Thanks to Andrew Cole for this story.

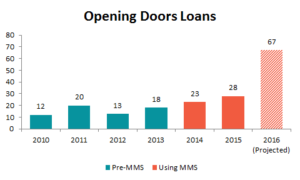

Opening Doors made 18 loans totaling $200,000 in 2013, the year before they joined the MMS cohort. This year, they’re on pace to hit nearly 70 loans worth $450,000, a more than threefold growth in activity in just two years. The organization serves primarily refugees with little or no credit history, many of whom are seeking loans to start their Uber or Lyft companies or to formalize their existing cash-based businesses. The team consists of three loan officers and is led by Jim Claybaugh and Julio Ortiz.

Opening Doors made 18 loans totaling $200,000 in 2013, the year before they joined the MMS cohort. This year, they’re on pace to hit nearly 70 loans worth $450,000, a more than threefold growth in activity in just two years. The organization serves primarily refugees with little or no credit history, many of whom are seeking loans to start their Uber or Lyft companies or to formalize their existing cash-based businesses. The team consists of three loan officers and is led by Jim Claybaugh and Julio Ortiz.

Opening Doors has lent more than $2 million dollars since starting its loan program in 1999, and has an average loan size of $7,000. Starting in 2016, the program has focused on making what CEO Deborah Ortiz calls ‘molecular loans,’ loans of approximately $1,000 that act as seed capital for borrowers with nonexistent credit histories. “We work with the entrepreneur to complete a full business plan, and if they make consistent payments, we’ll do a larger loan when the plan is complete.” MMS has helped contribute to this refocusing. The program has streamlined the underwriting process, and lowered the overall cost of making a loan, making molecular loans cost effective.

The lender was able to build these starter loans because MMS has given Opening Doors a rigorous, clearly defined set of underwriting metrics. If borrower can make good payments for 6-12 months, the organization will consider them for a larger loan, knowing that they stand a good chance of clearing their underwriting standards at that point, according to Jim Claybaugh. They override MMS’s underwriters as they feel is warranted, but are confident and informed about the risks they’re taking on when they step outside of the program’s recommendations. Approvals from the system have clear sailing.

MMS has also enabled the organization to stay on top of their applications much more closely, with pipeline tracking letting them see in real time where each loan application is in the process. Julio Ortiz meets with the team weekly to review the pipeline, to see what’s hung up and what’s moving forward.

Overall, the organization is very pleased with the performance of the portfolio. Less than 1% of their portfolio is 30 days or more delinquent, with only 3 loans out of 110 made under the system past-due.

—

To learn the impact of Opening Doors success, check out the following:

Opening Doors’ press release: Two Million in Loans

“It’s hard to single out just one story among our clients,” Ortiz said. “Different business types, sizes, and loan amounts, but all have the same goal, self-sufficiency and economic prosperity.”