In this Must Know…

- 2018 State of the Union

- We Want to Connect!

- Net Neutrality Update

- Renew your membership or join to help us continue our successful advocacy work! The governor’s budget is proof!

- Register for the Microlenders Forum on February 13, 2018 in San Francisco. (Space is limited.)

- The Goodies – This week’s highlight is a bunch of new informative reports on everything from making platforms work for gig workers to small business credit to minority entrepreneurship. Scroll down, download, print and read over lunch.

2018 State of the Union

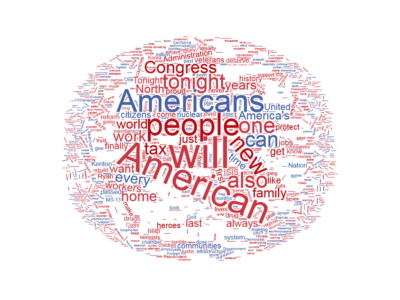

President Trump gave his State of the Union on Tuesday night. As you can tell from the word cloud of his speech, America in its rhetorical form, was front an center. What was in it for small business? Our massive tax cuts provide tremendous relief for the middle class and small businesses…. Small businesses have also received a massive tax cut, and can now deduct 20 percent of their business income. Yes, a “massive tax cut.”

Yes, as we’ve mentioned before, the tax cut is a good thing for individual small business owners. However, it remains to be seen how the tax cuts will affect the federal budgets going forward in areas such as infrastructure, research and development, education, the CDFI Fund, and the SBA programs – all of which are essential to an overall healthy entrepreneurial ecosystem. We will know more eight days from now when hopefully Congress will have a budget for the FY 2018 (which we’re five months into).

Governor Brown also made his State of the State late last week. Read GO-Biz Director, Panorea Advis’s take on the Governor’s State of the State. Specifically:

Finally, building off of the Governor’s address, his proposed 2018-2019 budget includes the extension of the California Competes Tax Credit. To date, 865 companies from throughout California have been awarded tax credits and these businesses are projected to create 83,414 new jobs and invest $15.7 billion in California. The proposal also includes new resources to support entrepreneurs and small businesses in addition to expanding the New Employment Credit for businesses that hire individuals with barriers to employment.

We Want to Connect!

As we mentioned last week, CAMEO is revamping our digital and social media channels to better serve our members and connect you to resources. We’re starting small with two efforts: a new Facebook cover photo contest and asking a simple two question survey on which social media channels you use professionally.

First the Facebook cover. Nicole Pelayo, an Accion client (left), has graced our page for quite a while. She is lovely and the photo is fantastic, but the time has come to find a new face of Micro for CAMEO’s Facebook page.

First the Facebook cover. Nicole Pelayo, an Accion client (left), has graced our page for quite a while. She is lovely and the photo is fantastic, but the time has come to find a new face of Micro for CAMEO’s Facebook page.

Help us choose a new cover for our page by posting photos that you think best represent the micro sector. Comment on the other photos. The expert panel (CAMEO staff) will consider photo originality/uniqueness, composition, quality, content, relevance to micro, and comments by your peers. Deadline is February 14, 2018 at 5pm. The winner(s) will be featured in the following Must Know and have the satisfaction that their photo graces the CAMEO Facebook page and represents the sector. While you’re at there, ‘like’ MicroBizCA on Facebook.

And second, take 15 seconds to answer this simple two-question survey on what social media channels you use.

Net Neutrality Update

We’ve talked a lot about net neutrality as in the FCC voted to gut net neutrality protections. If you’re still confused, watch this brilliant Burger King explanatory video about Whopper Neutrality. Yep, you heard me. It’s fun and informative at the same time. If the federal government won’t move quick enough, the states will. Governors in Montana and New York recently signed executive orders mandating that all Internet providers with state contracts must abide by net neutrality rules and state legislators are introducing net neutrality bills, including California.

We’ve talked a lot about net neutrality as in the FCC voted to gut net neutrality protections. If you’re still confused, watch this brilliant Burger King explanatory video about Whopper Neutrality. Yep, you heard me. It’s fun and informative at the same time. If the federal government won’t move quick enough, the states will. Governors in Montana and New York recently signed executive orders mandating that all Internet providers with state contracts must abide by net neutrality rules and state legislators are introducing net neutrality bills, including California.

If you are worried that companies like Comcast and Verizon will experiment with new ways to fiddle with your Internet connections, then you can download OONI’s (the Open Observatory of Network Interference) open source, non-profit app for tracking Internet censorship.

And if you’re wondering why net neutrality is important to you and your clients, check out CAMEO’s op-ed in The Huffington Post – Small Business Not Neutral on Net Neutrality.

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last Must Know. I have posted a running tab of current Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

New Resource: NCCLF developed spacesforgood.org, a free online space finding platform dedicated to meeting the commercial real estate needs of nonprofits in the Bay Area.

New Resource: Are you serving returning citizens? Credit Builder’s Alliance has a new toolkit – “Supporting Returning Citizens in Entrepreneurship and Credit Building.”

