Survey collected from our colleagues at Reimagine Main Street.

The last two years have taken a tremendous toll on small businesses and challenges persist for many entrepreneurs. Small businesses that do not have a financial cushion or a source of external financing

remain at risk.

Against this backdrop, Reimagine Main Street sought to better understand capital needs of small business owners and to assess confidence in their ability to meet those needs. They also took a pulse on attitudes toward a range of institutions where they might turn for capital.

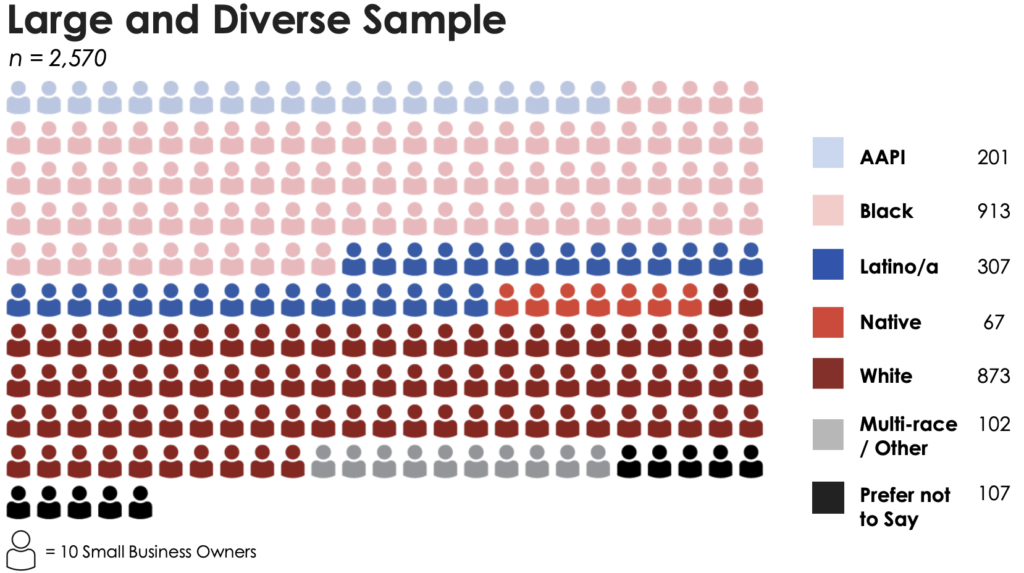

Reimagine Main Street and its partners fielded this national survey from April 7 – April 28, 2022 to generate insights into needs and attitudes small business owners, including AAPI-, Black-, Hispanic- and Native owned small businesses.

Executive Summary

- Most entrepreneurs of color lack confidence they could finance unexpected operating expenses or go after growth opportunities including contracts, marketing campaigns, or hiring additional workers.

- The capital needs of these entrepreneurs could be met by Community Financial Institutions (e.g. CDFIs and Minority Depository Institutions) and responsible FinTech lenders, but these sources of capital and guidance are not familiar to most entrepreneurs of color.

- The SBA should use its new-found position of trust among business owners to connect business owners to private sector resources including Community Financial Institutions, responsible FinTech lenders, and banks that can meet their needs.

Survey Takeaways

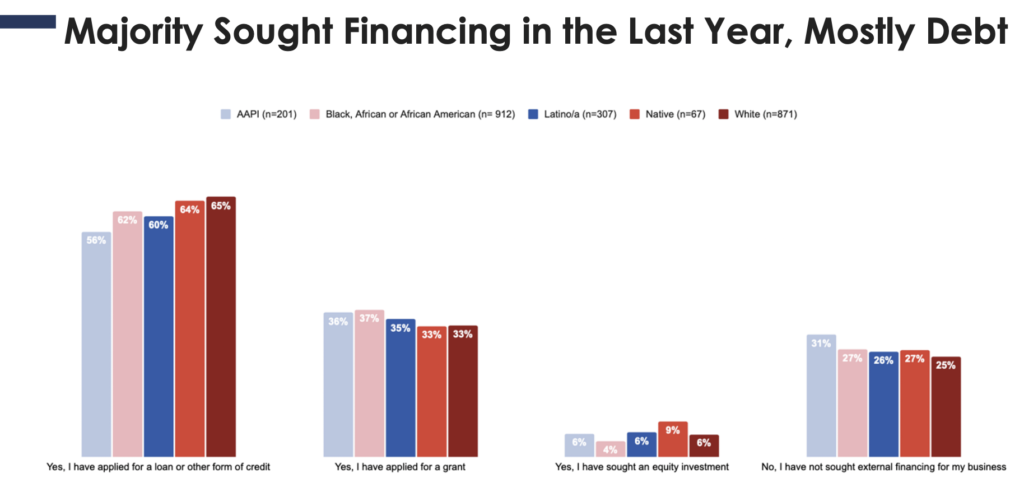

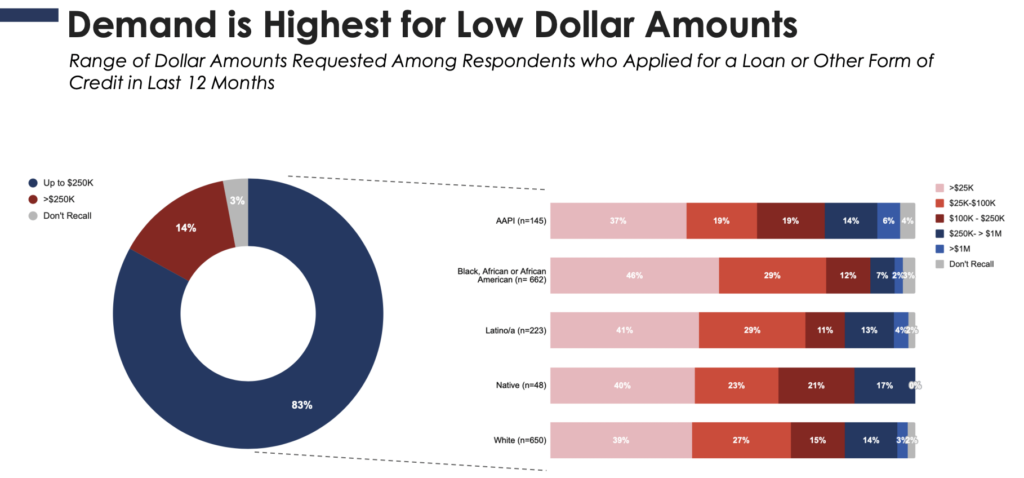

- Demand is High for Low Dollar Amounts: Most (79%) respondents applied for a loan or other form of credit in the last twelve months. Of those who did, 83% were seeking less than $250,000 and 69% applied for less than $100,000.

- Trust in Unexpected Places: At a time when trust in government is waning, most respondents know, like, and trust the US Small Business Administration. Three in four (76%) Black, Latino/a, and White respondents say they trust the SBA, rising to 81% of AAPI respondents but falling to 46% of Native respondents.

- Opportunities to Increase Awareness of Financing Options: While banks and credit unions are well-known, almost half of respondents do not know about Community Development Financial Institutions (CDFIs) or Minority Depository Institutions (MDIs) and 41% of respondents are not familiar with online lenders.