The MLA newsletter is chock-a-block with articles, resources, technology, success stories, interviews, and big picture ideas on all Lending Academy features. This edition revolves around the theme of success – from Claudia testifying at a Senate hearing to our top lenders growth in microlending. We also unveil CAMEO's new program to move you toward success with institutional best practices and professional development.

In this Issue…

- Claudia Testifies at Senate Hearing

- MMS Update: Results of the First Year

- Success Story: Our Large Volume Lenders

- Best Practices: Excellence in Lending (EiL)

- Training Opportunities: Microloan Readiness

- Research: The State of Small Business Lending

- News

Claudia Testifies at Senate Hearing

Senator Jeff Merkley (D-OR), chair of the U.S. Senate Committee on Banking, Housing, and Urban Affairs, subcommittee on Economic Policy, invited our esteemed CEO to testify at his hearing – "Who is the Economy Working For? The Impact of Rising Inequality on the American Economy." Claudia's main message was:

Senator Jeff Merkley (D-OR), chair of the U.S. Senate Committee on Banking, Housing, and Urban Affairs, subcommittee on Economic Policy, invited our esteemed CEO to testify at his hearing – "Who is the Economy Working For? The Impact of Rising Inequality on the American Economy." Claudia's main message was:

If we are serious about addressing income inequality, then we need to support entrepreneurship and starting a business as a real pathway to closing the wealth gap and generating new jobs.

Read her written testimony about how small business income will help close the economic inequality gap and use the data points or talking points in making the case in your own community.

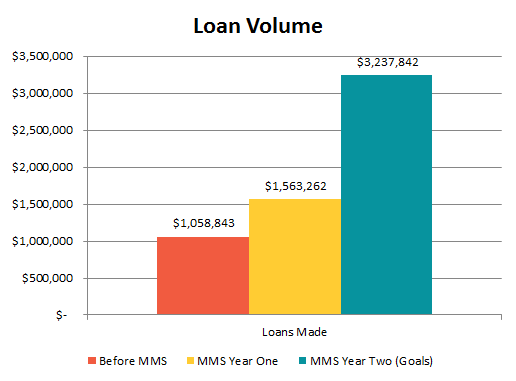

Technology: MMS Update –

Results of First Year!

As a cohort, the three members of the MMS pilot now constitute the fourth largest microlender in the CAMEO network with 85 loans funded. On average, lending by the cohort has increased 150% in the first year. Opening Doors in Sacramento, has joined the cohort with 14 applications in the first month and 2 loans closed. MEDA and Mendocino EDC are in line for onboarding. Check out Andrew's blog post that summarizes the results of MMS's first year. We can’t wait for next year's results.

Contact Susan Brown if you're interested in learning more or participating.

Success Story: Our Large Volume Lenders

Three lenders – Opportunity Fund, VEDC and Accion San Diego – make up 75% of loans made by the CAMEO network of microlenders. Together they've made 1,575 loans for a total of about $16 million. Overall these three programs have seen significant growth from 2011, anywhere from doubling or tripling the number of loans they’ve made and increasing the dollars on the street – all while maintaining their portfolio’s quality. In the next newsletter, we'll ask them what it took for them to grow.

Three lenders – Opportunity Fund, VEDC and Accion San Diego – make up 75% of loans made by the CAMEO network of microlenders. Together they've made 1,575 loans for a total of about $16 million. Overall these three programs have seen significant growth from 2011, anywhere from doubling or tripling the number of loans they’ve made and increasing the dollars on the street – all while maintaining their portfolio’s quality. In the next newsletter, we'll ask them what it took for them to grow.

Best Practices: Excellence In Lending

To provide all of our microlenders with the tools to grow to serve the market for microloans in their communities, we are launching a new initiative – Excellence in Lending (EiL). This program will go deeper into what it takes to have a high performing lending program capable of growth in volume while maintaining high repayment rates. Results from the program will be shared across CAMEO’s member network, allowing newer and smaller lenders to benefit from the experience of established programs, furthering CAMEO’s long-term goal to grow microlending in California.

new initiative – Excellence in Lending (EiL). This program will go deeper into what it takes to have a high performing lending program capable of growth in volume while maintaining high repayment rates. Results from the program will be shared across CAMEO’s member network, allowing newer and smaller lenders to benefit from the experience of established programs, furthering CAMEO’s long-term goal to grow microlending in California.

Our first step was to develop an assessment survey, which identifies and measures key elements of a well-run microlending program. The second step is for you to fill out the survey. The more people who fill it out, the more effective the tool will be. After the survey is done, we will compile the results and together we will determine benchmarks for success as well as future programming. We plan to hold an in-person discussion at our Microlenders Forum in January. Through this process, we will be able to

- Identify organizational, financial and management opportunities to build capacity, volume, customer service and fiscal stability;

- Refine and improve metrics for these elements;

- Establish consensus on these elements and metrics as best practices in microlending; and

- Identify and offer additional resources and training needed to sustain these best practices.

Next week, the survey will go out to the heads of the microlending organizations, so watch your inbox. Please support our efforts by responding to the survey.

Training Opportunities: Microloan Readiness Webinar Series

We are bringing you a high-quality three-part training series in which you will:

We are bringing you a high-quality three-part training series in which you will:

- Learn what a lender is looking for in a successful loan package

- Learn to prepare clients for basic loan readiness

- Learn how to close the deal and get your clients a loan

We've done two very well-received webinars on profit and loss statements and global cash analysis. Susan does a great job. The last webinar is on October 30 and will show how a lender looks at a credit report. Contact Andrew Cole for information on past trainings.

CAMEO's Individualized Learning Program for Trainings and Professional Development can be used to partially defray trainings, workshops and events that help develop leadership and improve operations of our member organizations. Learn more on how to access this member benefit as well as other training opportunities.

Research: The State of Small Business Lending

"The State of Small Business Lending: Credit Access during the Recovery and How Technology May Change the Game" is a recent paper from Karen Mills (formerly with the SBA), published by the Harvard Business School.

In the current lending environment, where you sit often determines where you stand on the question of, is there a gap in access to bank credit for small businesses? Most banks say they are lending to small businesses, but major surveys of small business owners point to constrained credit markets.

The paper looks at the forces behind constrained credit markets for small business and what might be done about it. Note that the paper is long, but has an excellent executive summary.

News

- Lending Club lent $1 billion last quarter.

- This website grades banks on their small business lending (under $1 million). If you search for banks in SF, only Umpqua and Bank of the West get a 'C' or better – rest are 'D' or 'F'. Imagine what the grades would be on microloans.

- To regulate or not to regulate online lenders? BloombergBusinessWeek provides one answer and Forbes another answer.

- Terminology to help define online lending companies.

- This is a great video that explains why a credit history is so important (small business shows up around 4:54)