New Report: Institute for the Future outlines a worker-centered design for gig economy platforms in “Designing Positive Platforms: A guide for a Governance-based Approach.”

New Report: Prosperity Now issued a new report – “Advancing Collective Prosperity through Entrepreneurship in Atlanta.” Entrepreneurship can provide pathways to building wealth. But White-owned businesses nationwide are valued 11 times higher on average than Black-owned businesses. Prosperity Now recently facilitated a community of practice in Atlanta. This cohort of professionals came together over the course of several months to learn from one another and to identify strategies for strengthening Black-owned businesses.

New Report: The SBA Office of Advocacy released, “Latino Business Ownership: Contributions and Barriers for U.S. Born and Immigrant Latino Entrepreneurs,” that evaluates the differences in Latino self-employment rates and business income, comparing immigrant and U.S.-born Latino men and women with non-minorities. Roughly 600,000 business owners are U.S.-born Latinos, with an additional 1.2 million immigrant Latino business owners. The study shows that total Latino business owners generate $62.5 billion in business income. However, Latino business owners on average report less business income, and U.S born Latinos have a smaller self-employment rate.

New Report: The Federal Reserve’s Small Business Credit Survey released “Report on Rural Employer Firms” while we were on holiday. Highlights include: Firms in rural areas are more stable and face less financing constraints; and small banks play a bigger role in rural areas.

Free Webinar: Join Prosperity Now for their 2018 Prosperity Now Scorecard national launch webinar at 9:00am PST // 12noon EST on Tuesday, February 6, when they will unpack the latest data, highlight emerging trends, and answer your questions about how residents in all 50 states are faring financially and what state governments can do to help. The Prosperity Now Scorecard examines over fifty measures on issues ranging from savings to debt and credit, housing costs to self-employment, microbusiness, and more. The Scorecard also assesses all 50 states and the District of Columbia on steps they can take to improve outcomes for residents, including the adoption of state EITCs, expansion of Medicaid and more.

Funding Opportunity: The U.S. Small Business Administration has announced the availability of two new grant opportunities for established and aspiring Women’s Business Center host organizations to provide outcome-oriented business services for women entrepreneurs. The deadline is February 12, 2018. Visit the Grants.gov page for more info.

West Coast Listening Session: Join Prosperity Now and your West Coast Region peers to review regional trends in the 2018; share solutions that help families thrive and close the racial wealth divide; updates on Prosperity Now’s perspectives on federal policy challenges and the opportunities; and discuss opportunities to engage at local, regional or federal levels. Register for the listening session on February 21, 11:30 am PST / 12:30 pm MST with Mohan Kanungo of Mission Asset Fund as the moderator.

Professional Development Opportunity: Applications are now being accepted for OFN’s Opportunity Fellows Program! This program, which launched in 2017, will challenge a diverse cohort of CDFI leaders to learn about facilitating and leading systemic change within their CDFIs to cultivate greater diversity and inclusion with the goal of ensuring equitable investment in underserved and disenfranchised communities. The application deadline is Friday, February 23, 2018.

Funding Opportunity: The U.S. Department of the Treasury’s Community Development Financial Institutions Fund (CDFI Fund) released the Notice of Funds Availability (NOFA) and applications for the FY 2018 Community Development Financial Institutions Program (CDFI Program) and Native American CDFI Assistance Program (NACA Program). To help potential applicants better understand the CDFI Program and NACA Program and how to apply for funding, the CDFI Fund is planning to conduct a number of application workshops in Washington, DC at the CDFI Fund’s headquarters on February 15 and February 27, 2018.

Professional Conference: Registration for the 2018 CDFI Institute is open. The 2018 Institute will take place on February 28 and March 1 at the Renaissance Hotel, located at 999 9th Street NW in Washington, D.C. You can learn more about the conference’s agenda at the CDFI Coalition’s website.

Moving Main Street Forward: AEO’s microbusiness and microfinance conference is a must-attend event for professionals providing capital, technical assistance and other forms of trusted guidance to Main Street and microbusiness owners. The agenda will be packed with inspiring keynotes, thought-provoking plenaries and compelling breakout sessions designed to engage attendees in bold and provocative conversations on using inclusion, innovation and investment to move Main Streets across the country forward. See you in Detroit, Michigan, April 30 to May 2, 2018.

For Your Clients: California State Treasurer John Chiang officially rolled out CBIG.ca.gov, the California Business Incentives Gateway. The online gateway connects business owners and entrepreneurs to incentives to help them grow and create jobs. The CBIG site makes it easy for businesses expanding or locating in California to find and apply for incentives as part of a strategic business plan.

For Your Clients: Read a summary of how the tax reform bill will affect freelancers – then pass it on to your clients.

New Resource: The SBA’s SF District Office has launched a slack channel – The Business Support Network – that you are invited to join. Feel free to announce events and voice questions about where to send clients, how to handle specific types of businesses, find funding (for clients or yourselves), shape programming to serve business owners, and more. (Note: they had some technical difficulties, so if you signed up, you’ll need to sign up again.)