In this Issue…

- The Election’s Effect on Microfinance

- Small Business and Responsible Lending, A Legislative Workshop

- Borrower’s Bill of Rights 2.0

- Changes to the CalCAP Program, a conference call

- MicroLenders Forum on February 1, 2017

- Research: Bridging the Small Business Credit Gap Through Innovative Lending

- News

ICYMI: Read and share Claudia’s op-ed in American Banker – How to Tame the Wild West of Marketplace Lending #microbiz #Fintech

The Election’s Effect on Microfinance

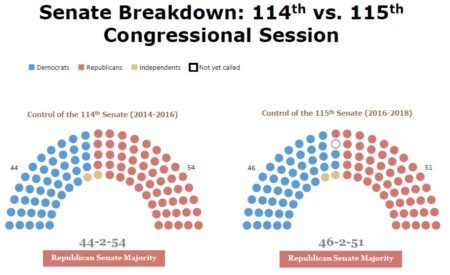

On Thursday Nov. 10th, Opportunity Financial Network (OFN) offered a webinar to discuss the impact of the election on the CDFI industry and present their plan to engage the new Administration and 115th Congress.

On Thursday Nov. 10th, Opportunity Financial Network (OFN) offered a webinar to discuss the impact of the election on the CDFI industry and present their plan to engage the new Administration and 115th Congress.

“Regardless of the vote you cast yesterday, one thing is certain,” said their email, “the American people are tired of not being able to move their families and their communities forward. They want change.”

Susan Brown attended the webinar and recaps what to expect from a Trump administration and how the sector will respond in her blog post – Post-Election Assessment of Microfinance.

Also, the Senate Small Business Committee tried to move a package of bills passed by the Committee by Unanimous Consent in the Senate. Due to a number of holds, the package will not move forward, but CAMEO actively engaged in pushing through the small business agenda that includes the modernizing of the SBA’s Microlending TA program among other issues.

Small Business and Responsible Lending, A Legislative Workshop

In mid-October, the Assembly Committee on Jobs, Economic Development, and the Economy (JEDE) hosted CAMEO, Opportunity Fund, Small Business Majority, Funding Circle and the SBA for an informational workshop on what small businesses need to thrive. Our goal was to educate legislative and state agency staff on 1) small business trends, including the growing numbers of self-employed using on-demand platforms; and 2) access to capital issues, including the pitfalls of alternative, online lending.

In mid-October, the Assembly Committee on Jobs, Economic Development, and the Economy (JEDE) hosted CAMEO, Opportunity Fund, Small Business Majority, Funding Circle and the SBA for an informational workshop on what small businesses need to thrive. Our goal was to educate legislative and state agency staff on 1) small business trends, including the growing numbers of self-employed using on-demand platforms; and 2) access to capital issues, including the pitfalls of alternative, online lending.

Read more and find resources on our blog – Small Business and Responsible Lending, A Legislative Workshop.

We are grateful to the JEDE committee for such a successful event. The room was full and we generated lots of interest from legislative staff to work on small business issues at the state level. We’ve followed up with attendees and are evaluating which specific actions we will pursue. Stay tuned for an active 2017 at the state level.

Borrower’s Bill of Rights 2.0

The Responsible Business Lending Coalition has revised the Small Business Borrowers Bill of Rights (BBoR). In drafting the BBoR 2.0, they reinforced the six fundamental rights that all small business borrowers deserve and incorporated the feedback and informed suggestions that BBoR supporters shared with them over the past year. Comments on the revised version were accepted until mid-November. CAMEO agrees with the changes and believes that they make a stronger case for responsible lending.

After considering all comments and recommendations submitted, the coalition will finalize the BBoR 2.0 and invite current signatories and endorsers to renew their commitment to the BBoR in January of 2017. They will also launch a renewed campaign to expand the number of signatories and endorsers actively supporting the BBoR. We encourage everyone to sign on to the BBoR.

Changes to the CalCAP Program, a conference call

The California Pollution Control Financing Authority (CPCFA) is proposing changes to the CalCAP program.

Please join us and your fellow CAMEO lenders for a presentation and discussion of these changes to the CalCAP program and why this is an issue for all participating lenders.

Wednesday, December 14, 2016 at 11:00am PT

Opportunity Fund’s analysis on the changes that the CPCFA indicates that the changes would have profound impact on how the program works. The changes are also being applied to all of CPCFA’s programs such as the ADA program and the seismic saftey program.

MicroLenders Forum on February 1, 2017

We are excited to announce our 8th annual MicroLenders Forum to be held at the Federal Reserve Bank of San Francisco.

We’ve got a great program lined up for you that

includes: opportunities to scale up your microlending activities with new technologies; exciting new programs from CAMEO to build capacity of both your staff and your portfolio; and a new program to increase bank referrals. Of course there will be plenty of time for networking and sharing accomplishments and concerns.

9:30am-3:30pm

101 Market Street

San Francisco

Research: Bridging the Small Business Credit Gap Through Innovative Lending

This report describes the latest innovations across the globe in the field of micro, small, and medium enterprise (MSME) finance. In it, Venture Lab explores how innovative, tech-enabled lenders are using niche marketing, digital or mobile platforms, and enterprising partnerships – and often a combination of all three – to make financing available to under-served MSMEs. Informed by its investments and work with more than a dozen fintech start-ups in the MSME finance space, Venture Lab charts a course for investors, regulators, microfinance institutions, and entrepreneurs to seize today’s opportunity to close the gap.

News

- The US SBA Sets New Small Business Lending Records with about $34 billion in lending for all of their programs – 7(a), 504, microloans, community advantage.

- According to Treasury Secretary Jack Lew, each business day, mainstream financial institutions decline more than 8,000 loan applications. This market failure represents a $44-$52 billion credit gap to Main Street.

- NerdWallet recently released a special report on the merchant cash advance industry, which is part of their new MCA educational portal.

- The Nonprofit Leaders in Financial Technology (nLIFT) was launched to increase financial inclusion through technology-driven platforms.