In this Must Know…

- Historic Truth-in-Lending Law for Small Businesses Passed!

- LendingFront Online Loan Platform

- Small Business Saturday

- The Goodies – This week’s highlight is CAMEO’s partnership with the Federal Reserve to conduct a Small Business Credit Survey. The survey closes December 8, 2018.

Historic Truth-in-Lending Law for Small Businesses Passed!

We did it! With your help! Thank you for your strong support of SB-1235, which became law in California when Governor Brown signed the bill late Sunday night. Because of you — and the hard work of a broad coalition of industry and nonprofit organizations — we’ve set the national standard for transparency in small business financing.

California’s “truth in lending” law is the first in the country, and our state is leading the way to ensure that small business borrowers have more transparency and clearer information when considering online and alternative financing options.

Under the new law, Department of Business Oversight (DBO) will set clear and consistent disclosure standards that provide small business owners with better transparency during the loan process. CAMEO, along with our partners, led a coalition of more than 60 private sector and nonprofit organizations to support this legislation and ensure its integrity. We will be working with DBO during the regulatory process to represent the interests of our small business borrowers.

A big thanks to those we worked with: Louis Caditz-Peck of LendingClub, Kurt Chilcott of CDC Small Business Finance, Mark Herbert of Small Business Majority, Connor French and Laura Bond of Funding Circle, Gabriel Villarreal and Gwendy Brown of Opportunity Fund, Sharon Velazquez of Greenlining, and Kevin Stein of CRC. The effort came together because we worked together to build a coalition and bounce strategy off each other. It was a huge team effort and CAMEO played a large role in that.

Our work isn’t done. One down, 49 states to go. If you’re not an endorser or signatory. We’d like to invite you to continue your support of small business by becoming an official endorser of the Small Businesses Borrowers’ Bill of Rights.

LendingFront Online Loan Platform

LendingFront Online Loan Platform

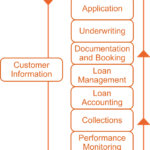

Join us on October 18, 2018, at 2:00 pm as we introduce LendingFront, a new technology platform that streamlines the lending process. (Click to register.)

Many smaller members have modest technology budgets but could benefit substantially from more advanced software. CAMEO has coordinated members for group purchasing of sophisticated technology that would otherwise be unaffordable, while also providing capacity building support.

Get Ready for Small Business Saturday

Get Ready for Small Business Saturday

Small Business Saturday is a welcome boon for the small business community. According to the Small Business Saturday Consumer Insights Survey, an estimated 108 million consumers reported shopping at independently-owned businesses on November 25, 2017. This translated into roughly $12 billion in reported spending. Learn how you can get in on the action.

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that has crossed our desks since the last Must Know.

New Reports

- Asset Funders Network (AFN) recently released “Supporting Employee Financial Stability: How Philanthropy Catalyzes Workplace Financial Coaching Programs.”

- Milken Institute released “Best Practices for Technical Assistance Programs Serving Black and Hispanic Entrepreneurs and Small-Business Owners.”

- The SBA recently released a report on small business lending based on data from banks.

For Your Clients

- Prospera hosts Second Annual Summit for Latina Entrepreneurs, Saturday, October 27, 2018, from 8:30 am – 6:30 pm.

- CAMEO is partnering with the Federal Reserve to conduct a Small Business Credit Survey. The survey closes December 8, 2018.

Professional Opportunities

- The 34th OFN Conference – “CDFIs: Agents of Change” – takes place October 8-11, 2018 at the Marriott Marquis Chicago.

- Join CalNonprofits for their policy convention – Nonprofits Standing Up for California – on Thursday, October 18, 2018, in Los Angeles.

- CALED brings you the Introduction to Economic Development Certificate Program on October 22-25, 2018 in Fresno.

- Register for Asset Funder’s Network Annual Bay Area Asset Building Conference on November 1, 2018, in Oakland.

- The Office of the Comptroller of the Currency (OCC) will host two workshops – Credit Risk and Operational Risk Workshop – in San Francisco on November 6-7, 2018.

Other Goodies

- Happy Hispanic Heritage Month: 400 Hispanic women-owned businesses are launched each day; and since 2007, Hispanic women-owned firms have grown at a rate of 172 percent.

- Member Kudos: La Cocina will be opening a Municipal Marketplace at 101 Hyde Street in San Francisco next year.

- Jobs: CalSavers, JEDI, California Farmlink, Cutting Edge Capital, Chinatown Service Center, Pacific Community Ventures, Women’s Economic Ventures, and Santa Cruz Community Credit Union are hiring!

- The U.S. Small Business Administration is now accepting nominations for its 2019 National Small Business Week Awards, including the annual Small Business Person of the Year. The deadline is January 9, 2019.