Black Businesses

And…Action! (new recurring section)

The Goodies – This week’s highlight is that BALLE has opened the application process for their 2018 BALLE Local Economy Fellowship program. Applications are accepted on a rolling basis (so apply early!)

Black Businesses

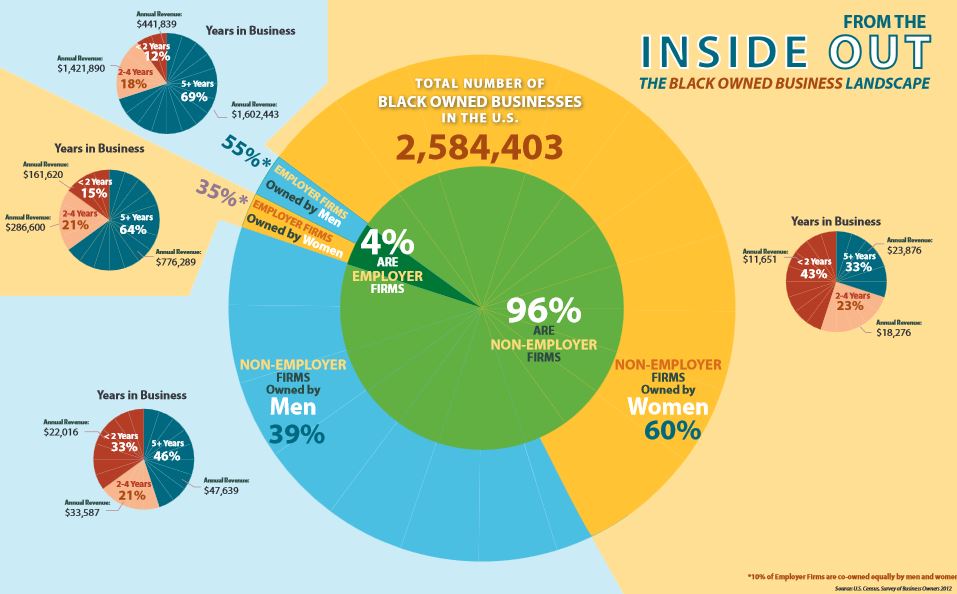

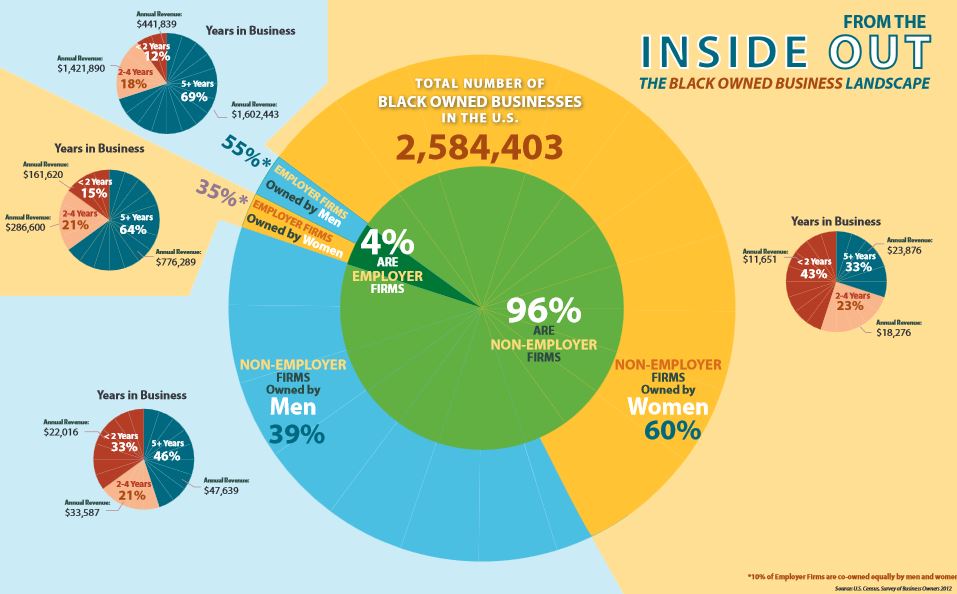

AEO recently released a new report “

The Tapestry of Black Business Ownership in America: Untapped Opportunities for Success.” The report assesses the economic strength and potential of Black-owned businesses, identifies myths, challenges and opportunities across a mosaic of segments, and suggests a plan for how investors and policymakers can increase the effectiveness of programs designed to support Black entrepreneurship. (See the report for the full graphic.) AEO President and CEO Connie Evans said:

Our findings show that in actuality, Black Americans have high entrepreneurial drive and the same motivations as other entrepreneurs, yet face three persistent barriers that operating together impede the establishment and growth of Black-owned firms. Understanding and addressing the unique interplay of these obstacles are crucial steps to unleashing the potential economic power of Black business ownership in America.

