In this Issue…

- Success Story: Mendocino Wool’s DPO

- 32% Annual Growth Projected for MMS

- CrowdFunding Webinar

- Modify The State Loan Guarantee Program to Include Online Lending

- Research: Analysis of Business Loan Terms

- Research: The Fed’s 2015 Small Business Credit Survey

- News

But first HOT OFF THE PRESSES! Read and share Claudia’s op-ed in American Banker – How to Tame the Wild West of Marketplace Lending #microbiz #Fintech

Success Story: Mendocino Wool’s DPO

Many CDFIs focus on scaling their microlending, Community Advantage and SBA 504 loans. Another branch of community lending is represented by a project in Mendocino County – social impact lending using a Direct Public Offering (DPO) in which an investment opportunity is offered and sold directly to the public. Susan Brown wrote this story on the successful funding for Mendocino Wool and Fiber. The DPO was undertaken by the Economic Development & Financing Corp, a CAMEO member operating in Mendocino, and a user of the MMS platform.

Many CDFIs focus on scaling their microlending, Community Advantage and SBA 504 loans. Another branch of community lending is represented by a project in Mendocino County – social impact lending using a Direct Public Offering (DPO) in which an investment opportunity is offered and sold directly to the public. Susan Brown wrote this story on the successful funding for Mendocino Wool and Fiber. The DPO was undertaken by the Economic Development & Financing Corp, a CAMEO member operating in Mendocino, and a user of the MMS platform.

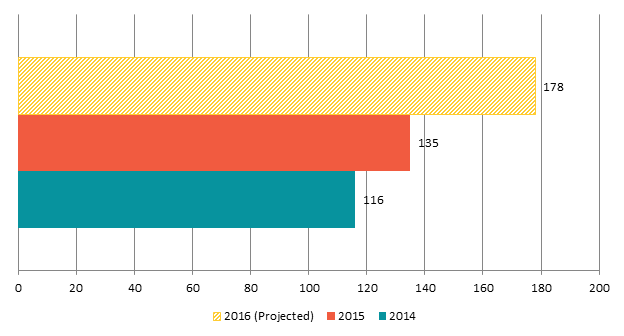

32% Annual Growth Projected for MMS

Six organizations participated in MMS during the first half of 2016: CDC Small Business Finance, Economic Development & Financing Corporation, Fresno CDFI, Mission Economic Development Agency, Opening Doors, and Women’s Economic Ventures. They have received a combined total of 311 applications so far this year, and funded a total of 89 loans. We project 189 loans for the year, which would be a 32% growth over last!

Six organizations participated in MMS during the first half of 2016: CDC Small Business Finance, Economic Development & Financing Corporation, Fresno CDFI, Mission Economic Development Agency, Opening Doors, and Women’s Economic Ventures. They have received a combined total of 311 applications so far this year, and funded a total of 89 loans. We project 189 loans for the year, which would be a 32% growth over last!

Read the rest of Andrew Cole’s mid-year MMS report.

Contact Susan Brown if you’re interested in learning more or participating in the MMS program. MMS, developed by LiftFund, provides instant risk assessment and fast, quality underwriting to support microlenders in scaling up and maintaining strong portfolio performance.

Crowdfunding: A New Rung on the Funding Ladder

Join Kathleen Minogue, a crowdfunding educator, and CAMEO on September 22, 2016 at 11:00am PT for a free webinar – Crowdfunding: A New Rung on the Funding Ladder. Besides explaining what crowdfunding is and the four types, Kathleen will also cover:

Join Kathleen Minogue, a crowdfunding educator, and CAMEO on September 22, 2016 at 11:00am PT for a free webinar – Crowdfunding: A New Rung on the Funding Ladder. Besides explaining what crowdfunding is and the four types, Kathleen will also cover:

- How crowdfunding is different from traditional loans and private investment

- Keys to running a successful campaign

- Rewards crowdfunding overview

- No-interest Peer-to-Peer loans overview

- Benefits of crowdfunding beyond funding

- Leveraging crowdfunding success for bankability

- Is my business a good candidate? (4 key self-assessment questions)

Rules around equity crowdfunding are evolving, so it’s important to keep abreast of the changes.

Modify the State Loan Guarantee Program to Include Online Lending

We’ve written a lot about the explosive growth of online lenders that offer quick cash, but often come with confusing and expensive terms. Many CAMEO members want to refinance these loans, but face a challenge in that the California State Loan Guarantee Program doesn’t back this type of financing. Thanks to Carla Ulloa of CDC Small Business Finance (CDC) for this insight into the challenge.

