In this Issue…

- MMS Going Gangbusters

- DBO Report: Online Lending Surges

- DBO Guidance on SB 197

- Education Electeds on Responsible Lending

- Banker's Perspective: Byron Reed, Wells Fargo

- Research: SmallBiz Perspective on Online Lenders

- News

MMS Going Gangbusters

Our participating CDFIs continue to have success with MMS!

Our participating CDFIs continue to have success with MMS!

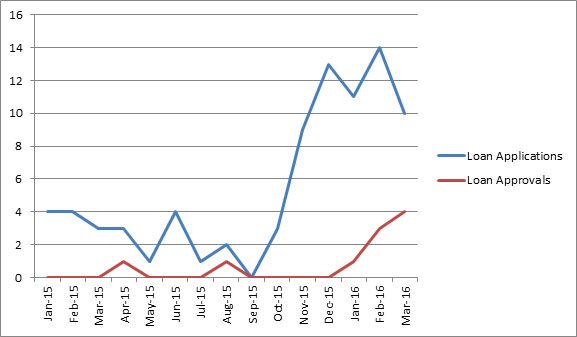

CDC Small Business Finance opened their program up to applicants seeking loans up to $50,000 at the end of 2015. Their applications have skyrocketed. From January – October 2015, the organization received an average of 2-3 applications per month, and approved a loan once every four months. Since October 2015, they average 10-12 applications and approve 2-4 loans per month, almost quadrupling their activity. All applications are currently handled by one loan officer, Carla Ulloa.

Fresno CDFI and Mission Economic Development Fund (MEDA) joined more recently. Fresno's applications have grown by 50% since the start of 2016, from 15 per month to 25; their approvals have doubled from 5 loans per month to 10. MEDA just hired a new loan officer to administer the program which delayed start-up. She has handled 13 applications since January, and approved 4 loans.

Two more nonprofit lenders have attended orientations and we hope to onboard them later this year.

Contact Susan Brown if you’re interested in learning more or participating in the MMS program. MMS, developed by LiftFund (formerly Accion Texas), provides instant risk assessment and fast, quality underwriting to support microlenders in scaling up and maintaining strong portfolio performance.

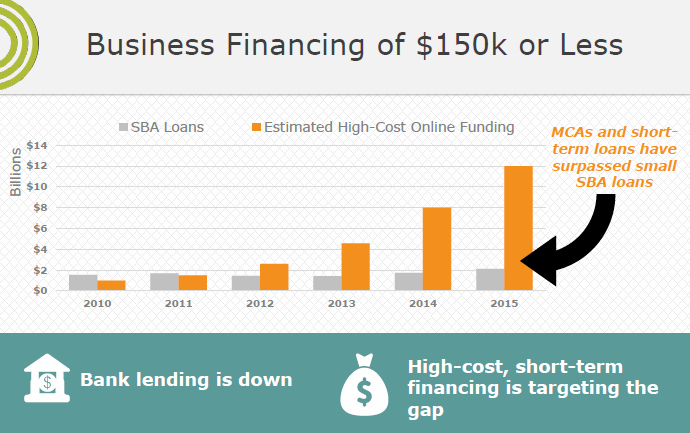

DBO Report: Online Lending Surges

Financing provided by 1 major online lenders to California consumers and small business increased by 936% from 2010-2014, to $2.3 billion, and the state’s growth rate exceeded the national pace by 236 percentage points, according to data the firms supplied in a Department of Business Oversight (DBO) survey.

The 13 companies’ U.S. dollar total reached $15.9 billion in 2014, the data showed.

The 13 companies’ U.S. dollar total reached $15.9 billion in 2014, the data showed.

“Clearly, California has a lot at stake in this growing segment of our financial services market,” said DBO Commissioner Jan Lynn Owen. “It’s crucial that we better understand the industry. These companies are providing needed access to financing. But we want to make sure our regulatory structure adequately protects the interests of our consumers and small businesses, and works effectively for industry.”

The DBO distributed the survey last Dec. 11 as part of its inquiry into the…online, or alternative, lending sector. The inquiry’s objective is to determine whether market participants are fully complying with state lending and securities laws. It also aims to assess how the state’s regulatory regime is working, and should work, with respect to the industry.

