The 2023 CAMEO Summit (our very first one!) was a resounding success – all thanks to our attendees, sponsors, volunteers, and of course, staff. We are incredibly grateful to everyone who made the trip to downtown Sacramento for Advocacy Day, MicroLenders Forum, or both. It is a testament to the commitment of our network to address the issues and challenges facing entrepreneurs each and every day.

June 7, 2023: Advocacy Day

Advocacy Day kicked off with a bang thanks to an amazing keynote address by California Treasurer Fiona Ma. She spoke at length about her experience as a small business owner and how she is proud of the programs offered by the Treasury Department that support small businesses. Also from the Treasury, Andrea Gonzalez, Program Manager for the California Investment & Innovation Program (Cal IIP), explained how the Cal IIP capacity grant will work and how CDFIs can partner with them to deploy resources to communities in need to achieve an equitable economic recovery. Last but not least, Jonathan Herrera talked about CalSavers and its benefits for micro and small businesses and their employees. AB 1126 passed last year and supported by CAMEO will require employers with 1-4 employees to enroll in the program by 2025 if they don’t offer their own retirement savings program.

Next we had the pleasure of hosting Assemblymembers Eduardo Garcia and Tim Grayson. Assemblymember Garcia has been a champion of micro enterprise home kitchen operations (MEHKO) policy for a long time, and he continues to work with organizations like CAMEO to improve regulations and make it easier for micro entrepreneurs to make a living. Assemblymember Grayson, chair of the Assembly Banking and Finance Committee, has a bill that will track if underserved entrepreneurs are participating in the clean energy economy and a crypto regulation bill, both have passed the Assembly and will be heard in the Senate. It was great to have him with us to talk to our network about the importance of responsible business lending.

We invited Louis Caditz-Peck, CAMEO board member, Senior Fellow at the Aspen Institute, National Community Reinvestment Coalition (NCRC), and CFPB Consumer Advisory Board member to continue the conversation about responsible business lending issues. He talked to us about SB 33, SB 666, and SB 869 – all incredibly important bills that will make a huge difference for micro and small business owners who are often targeted by predatory lenders when looking for capital to finance their businesses.

After a quick update on CAMEO’s current and future training programs, CAMEO CEO Carolina Martinez and CAMEO Board Vice President Jesse Torres gave us an overview of the new Community Economic Resilience Fund (CERF). The Fund was created to support communities with their transition to more sustainable, climate forward industries while strengthening access to good jobs. Out of the $39 million in state funding for CERF, five CAMEO members are involved in projects totaling $29.6 million (75% of the funds!).

