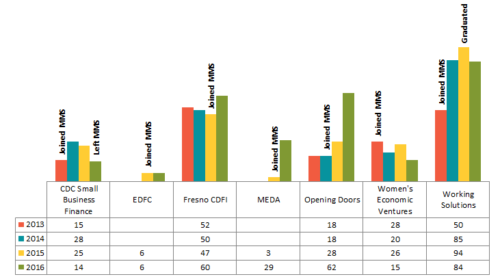

CAMEO’s MMS program is in it’s fourth full year. Since the inception of the program, the number of loans has increased by 166% and the loan volume by 174% (see above graph). In 2016, lending grew by 38% across the entire cohort. MMS users made 186 loans in 2016, for a total loan volume of $3.6 million. The average loan size was $19,512.

Half of the participating organizations grew their lending activity:

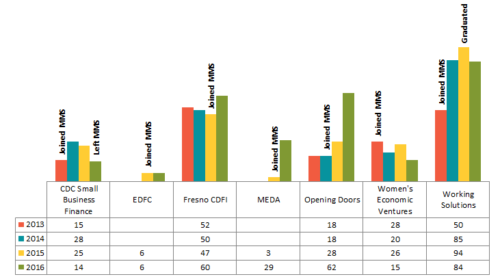

CAMEO’s MMS program is in it’s fourth full year. Since the inception of the program, the number of loans has increased by 166% and the loan volume by 174% (see above graph). In 2016, lending grew by 38% across the entire cohort. MMS users made 186 loans in 2016, for a total loan volume of $3.6 million. The average loan size was $19,512.

Half of the participating organizations grew their lending activity:

- MEDA increased number of loans by 866%,

- Opening Doord increased number of loans by 121%, and

- Fresno CDFI increased number of loans by 28%!

(MMS Growth by Organization)

LiftFund rolled out a new version of MMS in September 2016 in order to streamline the process for both the borrower and the lender. MMS now includes an online document collection portal, which allows the borrower to post their documents directly into the system without sending them to the loan officer first. The portal generates a unique list for each applicant, and can be adjusted by the loan officer or underwriter to add or remove documents as needed. Since the portal was introduced, the cohort decreased the number of days it took to collect documents from an average of 22 days 18 days.

The new version also puts vital information right at the top of the application, so users can quickly review an application’s status without having to dig through multiple screens and subfields. This reduces back and forth between loan officers and underwriters due to missing or incomplete information; both parties can now check the application for minimum completeness as soon as they open the record.

For 2017, the cohort plans to expand. Each member set organizational goals at or above CAMEO’s baseline of 33% growth year-over-year. Some users have grown enough that they are considering graduating from the cohort into their own MMS licenses, as Working Solutions did in 2015.

(MMS Growth by Organization)

LiftFund rolled out a new version of MMS in September 2016 in order to streamline the process for both the borrower and the lender. MMS now includes an online document collection portal, which allows the borrower to post their documents directly into the system without sending them to the loan officer first. The portal generates a unique list for each applicant, and can be adjusted by the loan officer or underwriter to add or remove documents as needed. Since the portal was introduced, the cohort decreased the number of days it took to collect documents from an average of 22 days 18 days.

The new version also puts vital information right at the top of the application, so users can quickly review an application’s status without having to dig through multiple screens and subfields. This reduces back and forth between loan officers and underwriters due to missing or incomplete information; both parties can now check the application for minimum completeness as soon as they open the record.

For 2017, the cohort plans to expand. Each member set organizational goals at or above CAMEO’s baseline of 33% growth year-over-year. Some users have grown enough that they are considering graduating from the cohort into their own MMS licenses, as Working Solutions did in 2015. ]]>

]]>