The report describes three barriers: wealth gap, fewer assets and less disposable income to invest in business; a credit gap, decreased access to formal credit and high denial rates; and a trust gap, institutional bias that Black Americans have experienced, inhibiting them from applying to financial institutions for more capital, joining networks, creating valuable partnerships, and more. If Black-owned firms reached employment parity with all privately-held U.S. firms…

- 600,000 new jobs would be created;

- $55 billion of economic activity would be generated; and

- unemployment in the Black community would go down to 5 percent (many Black-owned businesses serve and hire from their communities and local dollars circulate more often in local communities than dollars spent at national chains.

On a related note, CFED issued “

A Downpayment on the Divide: Steps to Ease Racial Inequality in Homeownership.” The report explores the relationship between race and homeownership and recommends ways to leverage the wealth-building potential of homeownership to close the divide. We know that homeownership is one strategy that business owners use to finance their business.

And…Action!

We are starting a new section of the

Must Know — And…Action! — because the current political reality asks for greater participation in the process, both at the state and the federal level. Here is where we will list actions you can take to ensure the success of the micro sector. It may be helpful to appoint someone on your staff to be responsible for taking action.

CalNonprofits has a quick

survey on how the Trump administration is affecting the work you do as nonprofits — whether positively or negatively.

Federal FY 2018 Budget

The President’s outline of his budget priorities has landed in Washington with a dull thud and is proving to be very unpopular, even within his own party. Full details will be revealed in May. Usually, the President meets with agency department heads, but most of those meetings have been canceled. Congress will be meeting in the meantime to come up with their own budget. This opens up a big opportunity for us. What you can do:

- Email/Call/Fax your representative and ask them to sign on to this letter to support a robust funding for economic development and entrepreneurial programs under the SBA. (Find your rep by zip code on the right.)

- Email me your success stories about your program. Include what program, your grant information, what you did, what the outcomes were, and how it has impacted your community. Congress wants data!

- Join coalition activities, such as local support for CDBG funding, and let us know about them, so we can support them too.

- If your representative sits on the Appropriations Committee – Ken Calvert, David Valadao, Lucille Roybal-Allard, Barbara Lee, and Pete Aguilar – be prepared to visit them on their April break (April 10-21).

More federal actions to come. Eat your Wheaties ;) And I’m only half-joking.

Clarification on FY 2017 Federal Budget

If you’re confused on the budget process for FY 2017 like I was, here are some answers. Thanks to AEO and Mark Lee for keeping us updated on all things DC.

- There have been no FY17 grants awarded. Any reimbursements since September 2016 have been FY16 awards. Those reimbursements go from September 2016 to June 2017.

- No grants can be awarded under a CR. That goes for any agency.

So if you’re getting reimbursed for a grant, you will continue to do so as it is not a FY 2017 grant. Phew!

The process for FY2017 PRIME grants is as follows: SBA will call for applications in April. However, this is “apply at your own risk” because funding for FY17 has not been settled. The risk is that you may apply and the funds won’t become available, but we suggest that you apply so that you are prepared to be considered if the FY 2017 passes. The current Continuing Resolution expires on April 28. Awards will be announced in August for FY2017, assuming Congress settles on funding for FY2017. Reimbursements would likely start September 2017.

Extending the California EITC to the self-employed: CAMEO is strongly supporting

Assembly Bill 75 (Steinorth, Quick-Silva) would expand California’s Earned Income Tax Credit to allow self-employment income reported on an IRS Form 1099 to qualify as earned income. CAMEO will be testifying in support of this bill on Monday, March 27.

California’s CalCAP program: CAMEO supports

SB 551 (Hueso) – Capital Access Loan Program for Small Business, sponsored by Opportunity Fund, that makes several changes to the CalCAP Program. CAMEO will be testifying in support of this bill on Wednesday, April 5, 2017. Letters of support are due

March 27, 2017.

California’s COIN bill: CAMEO supports

AB 778 (Caballero). The bill proposes an extension of the COIN tax credit program until January 1, 2022.

Please see last week’s

Must Know for letters of support templates.

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last

Must Know. I have posted a running tab of current

Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

New Report: Our colleagues at WIPP have outlined an Economic Blueprint – a comprehensive set of public policy expectations on behalf of women business owners.

Professional Development Opportunity: BALLE has opened the application process for their 2018

BALLE Local Economy Fellowship program. Applications are accepted on a rolling basis (so apply early!) from February 2017 until the cohort is filled. Applicants can expect to be notified of their first round status (finalist, declined, or still under review) within 4-6 weeks of receipt of your application.

For Your Clients: Small Business Majority is hosting free a webinar –

Access to Capital 101: Funding Options to Start and Grow Your Business on April 5, 2017, April 19, 2017, and May 3, 2017 at 11:00am PDT // 2:00pm EDT. These free national webinars will help businesses navigate the funding landscape and connect with resources to help obtain the capital needed to start and grow your client’s business.

