In May 2020, the SBA Office of Advocacy published a report that compares bank lending data in rural and urban areas from 2007-2016. This report is useful to examine the progression of small business lending during and after the financial crisis, and what it means in terms of economic development for rural and urban areas. Will COVID-19 have the same effect? If so, what lessons can we learn so that all our businesses and communities recover? Some of the key insights are summarized below.

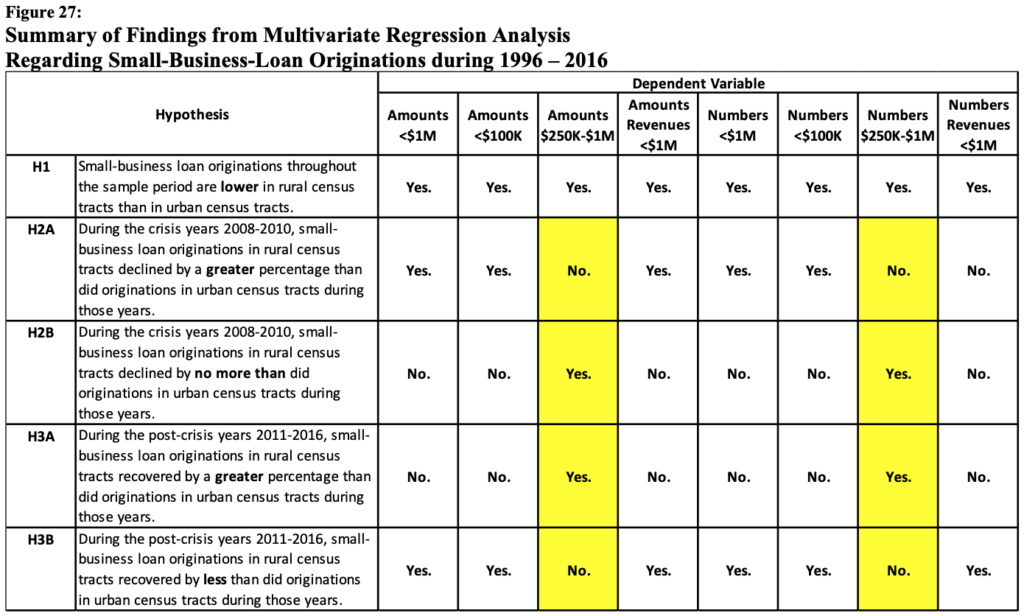

During the crisis, loans declined by about the same percentage in rural and urban areas. For the 10-year period covered by this analysis, the amount originated in bank loans peaked in 2007 at $319.2 billion. From 2007 to 2010 – at the height of the crisis – the percentage of loans declined by 47% across the nation, mirrored by a drop of 47% in urban areas and 43% in rural areas.

After the crisis, loans in rural areas recovered by less than they did in urban areas. By 2016, loans in urban areas had somewhat rebounded to 29% below the 2007 peak, while rural areas remained 41% below – seeing virtually no change. These results hold for both the amount and number of small-business loans.

Small loans saw a larger decline both during and after the crisis. During the crisis years of 2007-2010, loans under $100,000 saw a 63% decrease while loans larger than $100,000 only declined by 33%. As the economy as a whole recovered between 2011-2016, smaller-sized loans still suffered disproportionally, remaining 43% below the peak while larger loans were 19% below the peak.

This analysis shows that small businesses in rural areas and those seeking small loans did not only suffer disproportionally from a reduction in financing during the crisis, but that this issue was exacerbated after the crisis ended and the economy as a whole began to recover.

The authors of the report offer several recommendations for possible actions to take to address these issues. Those include:

- Incentivizing banks to originate more small business loans in rural and underserved areas by counting them as “community development loans” when evaluating a bank’s CRA rating.

- Expanding both the number and amount of loans in rural areas that are guaranteed by U.S. Small Business Administration loans, thus reducing potential losses and increasing supply in those areas.

- Reducing the underwriting burden on banks in terms of documentation for exam classification purposes.

- Encouraging the growth of small-business lending by nonbank lenders, such as credit unions.

- Not over-regulating the budding FinTech industry.

Finally, the authors called for further research on this phenomenon, especially to identify the causes of the declines in loans and the types of banks that are responsible for these results.