Thanks to Ryan Doria for this blog post.

The CARES Act created the Paycheck Protection Program (PPP) in late March to help companies keep their employees on the payroll as they struggle to persevere through the economic challenges wrought by the COVID-19 pandemic.

Thousands of small businesses and hundreds of nonprofits were assisted by lenders in CAMEO’s statewide network, according to data from the Small Business Administration. Members including in the analysis include: AMPAC, California FarmLink, CDC Small Business Finance, Lendistry, Opportunity Fund, Self-Help Credit Union, and USC Credit Union. If your organization made PPP loans and were not include, please email Heidi Pickman.

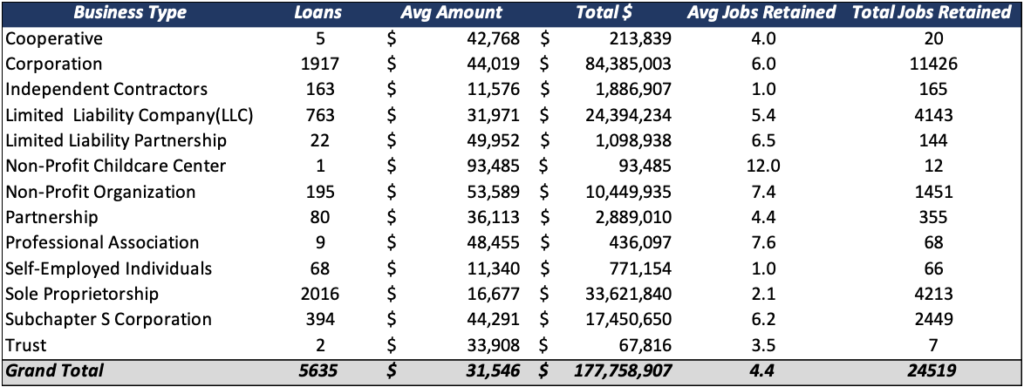

Released under the Freedom of Information Act, the federal loan data reported a total of $18 billion dollars spread across a variety of business types and industries for loan sizes less than $150,000 as of June 30. Of that funding, CAMEO members accounted for $178 million disbursed across 5,600 organizations, which translates to 24,500 jobs retained. With the previous application deadline extended to August 8, these numbers are expected to increase at the time of this writing.

The types of businesses and organizations that received federal funding was a bit surprising. Corporations and sole proprietorships received the lion’s share of the funds (66%). Other business types such as LLCs and S-Corps represented a smaller share (26%). Independent contractors and self-employed individuals, on the other hand, only accounted for 1%. This is likely due to a variety of factors. With a smaller payroll, these borrowers averaged smaller loan sizes. They also had a later starting date to their application window, beginning a week later than small businesses and sole proprietors. Lastly, they face stricter provisions for loan forgiveness. This could potentially dissuade them from applying in lieu of other options for financial assistance.

Nonprofit organizations also received federal assistance for their staff, accounting for 6% of the funds. Other organizational types were also among the program’s benefactors, including: cooperatives, professional associations, nonprofit childcare centers, and trusts.

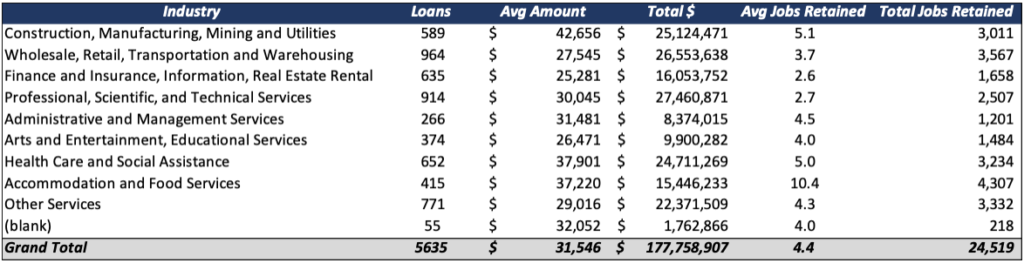

The types of industries represented in the loan data were also quite diverse. From construction and manufacturing to transportation, retail trade, and real estate renting, many industries were able to participate in the program. Healthcare and professional services were the biggest beneficiaries, receiving $24.7M and $27.5M respectively. Other industries stood out in different ways. Accommodation and food services, for example, tended to save the most jobs with an average of 10.4 jobs retained and 4,300 jobs retained overall. Construction had the highest average loan amount ($42,700) while maintaining a higher-than-average number of jobs retained (5.1 jobs).

