- Annual Meeting: Book Your Room

- Faces Winner El Nopalito Produce

- Momentum is Building for Responsible Lending

- The Goodies

- Watch and share our WOVEN Video.

- Read Claudia’s piece: “Business Ownership Will Close the Wealth Gap“.

Annual Meeting: Book Your Room

Register for CAMEO’s Annual Member Meeting and Advocacy Day – June 7, 2016 at the Sacramento Sheraton.

Note that June 7 is California’s primary election day. Visit California’s Secretary of State’s website or your county’s election website by May 23 to vote by mail.

CAMEO has reserved a block of rooms available for attendees on June 6 (Single and Double rate: $159, tax not included in this price). Please make your arrangements by May 20 (expiration date of the block room). Space is limited. Guests should make reservations by

- calling Central Reservations office: 1 (800) 325-3535. State that you are with the CAMEO group; or

- making your reservations online.

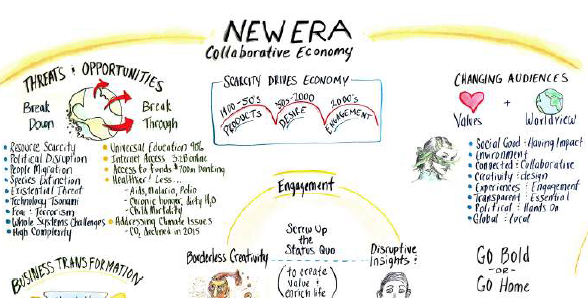

We’re excited to bring back Dan Beam, a creative design strategist, to lead this year’s annual meeting. He will guide us in viewing the tremendous changes happening in our economy, where they’re disruptive and what are the opportunities are for our sector. We will discuss the NEW ERA of a Collaborative Economy and how that affects the microbusiness landscape and our work in the near future.

We’re excited to bring back Dan Beam, a creative design strategist, to lead this year’s annual meeting. He will guide us in viewing the tremendous changes happening in our economy, where they’re disruptive and what are the opportunities are for our sector. We will discuss the NEW ERA of a Collaborative Economy and how that affects the microbusiness landscape and our work in the near future.

The meeting will be a full day! We will hold our CAMEO member meeting, have a rich discussion with Dan Beam, celebrate our Faces of Entrepreneurship Award winners (see below) and then send you off to your legislators to educate them on why our client business owners need responsible small business lending practices. This is a very hot topic now but we need to make sure that we communicate the potential impacts on our communities. Check out the Annual Meeting webpage for more information.

Faces Winner El Nopalito Produce

Vincente Quintana started El Nopalito Produce in Watsonville with a 30-pound box of cactus paddles and in just six years turned his kitchen-table business into a thriving concern with six employees, processing 10,000 pounds a week and distributed in more than 30 markets across central California. Thanks to El Pajaro CDC for nominating Vincente for our Faces of Entrepreneurship Awards! Read more about Vincent’s remarkable growth story on our website.

Vincente Quintana started El Nopalito Produce in Watsonville with a 30-pound box of cactus paddles and in just six years turned his kitchen-table business into a thriving concern with six employees, processing 10,000 pounds a week and distributed in more than 30 markets across central California. Thanks to El Pajaro CDC for nominating Vincente for our Faces of Entrepreneurship Awards! Read more about Vincent’s remarkable growth story on our website.

The other two winners are:

- Bethany Smith, B Team Solutions, LLC, nominated by Coachella Valley Women’s Business Center; and

- Rebecca Weston, Sacred Mountain Spa, nominated by Jefferson Economic Development Institute.

State legislators will present the awards at our annual meeting luncheon on June 7.

Momentum is Building for Responsible Lending

As a reader of the Must Know, you are familiar with CAMEO’s effort to educate our state leaders on responsible small business lending practices. We’re concerned about the surging growth of Merchant Cash Advances(MCA) that outweighs other lending by a factor of six. Often MCAs are high-cost and short-term and can easily put a small business into bankruptcy. Many of these ‘loans’ are going to people who can’t get a traditional bank loan and could be our members’ clients. In the last couple of weeks, the issue has received lots of attention.