The DBO sent the survey to 14 firms. The firms that responded include: Affirm, Avant, Bond Street, CAN Capital, Fundbox, Funding Circle, Kabbage, LendingClub, OnDeck, PayPal, Prosper, SoFi and Square. The only company that did not respond is CircleBack. Read the survey responses.

DBO Guidance on SB 197

And in other DBO News…

Our colleagues at the Equipment Leasing and Financing Association sent a letter to the Department of Business Oversight (DBO) about SB 197 (last year's referral fee bill, co-sponsored by Opportunity Fund.) DBO has responded to their letter and gives guidance on how SB 197 will be implemented.

Educate Your Elected on Responsible Lending

CAMEO's educational campaign to inform California's small business leaders and elected officials on what good capital looks like will continue in Sacramento at our annual meeting. Here's some resources to help with your visits:

- Download the District Meeting webinar slides. The info is applicable to the Sacramento meetings

- Read our CAMEO Launches Campaign For BBOR.

- Find your California legislators.

- Learn more about good small business lending practices and the Small Business Borrower's Bill of Rights.

- The Accion Network has a webpage to educate business owners on predatory lending.

Banker's Perspective: Byron Reed, Wells Fargo

Byron K. Reed is senior vice president and Director of Community Relations for the Los Angeles Metro / Orange County Region for Wells Fargo. He is responsible for spearheading their program to provide investments and loans for community/economic development and low-income housing initiatives throughout his regions. Reed has more than 30 years of banking experience working in the areas of community development, corporate philanthropy, government relations, trust services and small business and consumer banking. His first job out of college was as a commercial lender for First Interstate Bank.

Byron K. Reed is senior vice president and Director of Community Relations for the Los Angeles Metro / Orange County Region for Wells Fargo. He is responsible for spearheading their program to provide investments and loans for community/economic development and low-income housing initiatives throughout his regions. Reed has more than 30 years of banking experience working in the areas of community development, corporate philanthropy, government relations, trust services and small business and consumer banking. His first job out of college was as a commercial lender for First Interstate Bank.

Claudia spent a few minutes with Byron talking about what keeps him up at night and what inspires him about the micro sector.

Byron is concerned about how many businesses in low and moderate income communities lack an understanding of their financial capabilities and don’t have a plan for their business’ growth. This is true even for mature businesses. He sees this as an opportunity for nonprofit microbusiness development organizations; by delivering truly appropriate technical assistance, they could put these businesses on track to succeed.

“TA is the path to capital,” asserts Byron. “And nonprofit TA providers and lenders need to be willing to meet these businesses where they are, maybe even sitting down before or after working hours to provide consultations.”

What inspires Byron is seeing small business owners that have struggled succeed. He has been mentoring Jason, who started a mobile DJ business while in high school that financed his college education. Jason’s business is flourishing with large contracts from radio stations. Jason got his first loan from a local CDFI, repaid it, and and is now expanding, with seven other DJs contracting with him.

Research: Banking the Unbanked: Bank Deserts in the United States

Low-income and rural households often lack access to bank accounts. While research has focused on the damage created by this lack of access and potential solutions available, there is little empirical evidence on the location or characteristics of what are called "bank deserts." This research fills in this missing piece of the puzzle. Around 350 urban and 650 rural bank deserts are identified. The research found that minorities, African Americans, and Hispanics are significantly more likely to live in a bank desert and the economical impacts are significant. Hispanics living in rural areas exhibit the highest risk for living in a bank desert. .

Low-income and rural households often lack access to bank accounts. While research has focused on the damage created by this lack of access and potential solutions available, there is little empirical evidence on the location or characteristics of what are called "bank deserts." This research fills in this missing piece of the puzzle. Around 350 urban and 650 rural bank deserts are identified. The research found that minorities, African Americans, and Hispanics are significantly more likely to live in a bank desert and the economical impacts are significant. Hispanics living in rural areas exhibit the highest risk for living in a bank desert. .

News

- Business Ownership Will Close the Wealth Gap (Claudia in Huffington Post)

- Online Small-Business Lenders Agree to Disclose Annual Rate on Loans

- OnDeck has made nearly 20,000 loans to small business owners in Georgia, Colorado, Arizona and California totaling $913.7 million dollars

- Five Small Business Financing Trends

- The Biggest Threat to Community Banks Is Thinking Small