For Your Clients: If you work with immigrant clients, CalNonprofits has an informative blog post – “Nonprofits & the Trump Administration: Practical tools for

protecting our immigrant clients and staff.” Also, check out “

Economic Impact of Immigration by State.” California ranks highest in jobs created by immigrant owned business.

For Your Clients: The U.S. SBA announced the launch of the

2017 Emerging Leaders Initiative, a seven-month executive-level training series targeting small businesses with high-growth potential in under-served cities across the nation. Participating cities in California are Bakersfield, Los Angeles, and Sacramento. If you have clients that have annual revenues of at least $400,000, have been in business for at least 3 years, and have at least one employee, other than self, check out the program.

Communications Resource: Wired has a great post – “

10 Online Press Room Examples for Nonprofits.”

For Your Clients: CAMEO is partnering with Women Impacting Public Policy and the Kogod Tax Policy Center at American University to research how women entrepreneurs use the U.S. tax code and how it impacts your business in order to determine whether it discriminates against women-owned firms. Please

take this survey and send it to your female clients. It will take less than five minutes and your answers could help us make a big difference for all women in business. The survey is free, your answers are anonymous, and you will not be asked for a donation.

Member Kudos: Congrats to

Steven Dial, the new CEO of AnewAmerica, and

Lisa Mensah, the new OFN President and Chief Executive Officer.

Workforce and Micro: The California Workforce Association and California Workforce Development Board have joined forces with the California Community Colleges to facilitate a series of 17 conversations called –

Partnerships that Unlock Social Mobility. The remaining ones are in March and April in Ventura, Los Angeles, Santa Cruz/Monterey, Riverside, San Diego, Richmond, Santa Clara, Redding, Eureka and Napa. We urge you to attend and make the voice of entrepreneurship heard. Our goal is for local WIBs to partner with CAMEO members to provide training. Please

let us know if you are able to make it and what you’ve learned.

Free Webinar: Join ASBC for a webinar –

Regulations Do Work for Business! on

March 21, 2017 11:00am-12:00noon PT // 2:00-3:00pm ET.

Networking/Professional Development Event: Our colleagues from ASBC are hosting “How Re-Imagining Capitalism Can Inspire Both Personal and Large Scale Positive Change” on

Wednesday, March 22, 2017from 5:30 – 8:00 pm at Hanson Bridgett, 425 Market Street, 26th Floor, San Francisco, California.

Rural Development Webinars: Tune in to a free webinar from IEDC – Maximizing the use of Federal and State Tools for Economic Development on

March 23, 2017, 7:00-8:30am PT // 10:00-11:30am ET.

For Your Clients: The next California Competes Tax Credit (CCTC) application period is open with more than $68 million in available tax credits. Businesses interested in applying can register to view a live webinar explaining the application process. This program is open to any business planning to create new full-time jobs in the state, regardless of size or location. The

deadline to submit applications is

Monday, March 27, 2017, at 11:59pm PT (Pacific Time).

New Report: OFN released “

Expanding Employer-Based Small Dollar Loan Programs and the CDFI Industry: Learnings from the Knowledge Network.” A

webinar discussing the report is on

April 11, 2017 at 11:00am-12:30pm PDT.

Advocacy Day: This year, OFN’s Advocacy Day will take place on

May 16–17, 2017. During Advocacy Day, your voice is needed to make the case to members of Congress and Administration officials about the

importance of funding for the CDFI Fund, the industry, and our communities.

Professional Conference: Save the Date for OFN’s 2017 Small Business Finance Forum, June 15 and 16 at the Fairmont Chicago, Millennium Park.

Funding Opportunity: OFN announced their

NEXT Fund for Innovation, a pilot that will provide flexible capital in amounts ranging from $500,000 to $2 million to CDFIs with innovative ideas. Applications are accepted on a rolling basis now through

June 30, 2017. The fund is open to all qualifying CDFIs, including non-OFN Members and past NEXT Awards recipients.

New Report: The National Women’s Business Council released

Social Entrepreneurship Amongst Women and Men in the United States.]]>

AEO recently released a new report “The Tapestry of Black Business Ownership in America: Untapped Opportunities for Success.” The report assesses the economic strength and potential of Black-owned businesses, identifies myths, challenges and opportunities across a mosaic of segments, and suggests a plan for how investors and policymakers can increase the effectiveness of programs designed to support Black entrepreneurship. (See the report for the full graphic.) AEO President and CEO Connie Evans said:

AEO recently released a new report “The Tapestry of Black Business Ownership in America: Untapped Opportunities for Success.” The report assesses the economic strength and potential of Black-owned businesses, identifies myths, challenges and opportunities across a mosaic of segments, and suggests a plan for how investors and policymakers can increase the effectiveness of programs designed to support Black entrepreneurship. (See the report for the full graphic.) AEO President and CEO Connie Evans said: