The Small Business Credit Survey is an annual study of small businesses across the United States undertaken by the 12 Reserve Banks of the Federal Reserve System. Every year, the survey offers insights into the financial health of small businesses as evidenced by their revenues, profits, payroll, and credit needs both in terms of their present situation and their expectations for the coming years.

Last week, the Federal Reserve released the 2019 Report on Employer Firms, the first report from the 2018 survey. This report focuses on businesses that have between 1 and-499 full- or part-time payroll employees and looks at their growth and financial needs in 2018 as well as their expectations for 2019.

The report shows similar trends as the 2017 report in terms of revenue and employment increases as well as demand for new financing. However, the survey results show some signs that growth and optimism may be tempering down. The share of firms reporting profit increases remained unchanged from last year, while the share of firms that expect to hire workers in 2019 is lower than the share of firms that anticipated employment growth in 2018. The report also shows that more and more small businesses are turning to online lenders to meet their financing needs. Below are some of the report’s key findings:

The report shows similar trends as the 2017 report in terms of revenue and employment increases as well as demand for new financing. However, the survey results show some signs that growth and optimism may be tempering down. The share of firms reporting profit increases remained unchanged from last year, while the share of firms that expect to hire workers in 2019 is lower than the share of firms that anticipated employment growth in 2018. The report also shows that more and more small businesses are turning to online lenders to meet their financing needs. Below are some of the report’s key findings:

Revenue and Profit

- 35% of firms reported revenue growth, up from 28% last year

- 72% of businesses expect their revenues to increase in 2019, the same share as last year

- 73% of firms reported their input costs had increased in the past year, and more than half of these raised their prices to offset this increase

Employment Growth

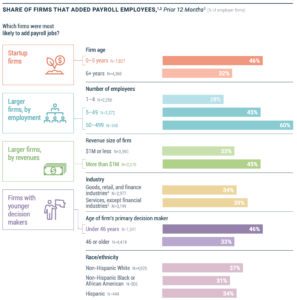

- The 37% of firms that hired workers in 2018 fell short of the 48% share that said they had planned to add payroll jobs in the 2017 survey

- 44% of businesses expect to have employment growth in 2019, an 8% decrease from last year

Financing

- 43% of firms applied for new financing in 2018, similar to the 40% that did so in 2017

- 47% of applicants received the full amount they requested, while only about half of businesses that did not apply reported they had sufficient financing

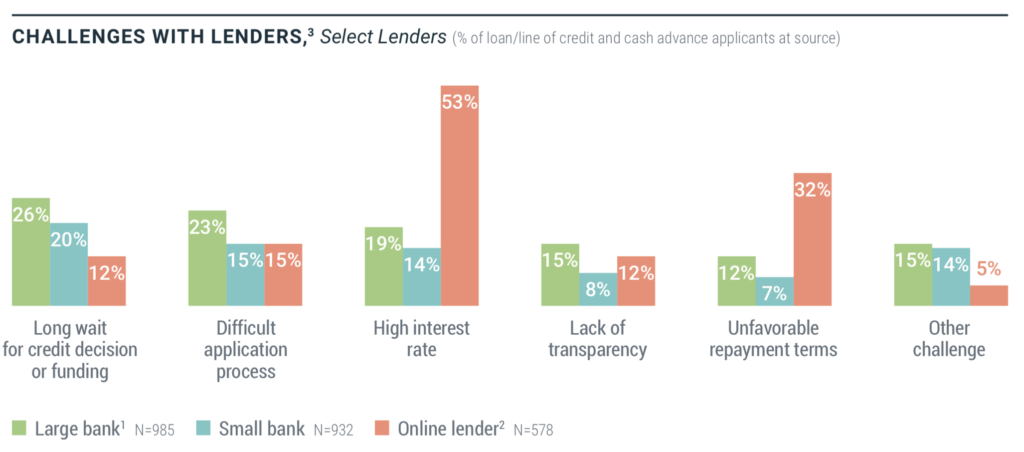

- 32% of firms that applied for financing did so through online lenders, up from 24% in 2017 and 19% in 2016. The growth continues despite applicants having lower satisfaction with online lenders than with banks.

- 54% of medium- and high-credit risk applicants sought financing from online lenders, while 50% sought it from large banks, 41% from small banks, 12% from credit unions, and 5% from CDFIs.

It’s this last point that is troubling for our clients and potential clients. That’s why we worked hard to pass SB 1235, a small business truth-in-lending bill and will continue our work until small business owners are able to understand their financing options.