When it comes to ‘Business and Jobs’, California is ranked 23rd in outcomes and 3rd in policy in comparison to other states. That’s according to CFED’s Assets & Opportunity Scorecard* that asks…

Are there quality jobs or business ownership opportunities available to all residents?

Business ownership plays an important role in a household’s ability to build assets; homeownership and business equity are number one and two, respectively, as a share of household wealth.

If we tease out businesses from jobs, California is a mixed bag. We rank 9th in microbusiness ownership (1-4 employees), but 39th in small business ownership (5-99 employees). We do better on business ownership by gender than the national average, but are more unequal when it comes to race. We’re in the bottom half of states of business creation and small business loans.

If California performed as well as the best state for

- microenterprise ownership (Florida with 21.8%), there would be 746,276 more workers owning microenterprises;

- small business ownership (Montana with 2.02%), there would be 124,51 more workers owning small businesses.

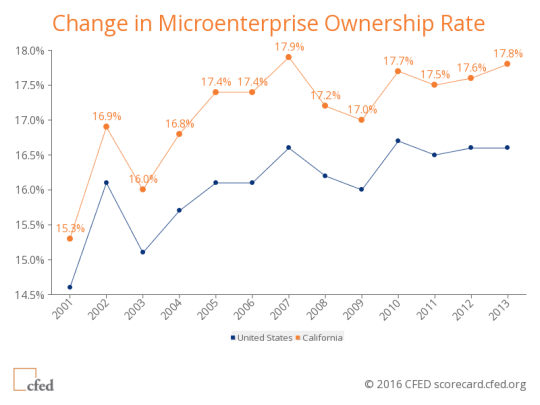

Microbusiness ownership has increased in California from 17.4% in 2006 to 17.8% in 2013. Small business ownership has declined in California from 1.50% in 2006 to 1.35% in 2013. (Total number of firms as a percentage of people in the labor force.)

**Download the full California Assets & Opportunity Scorecard.

**Download the estimated impacts for California (if they performed as well as the best state.)

How can California do better? CFED tracks three federal funding sources are available to states for microbusiness development and entrepreneurial training: the Community Development Block Grant (CDBG), the Workforce Investment Act (WIA) and Temporary Assistance for Needy Families (TANF). California does allow CDBG funds to be used and many of our members have received these funds in the past. However, we’ve heard anecdotally that microbusiness programs compete with other interests for the funds and the implementation isn’t consistent around the state. California does not use WIA or TANF funds to support microbusiness development. California also doesn’t have a Self Employment Assistance (SEA) program that allows the unemployed keep their unemployment benefits while they’re starting their business.

CAMEO put in a valiant effort in 2013 to bring a SEA program to California, but there were factors beyond our control that didn’t allow that to happen. We’ve also been working tirelessly with the Workforce system to integrate entrepreneurship into their system. The next step is to have the U.S. Department of Labor issue performance measures for self-employment so that local workforce boards can effectively contract with entrepreneurial training programs.

We’ve long been a proponent of business ownership as a way to reduce the inequality gap. Claudia testified at a hearing entitled “Who is the Economy Working For? The Impact of Rising Inequality on the American Economy (held by the U.S. Senate Committee on Banking, Housing, and Urban Affairs, subcommittee on Economic Policy.)

If we are serious about addressing income inequality, then we need to support entrepreneurship and starting a business as a real pathway to closing the wealth gap and generating new jobs.

From CFED: *The Assets & Opportunity Scorecard is a comprehensive look at Americans’ financial security today and their opportunities to create a more prosperous future. It assesses the 50 states and the District of Columbia on 130 outcome and policy measures, which describe how well residents are faring and what states are doing to help them build and protect assets. The Scorecard enables states to benchmark their outcomes and policies against other states in five issue areas: Financial Assets & Income, Businesses & Jobs, Housing & Homeownership, Health Care, and Education.