By Susan Brown

Working Solutions, a microlender based in San Francisco, obtained their own Microlending Management System (MMS) license from LiftFund in October. Working Solutions was the first organization to sign on to the MMS program, and they became the first to graduate from the program.

“We see this as a great success,” said Claudia Viek, CAMEO CEO. “This is exactly what we hoped would happen. Lenders would scale up their volume using MMS, becoming positioned for an independent license.”

In 2012 CAMEO launched an innovative use of LiftFund’s MMS platform by aggregating small volume lenders onto the platform. Seven CDFIs have been using one license under CAMEO to collect online applications, run automated risk assessments and use LiftFund’s two-day-turn-around underwriting team. MMS allows a CDFI to increase volume while maintaining portfolio performance and to shift staff capacity from underwriting and screening to building a greater loan pipeline in the community.

Several factors led to Working Solutions’ decision to purchase their own license.

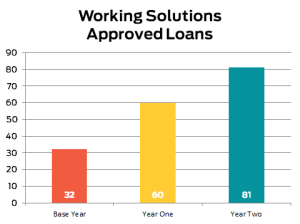

Volume. Working Solutions’ volume increased 200 percent with MMS due to increases in efficiency offered by the platform. CAMEO and LiftFund staff felt that the magic number for having an independent license is around 100 deals per year, a level Working Solutions will exceed next year.

Increased efficiency. CAMEO plays a middle-man role in day-to-day MMS operations in our aggregate model. As a CDFI’s volume increases, it makes sense to have a direct relationship with the system and the LiftFund staff. This will further streamline the loan process and allow Working Solutions to grow further.

Increased access. In the aggregated model, CDFIs get one account and funnel all staff activity through that one account. With their own license, Working Solutions can give each staff member an account. This allows the business development team to communicate within the platform throughout the day at their own MMS station and communicate in a more timely way. They also will be able to operationalize MMS features such as prospect tracking and reporting, which leads to a more integrated and comprehensive sharing of information.

Cost analysis. The main reason CAMEO developed the aggregated model was to allow small-volume lenders access to the pricey MMS program. When an organization grows to the 100 deals-per-year level, it becomes cost effective to pay for MMS independently.

“MMS has been a game changer for us,” said Emily Gasner, Working Solutions CEO. “We’ve been able to increase volume, add new loan products and introduce an online application that helped us compete with online lenders.”

Emily thinks that MMS has helped Working Solutions provide better customer service by streamlining operations. Clients know specifically what they need to succeed, and Working Solutions has been able to be more visionary on products and services.

“Joining CAMEO’s aggregate program made sense for us,” said Sara Razavi, Working Solutions COO. “We were able to learn the system, scale up our volume and assess its potential for us. And as we’ve grown, it was more cost effective, and we were ready to better realize the full potential of the software, so we sought our own license.”

In the coming year, Working Solutions plans to increase their conversion rate and continue to grow volume.

Working Solutions is now tracking the performance of loans approved through MMS or through their other approval processes. For example, MMS underwriting recommended “deny” on close to one-third of the deals approved by Working Solutions last fiscal year. This is primarily because the MMS underwriting process does not account for start-up projections, a large part of Working Solutions’ portfolio. However, there are other understandable underwriting restrictions, which most participants in CAMEO’s aggregate program also experience, and why it is common for participating CDFIs to approve some MMS-denied deals.

Working Solutions keeps a tight relationship with its borrowers through its post-loan, business-coaching model, which supports loan repayment success. It will be interesting to track the performance of both the MMS-approved and MMS-denied loans, as it may well be that both pools perform similarly.

CAMEO is grateful for Working Solutions’ leadership in the field and participation with us in innovation.