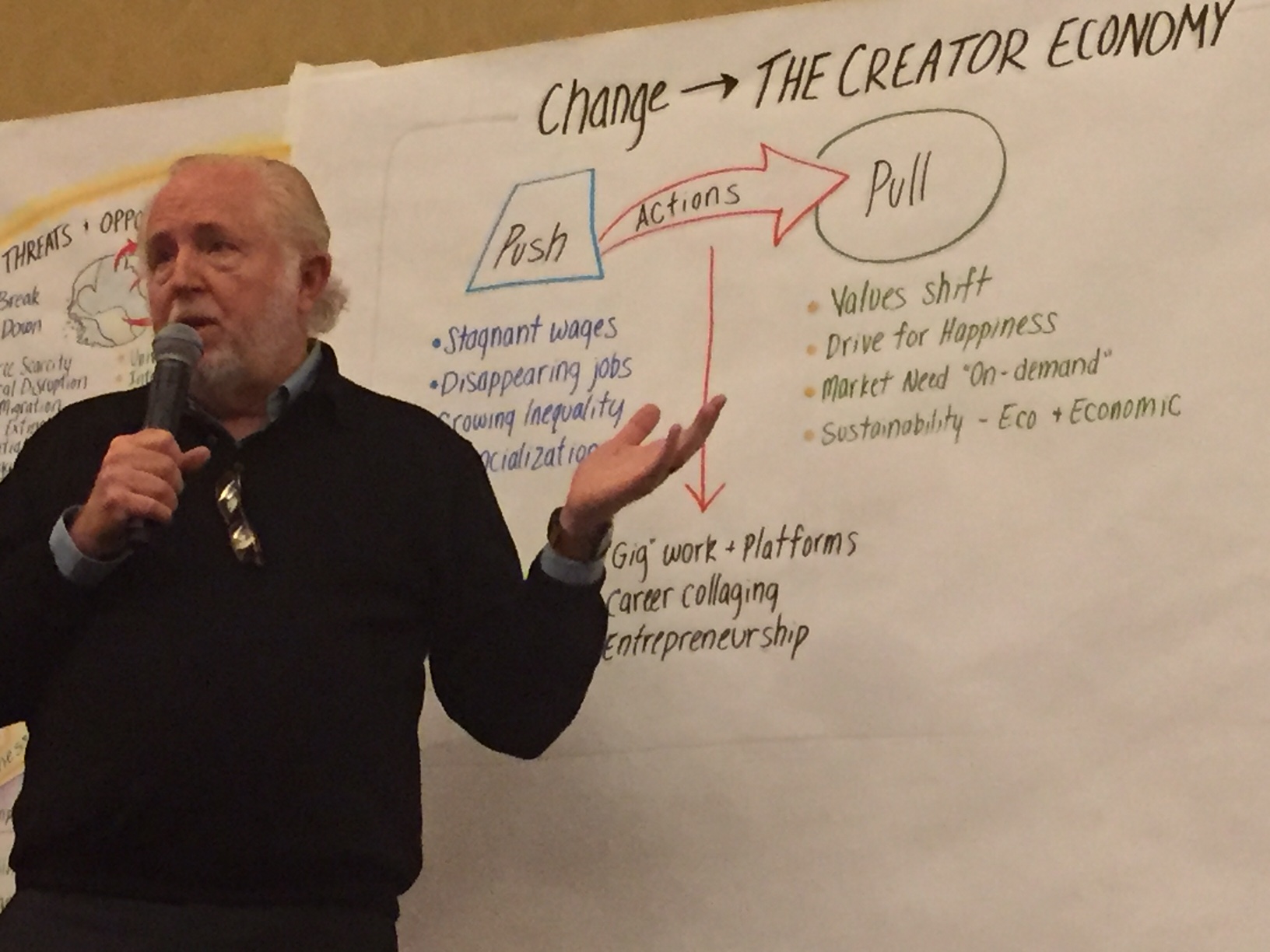

Thanks to the 60 or so attendees who joined us in Sacramento for a day of learning, fun and advocacy. It was an amazingly productive day. The meat of our meeting, a discussion lead by Dan Beam about the push and pull of change, gave members much to ponder. You can read all about it in the 2016 Annual Meeting Recap of Dan’s explanation of the tremendous changes happening in our economy and where they’re disruptive.

