The MLA newsletter is chock-a-block with articles, resources, technology, success stories, interviews, and big picture ideas on all Lending Academy features. This edition focuses on the many opportunities CAMEO is extending to its members in order to scale.

In this Issue…

- CAMEO in Action: SB 197

- Success Story: Southern Girl Desserts

- MMS Update: Fresno CDFI onboard, Q3 Update

- Loans to Lenders: Capital for Lending Programs

- Excellence in Lending: Scaling for the Mission

- Best Practices: OFN’s Risk Rating System

- Research: Financial Inequality – Credit to Wealth

- News

CAMEO In Action: SB 197

SB 197 (Block) is making its way through the California Legislature. It’s passed the Senate, Assembly Banking and Assembly Appropriations. Next stop is the Assembly floor later this month. CAMEO is co-sponsoring SB 197 with Opportunity Fund.

The bill would remove a competitive disadvantage that currently affects licensed commercial lenders in California. The bill would allow them to pay referral fees to those from whom they receive business, subject to certain restrictions intended to promote responsible lending. In essence, the bill would allow CAMEO’s microlenders to pay referral fees to consultants, non-profits (e.g. TA providers) and others who refer successful loans. It also will give your clients more information about affordable lending products. CAMEO is co-sponsoring SB 197 with Opportunity Fund.

Success Story: Southern Girl Desserts

For an example of the type of business SB 197 would help, check out the story of Southern Girl Desserts who got into some hot water with a couple of online lending products.

For an example of the type of business SB 197 would help, check out the story of Southern Girl Desserts who got into some hot water with a couple of online lending products.

Catarah Hampshire began baking southern-style cupcakes as a hobby, until she realized how much people loved the comforting, delicious taste of southern hospitality. Who isn’t curious about trying a Hennessey and Coke cupcake? Or having a chicken and waffles treat for dessert? Indulging in a tiny pecan pie-cake?

She officially opened Southern Girl Desserts in 2007 in Los Angeles. When business took off, her and her partner Shoneji Robison needed financing to purchase extra equipment. Find out about their troubles when they took a Merchant Cash Advance and how Opportunity Fund helped them take control of their business finances.

Technology: MMS Update

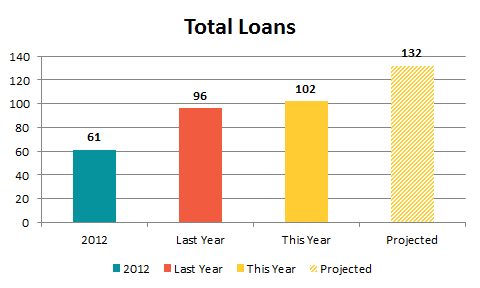

With three months still to go in this program year, each MMS organization has nearly met or exceeded the number of microloans they made last year. We project a 38% growth over the first year of the program, and a 116% increase over the 2012 base year. At a projected 132 loans, the MMS cohort is now the fourth largest lender in the CAMEO network and growing!

With three months still to go in this program year, each MMS organization has nearly met or exceeded the number of microloans they made last year. We project a 38% growth over the first year of the program, and a 116% increase over the 2012 base year. At a projected 132 loans, the MMS cohort is now the fourth largest lender in the CAMEO network and growing!

Next week, Andrew Cole and Susan Brown will travel to Fresno to train the Fresno CDFI staff on MMS. Fresno CDFI closed 50 microloans in 2014 and aspires to grow their program in the coming year. MMS will support this growth by allowing Fresno’s staff to focus on building the loan pipeline and servicing to maintain high repayment rates.

We are looking forward to including Fresno in CAMEO’s MMS family that now includes Working Solutions, Women’s Economic Ventures, CDC Small Business Finance, Opening Doors, Economic Development & Financing Corporation (EDFC), and soon, Mission Economic Development Agency/Adelante Fund.

Contact Susan Brown if you’re interested in learning more or participating in the MMS program. MMS, developed by LiftFund (formerly Accion Texas), provides instant risk assessment and fast, quality underwriting to support microlenders in scaling up and maintaining strong portfolio performance.

Loans to Lenders: Capital for Lending Programs to Scale

VEDC is forming a $20 million National Microfinance Fund (NMF) to expand its small business loan portfolio to include lending to microlenders across the country. VEDC recognizes the lack of readily accessible capital for non-profit microlenders. Through a national platform, quicker and easier access to capital will enable microlenders to scale.

VEDC is forming a $20 million National Microfinance Fund (NMF) to expand its small business loan portfolio to include lending to microlenders across the country. VEDC recognizes the lack of readily accessible capital for non-profit microlenders. Through a national platform, quicker and easier access to capital will enable microlenders to scale.

Join CAMEO and Brandon Napoli on August 19, 2015 at 2:00pm to discuss the benefits, eligibility requirements and application procedures for this new program.

Excellence in Lending: Scaling for the Mission

The goal of our Excellence in Lending program is to digest big picture topics important to our CDFI members: the frameworks, processes and goals that underlie programs and lead to greater success. These calls are for the big picture thinker at each CDFI, to support greater competitiveness, volume and efficiency.