Demographics

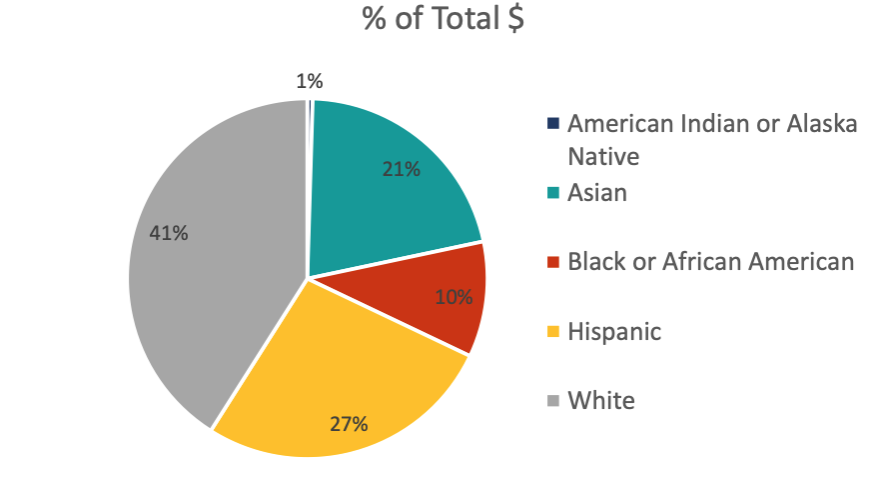

Along with business and industry information, the federal loan data included a number of self-reported demographics. These revealed some interesting trends on who benefited from the federal program. However, the demographic data had a high non-response rate; thus many of these initial findings must be taken with a grain of salt.

That said, it is interesting to note that although white people accounted for the largest share of the funds (41%), minorities overall received the majority share (59%) for loans of less than $150,000. Looking at each group separately, Hispanics and Asians received a comparable portion at 27% and 21% respectively. Meanwhile, black business owners received less than half that at 10%. American Indians / Alaska Natives were combined into one group on the survey and accounted for less than 1% of the federal funding disbursed by CAMEO members.

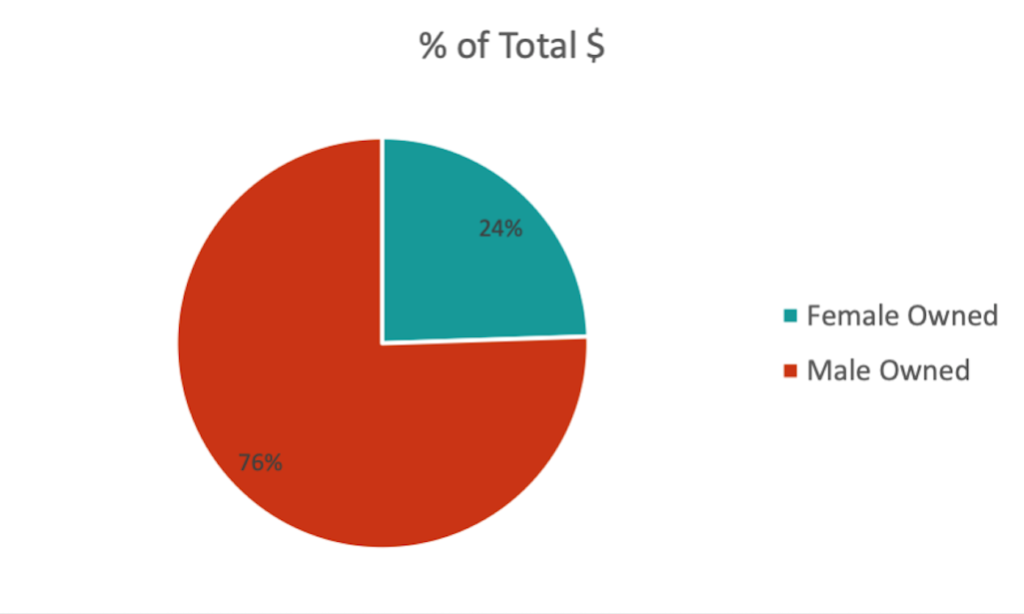

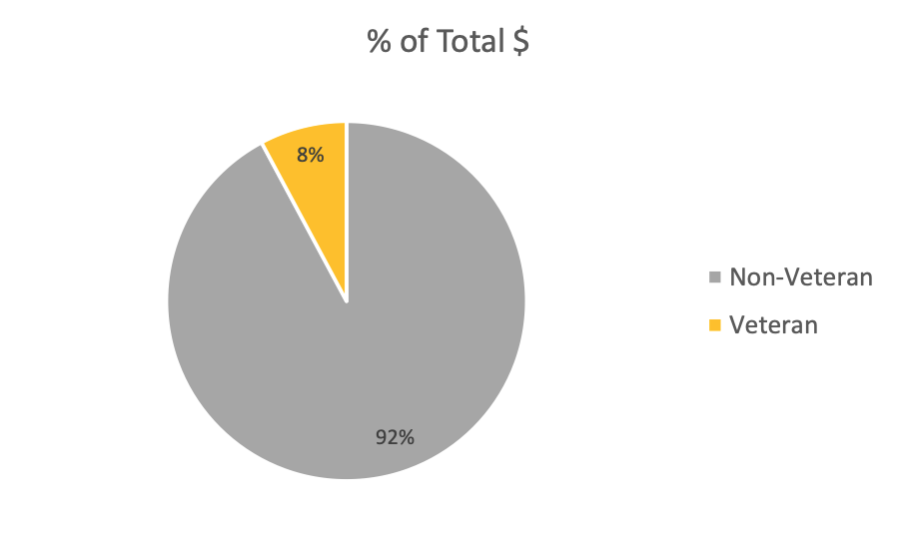

Data for gender was clearly indicated for owner of the business. Male-owned businesses received the majority of the funding at 76% while female-owned businesses received only 24%. Data for veteran status, on the other hand, was not as clear though it is likely that of the borrower. Veterans accounted for only 8% of the funds received. To reiterate, it is important to note that these demographic trends are based on a response rate of only 30% and pertain only to loan amounts of less than $150,000. Further analysis is necessary to validate these findings.