Thanks to the 60 or so attendees who joined us in Sacramento for a day of learning, fun and advocacy. It was an amazingly productive day. The meat of our meeting, a discussion lead by Dan Beam about the push and pull of change, gave members much to ponder. You can read all about it in the 2016 Annual Meeting Recap of Dan’s explanation of the tremendous changes happening in our economy and where they’re disruptive.

After Dan explained the zeitgeist, he gave us some insight into what it means for business formation and our sector. The information will guide CAMEO’s future development to better serve this emerging customer segment. When it came to CAMEO’s role, some immediate needs arose to the top.

- Better assess needs of new self-employed/gig workforce.

- Raise public awareness of typology, needs and policies to support a healthy ecosystem for the New Era Collaborative Economy.

- Redesign training and business assistance towards: increasing engagement, creating “collage careers”, and improving financial capabilities.

- Change criteria for economic impact, i.e. away from jobs to 1099 revenues spent on other contractors.

You can read more of Claudia’s take-aways from 2016 Annual Meeting. Please contact us with any suggestions, comments that you might have. We look forward to continuing the discussion with you!

Thanks to Senator Bill Monning and Assemblymember Eduardo Garcia, chair of the Jobs, Economic Development and the Economy Committee, who presented this year’s Faces of Entrepreneurship Awards and lent their support to small and microbusiness. Congrats to our winners.

- Vincent Quintana, El Nopalito Produce, nominated by El Pajaro CDC

- Bethany Smith, B Team Solutions, LLC, nominated by Coachella Women’s Business Center

- Rebecca Weston, Sacred Mountain Spa, nominated by JEDI

And then it was time to visit the legislators to educate the Assembly and the Senate on three crucial issues:

- responsible small business lending;

- the need to support business technical assistance (SBDCs, WBC, SCORE, VBOC and PTAC); and

- the importance of women’s business ownership in closing the wealth gap.

After the legislative visits, we gathered at Chops (see photo) to report back on our visits and we were overwhelmed at the positive response that our member advocates generated for responsible business lending. About a dozen legislators were intrigued at various levels including the willingness to carry a bill. We also found out about a possible source for business assistance. Stay tuned for action items!

Tech and Lending with Robert Lopez, VEDC

Join the CAMEO peer call on Wednesday, June 15, 2016 at 3:00pm. Robert Lopez, COO of VEDC in Los Angeles, took a year off from community lending to work at Dealstruck. As Robert puts it, “I got an MBA in Process working there.” Fortunately for us, Robert came back to community lending and will share what he has learned. He feels strongly that FinTech has something to teach CDFI lenders.

Join the CAMEO peer call on Wednesday, June 15, 2016 at 3:00pm. Robert Lopez, COO of VEDC in Los Angeles, took a year off from community lending to work at Dealstruck. As Robert puts it, “I got an MBA in Process working there.” Fortunately for us, Robert came back to community lending and will share what he has learned. He feels strongly that FinTech has something to teach CDFI lenders.

This will be a rich, provocative presentation and discussion. Don’t miss a chance to hear one of our own show us how the ‘other side’ does it and up your game.

Both CEOs and line staff can benefit from this rich training opportunity. We urge you to attend the series as well as the follow up calls with your fellow CAMEO members to digest the information so that you can apply it to your own organization.

OFN is offering a webinar series focused on growth and innovation for small business lenders to help us understand and navigate through this new landscape. These ideas aren’t only for lenders, training programs can apply many of these ideas. CAMEO will follow each session with dynamic peer group calls to digest and apply what was learned. Our brilliant consultant, Susan Brown, will lead the calls. She’s done a really amazing job in synthesizing the presentations and applying the concepts presented to individual organizations.

The June 15 call is a follow up to the OFN webinar Lending Life Cycle – Part Two: Lending Life Cycle and Technology on May 26. For the archives and full schedule of OFN webinars and peer calls, visit the Small Business Financing Webinar Series post on our website.

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last Must Know. I have posted a running tab of current Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

New Report: Opportunity Fund released a very important research report, “Unaffordable and Unsustainable: The New Business Lending on Main Street.” Until now, we have been relying on stories to explain what’s happening with online lending. Now we’ve got some data on the loans and cash advances being offered to small businesses by short-term, high-cost alternative lenders. Cliff notes on findings: 94% interest rates; average payment is 1.78x income -YIKES.

CAMEO Content: 1) Watch and share our WOVEN Video. 2) Read Claudia’s piece: “Business Ownership Will Close the Wealth Gap“.

Collegial Kudos: Area Development Magazine has awarded California its first-ever Gold Shovel Award for excellence in economic development and job creation. They could earn a double gold if they’d substantially support small and microbusinesses.

