In this Must Know…

- California Relief Grant – Round 5

- New California Small Business Advocate

- Have You Eaten Yet? Support AAPI Businesses Tomorrow!

- This week’s Goodie highlight is NCRC’s latest report which shows local bank branches remain critical for small business lending.

California Relief Grant – Round 5

Round 5 of the California Small Business COVID-19 Relief Grant Program opened today, and will close on March 31, 2021.

Governor Newsom signed into law a comprehensive package providing urgent relief for the small businesses of CA. The package provides an additional $2 billion for grants up to $25,000 for small businesses impacted by the pandemic.

CAMEO has held two Train-the-Trainer webinars for organizations and their staff to learn all about the application process and how best to prepare their clients for this new round of grants. Watch the recordings below:

New Small Biz Advocate

Congratulations to CAMEO member, Tara Lynn Gray, the new head of the California Office of the Small Business Advocate (CalOSBA) following the departure of Isabel Guzman who now leads the US SBA.

Tara Lynn Gray has served as CEO of the Fresno Metro Black Chamber of Commerce since 2017. We welcome the appointment of Ms. Gray and look forward to working with her to support our state’s smallest, most underserved businesses and to ensure an equitable and inclusive recovery.

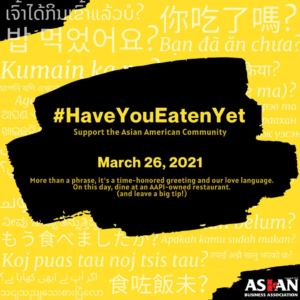

Have you Eaten Yet?

The AAPI community is hurting right now – from racist violence to the economic fallout of the pandemic on minority and underserved business owners.

One way you can support the community right now is by eating at AAPI-owned restaurants and shopping at AAPI-owned businesses tomorrow, March 26, 2021. Spread the word among your colleagues and post on social media using #HaveYouEatenYet.

The Goodies

For Your Clients

- SBA will host a webinar on the Shuttered Venues Operators Grant, from 11:30am to 1:00pm PT on March 30, 2021.

- Small nonfarm businesses in all 58 California counties are now eligible to apply for low‑interest federal disaster loans from SBA. The deadline to apply for economic injury is November 5, 2021.

New Research

- NCRC recently published Even While Thousands Vanished, Local Bank Branches Remained Critical For Small Business Lending.

- New report by the SBA confirms what many of us already know: small business loans have a statistically and economically significant impact on small business employment growth and small business entry.

Funding Opportunities

- The CDFI Fund’s new Small Dollar Loan Program encourages Certified CDFIs to establish and maintain small dollar loan programs and provide alternatives to high cost small dollar loans. Applications will open later this spring.

- ICYMI – Applications are open for the US Treasury’s Emergency Capital Investment Program.

Other Goodies

- Member Kudos: Asian Pacific Islander Small Business Program, Renaissance Entrepreneurship Center and Women’s Economic Ventures were among the 8 groups selected for SEED program funding.

- Jobs: Main Street Launch, Centro Community Partners, and Renaissance announced new jobs recently. See who else is hiring!