We’ve written a lot about the explosive growth of online lenders that offer quick cash, but often come with confusing and expensive terms. Many CAMEO members want to refinance these loans, but face a challenge in that the California State Loan Guarantee Program doesn’t back this type of financing. Thanks to Carla Ulloa of CDC Small Business Finance (CDC) for this insight into the challenge.

The State is looking into the feasibility of changing their rules for loan guarantees. CAMEO will work with our other small business allies to encourage them to do so.

Research: Analysis of Business Loan Terms

The Woodstock Institute reviewed 15 loans issued by 12 online financiers with familiar names such as OnDeck and Can Capital and not-so-familiar such as Mantis Funding and Capital Alliance. While this is a small data set, their findings coincide with other evidence we’ve seen. For example,

The Woodstock Institute reviewed 15 loans issued by 12 online financiers with familiar names such as OnDeck and Can Capital and not-so-familiar such as Mantis Funding and Capital Alliance. While this is a small data set, their findings coincide with other evidence we’ve seen. For example,

All the companies had a lack of transparency regarding the loan terms. Payments are made every weekday. Interest accrues on the outstanding daily balance. For all loans under 200 days, the effective interest rates were over 100%.

The Woodstock Institute works locally in Chicago and nationally to create a financial system in which lower-wealth persons and communities of color can safely borrow, save, and build wealth so that they can achieve economic security and community prosperity.

Research: Understanding the Small Business Landscape

Results from the 2015 Small Business Credit Survey

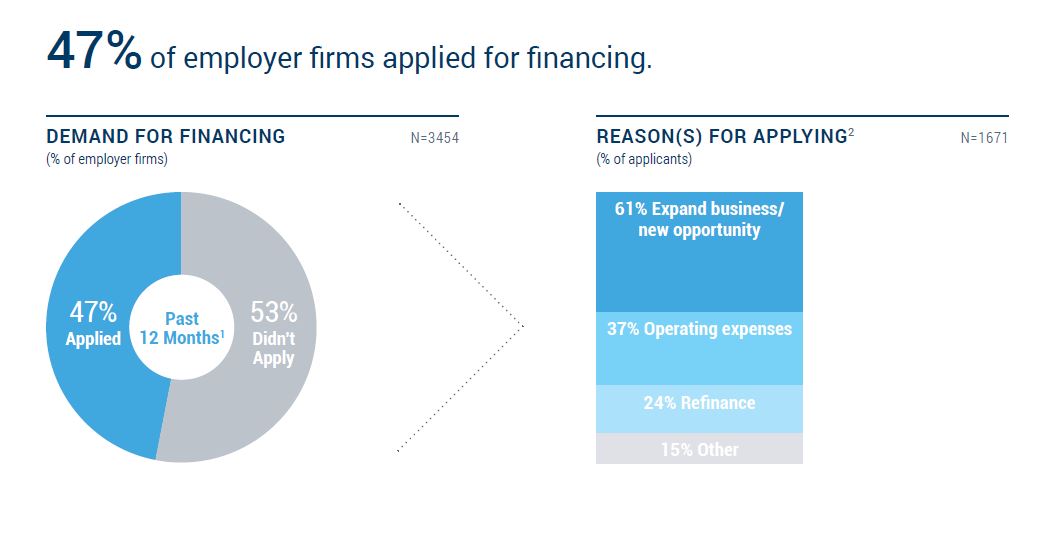

To learn more about business conditions and the financing needs of small businesses, seven Federal Reserve Banks collaborated on the 2015 Small Business Credit Survey (SBCS). The survey, conducted between September and November of 2015, gathered responses from 5,420 small firms in 26 states.

The 2015 Small Business Credit Survey: Report on Employer Firms features responses from the 3,459 employer firms in the sample. More than half of these firms reported that their revenues are increasing and that they are operating profitably. The results indicate that 47 percent of the respondents applied for financing, and of these, about half were approved for all the credit they were seeking. Financing shortfalls were more prevalent among smaller and newer firms. In addition, the results show that small banks were the most common source of credit, and that business owners are most satisfied with small bank lenders.

News

- The US SBA issued their Small Business Finance FAQ in July (2016)

- AEO’s Project Cue is Building a New Way to Credit.

- Grameen America, a CAMEO member, receives $2.5 million from the SBA for microlending.

- The SBA issues new rules for its microloan program that went into effect on July 27, 2016.

- The SBA is proposing a rule to amend several regulations relating to the 7(a) and 504 loan programs. Comments due October 7.

- Opportunity Fund’s report -:“Unaffordable and Unsustainable: The New Business Lending on Main Street” – is a must read.

- Our colleagues at CRC and Main Street Alliance have an op-ed in The Hill regarding predatory small business lending.