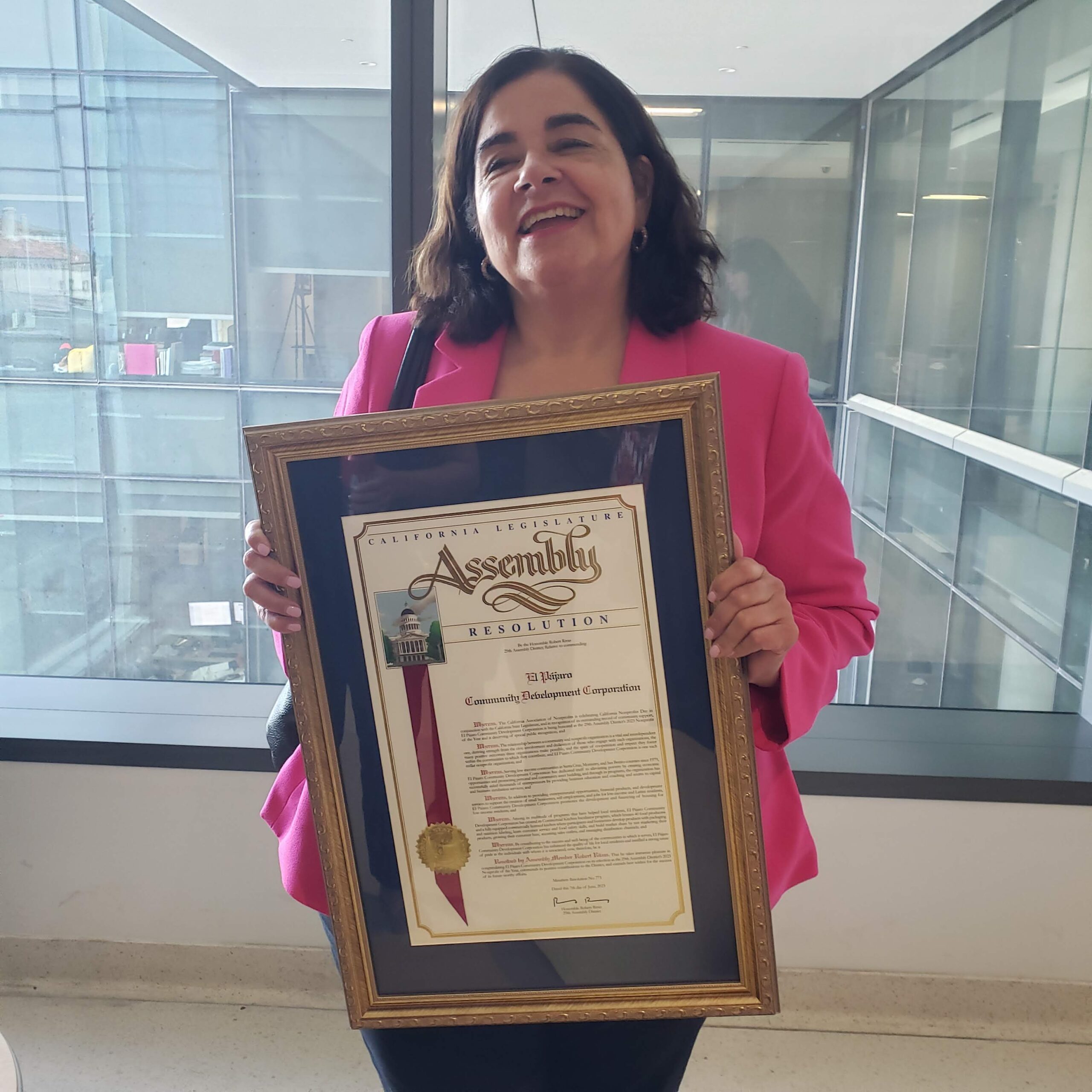

Lunch was provided by Gyro Genie, a wonderful local Sacramento business run by a father-son duo! Once bellies were full, our Advocacy Day attendees went off to the Capitol to meet with their representatives and do what they do best – tell the stories of their small business clients whose livelihoods are impacted by the decisions made in Sacramento every day. Their voices are so important and we thank all of those who took the time to meet with legislators!

June 8, 2023: MicroLenders Forum

Attendees of the CAMEO Summit started off their second day with the story of Julio Cesar Ortiz – a Sacramento small business owner and former Opening Doors employee. He shared his experience as the member of an immigrant family who had to knock on a lot of doors to get their business idea off the ground, thriving through sheer hard work and determination. While trying to find a brick and mortar location, he put in 50 applications before one was accepted. Julio is the owner of Gaspachos, who provided the delicious breakfast enjoyed by Summit attendees on both days.

Julio set the stage for Tara Lynn Gray, Director of the California Office of the Small Business Advocate and our keynote speaker. A longtime champion of small businesses, Director Gray talked about the importance of lifting up entrepreneurs of color and women entrepreneurs, who have been starting businesses at the fastest rate since the pandemic. She challenged us to think differently when offering services to our small business clients. She spoke about her Office’s work and answered very insightful questions from our attendees. Most of all she inspired us to grow in our work, scale our services, and try innovative ideas. If you’ve never heard Director Gray speak, you are missing out!

At the MicroLenders Forum, we like to spotlight CAMEO members who are innovating with their lending programs in order to inspire their colleagues, share best practices, and build a knowledge base among our network. This year, we were honored to have Alyssa Lopez from Inclusive Action for the City, Marni Brook from Women’s Economic Ventures, and Pablo Solares-Rowbury from MEDA’s Fondo Adelante CDFI who presented on lending to ITIN holders, forgivable loans for entrepreneurs of color, and the Small Business Racial Justice Coalition Underwriting Pilot.

Our VP of Strategic Initiatives and CDFI Incubator Director, Emily Gasner, kicked off a discussion about “Selling Your Loans on the Secondary Market.” Elizabeth Schott from Accessity and Gasper Magallanes from Working Solutions CDFI shared their experiences with selling their loans on the secondary market through programs like Entrepreneur Backed Assets (EBA) Fund. They discussed the ins and outs, the benefits, and the questions to ask before embarking on a program like this.

Emily then welcomed Anthony Williams from The Black Diamond Group, who talked about the importance of community ownership and the goals of the Urban Capital Network, an innovative initiative that is committed to create one million black and brown investors in underserved entrepreneurs over the next decade. Anthony explained how CDFIs are a key player in such initiatives and gave us a lot of food for thought.

Our final panel of the day featured Allison Kelly, CEO of ICA Fund, who facilitated a conversation with Derrick Tang, Deputy Director of Venture Capital at IBank California. They discussed IBank’s new Expanding Venture Capital Access program and why it is an important tool in the ecosystem of support for entrepreneurs.

We wrapped up the two-day event with lunch at The Bank and welcomed State Senator Steve Glazer, a longtime CAMEO ally and author of California’s truth-in-lending act, AB 1235. It was a fitting end to our Summit, which brought together people from all across the state (and country!) to work together in our shared mission to strengthen the entrepreneurial ecosystem and close the wealth gap.