Gwendy Brown, the Vice President of Research and Policy for Opportunity Fund, sums up what’s happened in her blog post entitled Momentum is Building for Responsible Lending.

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last Must Know. I have posted a running tab of current Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

May is Small Business Month in California. To celebrate, GO-Biz’s Office of Small Business Advocate (OSBA) is hosting a series of free webinars. To learn more and register click on the webinar title.

- Connect Your Small Business to the Global Marketplace on Thursday – May 12, 2016, 12:00 – 1:00 pm

- Overview of California’s Small Business Loan Guarantee Program on Thursday – May 19, 2016, 12:00 – 1:00 pm

Funding Opportunity: JPMorgan Chase is launching Partnerships for Raising Opportunity in Neighborhoods (PRO Neighborhoods). This is a $125 million, five-year initiative to identify and support custom solutions for the unique challenges facing disadvantaged neighborhoods in U.S. cities. CDFI’s are eligible to apply to help small businesses develop. Learn more and download the PRO Neighborhoods RFP. The deadline is May 16, 2016.

PRIME Grant Opportunity: SBA has announced that it is taking applications for PRIME: Program for Investment in Microentrepreneurs Act. The deadline to apply for funding is May 18, 2016.

CDFI Fund Opportunity: CDFI Fund is seeking comment on FY 2016 Prize Competition. The CDFI Fund is holding a competition for CDFIs to encourage new ideas on how to increase CDFI investment and access to capital in underserved rural communities. The Fund notes that it expects to award no less than $1 million of the FY16 funds through the competition. A conference call is scheduled for May 19, 2015 at 9:00am PT / 12:00 pm ET to give the community the opportunity to provide additional input. Written comments are due by May 25, 2016. Submit them via e-mail to William Girardo, Portfolio Manager, CDFI Fund. More information on the competition can be found on the CDFI Fund’s website.

Free Webinar: Small Business Majority and AARP host California Secure Choice – Making Workplace Retirement Savings Possible on Thursday,May 19, 2016 from 2:00 – 3:00pm PDT. They will discuss the retirement savings crisis in California, why small businesses face significant barriers when it comes to offering retirement savings programs and provide an overview of California Secure Choice program. California Secure Choice is a portable retirement benefit that small business owners get to offer their employees with none of the administrative hassle.

Free Webinar: Register for CDFIs: Optimize Your Process to Maximize Impact on May 25, 2016 at 9:00am PT. In this webinar, we will look at the costs involved in originating a loan and talk about how to leverage people, process, technology and great customer experience to create a competitive advantage. You will walk away with tips on how to look at your overall operation and determine where you are, where you want to go and how to get there.

Funding Opportunity: Wells Fargo Diverse Community Capital round 2 applications are open. Launched last fall, this three-year initiative is delivering $75 million in grants and lending capital to CDFIs that serve diverse-owned small businesses with a particular focus on African-American owned businesses. The program also provides social capital programs to help CDFIs increase their capacity to lend to diverse small businesses, including knowledge networks, consulting, and other collaborative efforts. Interest forms for this are due June 1, 2016.

Funding Opportunity: The U.S. SBA announced the 2016 Growth Accelerator Fund Competition, pursuant to the America Competes Act, to identify the nation’s most innovative accelerators and similar organizations and award them cash prizes they may use to fund their operations costs and allow them to bring startup companies to scale and new ideas to life. We understand the amount to be $50,000. For more details on the competition, including competition rules and eligibility, please see the SBA’s announcement. Applications are due by June 3, 2016..

OFN Western Regional Meeting: Save June 29, 2016. The meeting will take place in Los Angeles, CA at Federal Reserve Bank of San Francisco, Los Angeles Branch (950 S Grand Avenue, Los Angeles, CA 90015).

Take Action: We’re asking all of our members to hold district meetings with their California state representatives to inform California’s small business leaders and elected officials on what good capital looks like. We’ll follow up with meetings in Sacramento at our annual meeting. This is an issue they need to know about!

- Download the District Meeting webinar slides

- Find your California legislators.

- Learn more about good small business lending practices and the Small Business Borrower’s Bill of Rights.

- The Accion Network has a webpage to educate business owners on predatory lending.

- Let us know when you’ve scheduled your meeting and how it went!