The goal of our Excellence in Lending program is to digest big picture topics important to our CDFI members: the frameworks, processes and goals that underlie programs and lead to greater success. These calls are for the big picture thinker at each CDFI, to support greater competitiveness, volume and efficiency.

Our next call is August 27, 2015 at 2:00pm when Opportunity Fund will talk about scaling to reach more underserved businesses.

As merchant cash advances and other online lenders pour millions of dollars into disadvantaged communities at 50 percent and higher annual interest rates, it is increasingly incumbent upon each of our CDFIs to consider scaling up to the hundreds-of-loans-per-year level. Without this, the neediest in our communities have no viable alternatives to these ubiquitous and usurious online loans. The technology and organizational models for this volume of lending is established and proven.

CAMEO invites leaders and the big thinkers to a presentation from Opportunity Fund on their lending process on August 27, 2015 at 2:00pm. Their process — which does not use high tech algorithms or online applications — led them to close 1,560 microloans this past year. The business model that allows such scale has elements that leaders in the CAMEO lending network need to consider.

Opportunity Fund makes a strong case that scale is a key component of their tremendous success in increasing grants from funders, capturing new sources of capitalization and establishing innovative partnerships. As Marco Lucioni, their Executive Vice President of Lending, said in a recent interview with us, ‘anyone committed to scale could do what we are doing.’

Best Practices: OFN’s Risk Rating System

Don’t roll the dice on your portfolio. A  risk rating system is an essential part of running a professional, sustainable loan program. It can help you:

risk rating system is an essential part of running a professional, sustainable loan program. It can help you:

- Preserve your capital

- Improve your understanding on what makes for a strong, successful credit

- Get clearer on what credits to avoid in the future

- Improve how you structure deals

- Anticipate problems while they’re still salvageable

- Determine which businesses need post-loan business coaching

- Get a read on both big and small-picture strengths and weaknesses in your portfolio

- Gather information on where to focus goals in the coming months

- Improve your marketing and outreach to businesses whose profiles match your strong deals.

About 73 percent of CAMEO’s lending members have a risk rating system in place. Sixty percent review a risk rating report monthly, quarterly or annually. For those of you looking to scale up your loan volume, be sure to get a good risk rating system in place and invest time into using it regularly. A great place to start would be OFN’s Risk Rating Systems Memo.

Research: Financial Inequality – Credit to Wealth

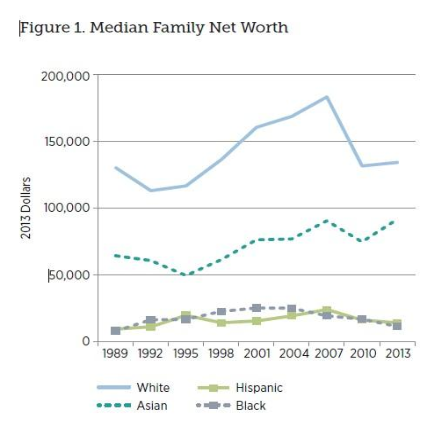

Financial inequality starts with basic access to traditional credit, like a bank loan or credit card. About 54 million people in the United States have no credit standing, i.e. they are “credit invisibles (video). The Consumer Financial Protection Bureau broke it down by race and ethnicity: “Whites are the least likely racial or ethnic group to be credit invisible….Blacks and Hispanics…, are notably more likely to be credit invisible or to have an unscored record than Whites.”

Financial inequality starts with basic access to traditional credit, like a bank loan or credit card. About 54 million people in the United States have no credit standing, i.e. they are “credit invisibles (video). The Consumer Financial Protection Bureau broke it down by race and ethnicity: “Whites are the least likely racial or ethnic group to be credit invisible….Blacks and Hispanics…, are notably more likely to be credit invisible or to have an unscored record than Whites.”

Without basic access to capital, the wide racial wealth gap continues to increase over time; millions of families nationwide lack enough assets to offer better opportunities for future generations. The Federal Reserve presented some evidence as to the extent and implications of racial wealth inequality in a webinar: Racial Wealth Inequality at the Metropolitan Area and National Levels: Findings and Implications.

So what can we do about the gap? CAMEO supports alternatives to FICO scores as we feel that will give more people access to basic capital and create more business owners. The evidence keeps mounting that business ownership is a key wealth generating strategy that can help close the wealth gap. Business assistance programs play a role to ensure that business owners have access to reasonably priced, appropriate capital as the type and amount of credit accessed influences the amount of wealth a business owner can create.

News

- After suspending the SBA’s 7(a) loan guarantee program for a few days because it hit the $18.75 billion limit, Congress approved a $23.5 billion cap through Sept. 30 and President Obama signed it last week.

- An American Banker op-ed looks at the reasons why the 7(a) program has become so popular.

- Another American Banker op-ed says “CFPB Should Shine a Light on Predatory Online Lenders” by collecting data on small businesses. CAMEO sent a letter to the CFPB in favor of doing so.