For Your Client: OFN has a new small business borrower education platform – Venturize.

For Your Clients: Small Business Majority is hosting Access to Capital 101: Funding Options to Start and Grow Your Business every Wednesday in June (15, 22, and 29). They present an overview of alternative lending options including community development financial institutions, SBA’s loan guarantee program and reputable online options, key questions to consider when seeking funding, the Small Business Borrowers’ Bill of Rights and helpful tools and resources.

Free Webinar: Friedman and Associates will host De-Mystifying the CDFI Certification Process on Wednesday,June 16, 2016, 11:00am – 12:30pm PDT. This webinar will take you inside the certification process and answer key questions including: 1) What does it mean to become a CDFI? What are the benefits? 2) What are the 7 tests of certification and how do I know if my organization can be certified? 3) What is the process to prepare the application? 4) If we are not yet ready for certification, how do we prepare for it?

Funding Opportunity: The U.S. SBA Office of Veterans Business Development Service – Disabled Veteran Entrepreneurship Training Program has a total of $300,000 in funding is available for this program in FY 2016. SBA expects to make up to six (6) awards; minimum award of $50,000, maximum award of $150,000. Applications are due June 18, 2016.

Free Webinar: CFED hosts Credit as an Asset: Building & Maintaining Credit for Entrepreneurs on June 21, 2016, 12:00-1:30pm PT. The webinar will discuss the significance of building a strong credit history for accessing business loans, credit’s effect on many other facets of entrepreneurs’ financial lives, and strategies for credit building. CAMEO member Gwendy Donaker-Brown from Opportunity Fund is presenting.

Free Webinar: Sparks hosts CDFIs: Grow Your Revenue by Selling Community Advantage Loans on the Secondary Market on June 22, 2016 at 9:00am PT.

OFN Western Regional Meeting: Registration is open for the June 29, 2016 OFN Western Regional Meeting. The meeting will take place in Los Angeles, CA at Federal Reserve Bank of San Francisco, Los Angeles Branch (950 S Grand Avenue, Los Angeles, CA 90015). Check out the agenda.

Professional Development Opportunity: You’re invited to join the CFED Assets & Opportunity Network and Center for Financial Security for a new four-part virtual Listening & Learning Series on Financial Coaching & Counseling. They are on the following Wednesdays from 12:-1:30pm PDT: July 13, August 10, and September 14. The A&O Network has also released Financial Coaching Census.

PayDay Lending Rules: The Consumer Financial Protection Bureau (CFPB) has proposed a rule aimed at reshaping the market for payday loans and other short-term credit. The proposal would require lenders to ensure that the consumer has the ability to repay the loan, provide notice that the lender is withdrawing funds from the consumer’s account and cease automatic withdraws if the consumer’s account is overdrawn. Comments on this proposal are due September 14, 2016.

For Your Clients: The Obama Administration’s final overtime rule, published on May 18, will make an estimated 4.2 million new workers eligible for overtime pay. Salaried workers, making up to $47,476 annually, will get time-and-a-half payments for work over 40 hours in a week. The effective date is December 1, 2016.

For Your Clients: The Governor signed SB 269 (Roth). The bill gives small businesses (less than 50 employees) that hire a Certified Access Specialist time to take care of problems related to disability access before a lawsuit can be filed in California courts. It also allows some time to take care of problems with signage and warning strips. Note a suit in Federal courts is still allowed because a state cannot preempt the Federal government. It is hoped the Federal Court will take this as a good faith effort on the part of small businesses.

For Your Clients: On Monday, May 16, new SEC rules became effective allowing businesses for the first time to provide equity to investors through crowdfunding platforms. Given uncertainty in the funding market for startups, these new rules could be extremely useful to entrepreneurs. (Click for infographic published by the SBA’s Office of Advocacy.)

Take Action: Our colleagues at Small Business Majority is gathering support to urge the Senate to fill the vacancy on the Supreme Court. If the Supreme Court continues to operate with a vacancy, many of its most important cases will almost undoubtedly result in a 4-4 split. This means that crucial issues facing the small business community could remain unresolved, and small business owners will face an uncertain business environment. If you believe it’s time for the Senate to do its job and hold a hearing, sign their pledge.

FIELD’s EntrepreneurTracker: FIELD worked with 19 microenterprise organizations in 2015 to collect data on the outcomes of 1,086 clients they had served in 2014. Each dollar spent on program costs generated between $8.96 and $9.45 in benefits. Learn more about EntrepreneurTracker.