By Addison Peterson, CAMEO’s Policy Specialist.

Twenty percent of California workers need access to a retirement plan. Workers without a retirement plan will cost California $63 billion between 2021 -2040 if nothing is done to offer retirement options.

CalSavers is a state-managed retirement fund for employees that do not have access to traditional retirement plans through their employer. Until last year, companies with five or more employees were required to have a retirement plan for their staff. SB 1126 (Cortese), passed in 2022, extended the mandate for California employers to provide a retirement plan or sign up for CalSavers if they had one or more employees.

Employers bear no fees or fiduciary responsibility to their employees’ CalSavers accounts. Employers with one to four employees have until December 31, 2025, to register. Employers with five or more employees have until December 31, 2023, if they have received a notice from CalSavers. If not, employers with five or more employees must register by December 31st of the year they received a letter to register.

The Employer mandate:

- If the employer does not offer a qualifying retirement plan

- Has one or more employees

- Has at least one eligible employee (18yrs or older)

Qualifying retirement plans include qualified pension, 401a, 401k, 403a, 403b, simplified employee pension, savings incentive match plan for employees, and payroll deduction IRAs with automatic enrollment.

Fines for noncompliance:

- $250/employee 90 days after 1st notice

- $750/employee 180 days after 1st notice

Calsavers retirement plans do not compete with private-sector plans. Data shows that state-sponsored employment plans boosted private-sector plans. In California, the share of new plans rose from 8.1% (2013-2017) to 9.4% (2019-21).

In California:

- The average funded account balance: $1,320

- Average monthly contribution: $189

- Average contribution rate: 5.15%

Employers with 5 or more employees must register every spring. CalSavers uses data from EDD to send notices to employers. Employers need to register from Spring through December. December 31st is the annual employer registration deadline.

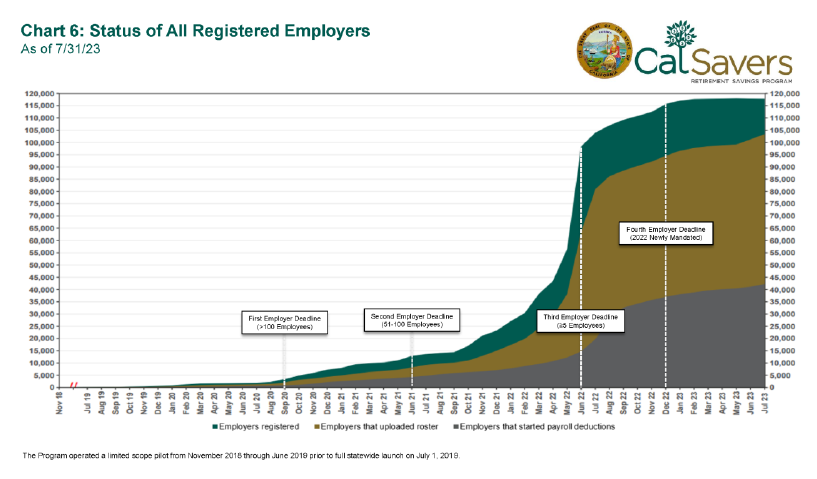

Program Growth

Participation Update: Savers (As of July 31, 2023)

- Funded Accounts: 437,586 (204,898 on 11/15/21)

- Participation rate: 64% (70.3% on 11/15/21)

- Average contribution rate: 5.14% (5.02% on 11/15/21)

- Average monthly contribution: $180 ($140 on 11/15/21)

Participation Update: Employers

- Wave 1 with more than 100 employees- 98%

- Wave 2 with more than 50 employees – 95%

- Wave 3 with more than 5 employees – 90%

- Wave 2022 with more than 5 employees – 81%

- Wave 2023 with more than 5 employees – 7.46%

- Early Action 1-4 employees – 2.28%

Microbusinesses have the lowest participation rates. More marketing efforts are needed to inform these businesses to register with CalSavers.