In this Issue…

- 2016 MicroLenders Forum – Register Today!

- Working Solutions Graduates MMS Cohort

- MMS Success Story: Nancy and David Ortiz, Buenaventura Travel Agency

- Accion San Diego Expands to Four Counties

- VEDC's National Loan Fund

- Research: SmallBiz Perspective on Online Lenders

- News

2016 MicroLenders Forum

January 26, 2016

9:00am – 4:00pm

Federal Reserve Bank of San Francisco

101 Market Street, San Francisco

Register for the 2016 MicroLenders Forum — you won't want to miss it!

We are delighted to announce that Ami Kassar, a prominent thought leader in the online lending sphere, will be our keynote lunchtime speaker. Ami is founder and CEO of Mutlifunding, an online loan broker, a nationally known small business lending expert and, and a prolific writer (e.g. Inc., The New York Times.) He is committed to ensuring that small business owners have the best possible access to the capital they need to help grow and manage their businesses.

Visit the MicroLenders Forum Registration page for the full agenda.

Working Solutions Graduates MMS Cohort

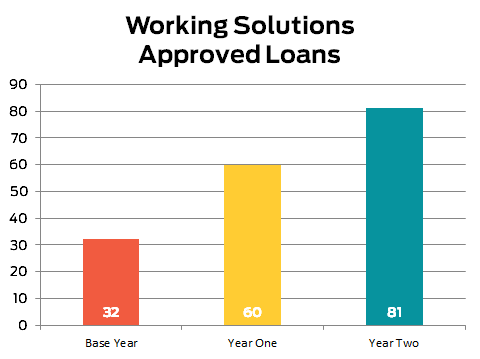

Working Solutions, a microlender based in San Francisco, saw substantial growth in the past two years, almost tripling its lending activity.

Working Solutions, a microlender based in San Francisco, saw substantial growth in the past two years, almost tripling its lending activity.

Working Solutions was the first organization to sign on to the Microlending Management System (MMS) program, and they became the first to graduate . They obtained their own MMS license from LiftFund in October.

“We see this as a great success,” said Claudia Viek, CAMEO CEO. “This is exactly what we hoped would happen. Lenders would scale up their volume using MMS, becoming positioned for an independent license.”

Read the entire blog post "Working Solutions Graduates MMS". Read the entire MMS Year Two Report.

Contact Susan Brown if you're interested in learning more or participating in the MMS program. MMS, developed by LiftFund, provides instant risk assessment and fast, quality underwriting to support microlenders in scaling up and maintaining strong portfolio performance.

Success Story: Nancy and David Ortiz, Buenaventura Travel Agency

Buenaventura Travel Agency received a loan from Working Solutions in August 2014 using the MMS platform. Thanks to Working Solutions for this story.

Buenaventura Travel Agency received a loan from Working Solutions in August 2014 using the MMS platform. Thanks to Working Solutions for this story.

Nancy Ortiz developed her passion for the travel industry as an employee at Avianca, the national airline of Colombia. After she and her husband David emigrated to the United States, they decided to turn that passion into a business, and in 1983 Buenaventura Travel Agency was born. Nancy and Diego offer flight, rail, and hotel booking services around the world, but specialize in personalized travel packages to Latin American and Caribbean destinations.

Accion San Diego Expands to Four Counties

Accion San Diego has added three counties to its service area: Imperial, San Bernardino and Riverside. Elizabeth Schott, CEO of Accion San Diego said she decided to expand because she saw a need.

Accion San Diego has added three counties to its service area: Imperial, San Bernardino and Riverside. Elizabeth Schott, CEO of Accion San Diego said she decided to expand because she saw a need.

"Our organization was approached by other partners working in the small business space in those counties- bankers, government agencies, nonprofits, chambers of commerce, and other community partners. They all expressed a strong demand for microlending activity, but said there was not a whole lot of supply."

Read the blog post for more information on why and how Accion expanded.

(Photo: Accion CEO Elizabeth Schott addresses a group of stakeholders at the Inland Empire Stakeholder Meeting on October 20, at the United Way of the Inland Valleys.)

VEDC's National Loan Fund

Valley Economic Development (VEDC) launched the National Microfinance Fund (NMF), a “loans to lenders” project, earlier this year to help small microlenders expand their loan capital base. They will lend out $5 million this year and raise an additional $10 million for 2016.

Valley Economic Development (VEDC) launched the National Microfinance Fund (NMF), a “loans to lenders” project, earlier this year to help small microlenders expand their loan capital base. They will lend out $5 million this year and raise an additional $10 million for 2016.

Mission Economic Development Agency (MEDA), a CAMEO member, is an NMF borrower, has used some of their NMF funds to make a loan to Alicia’s Tamales Los Mayas for a 6,000 square-foot factory in San Francisco.

“We want to focus on established, yet small microlenders who are expanding into underserved markets and populations,” said Brandon Napoli (NMF director and former CAMEO board member) A quarter of the fund is earmarked for lending deserts, defined as U.S. counties where small businesses receive a percentage of loans far below the national median.

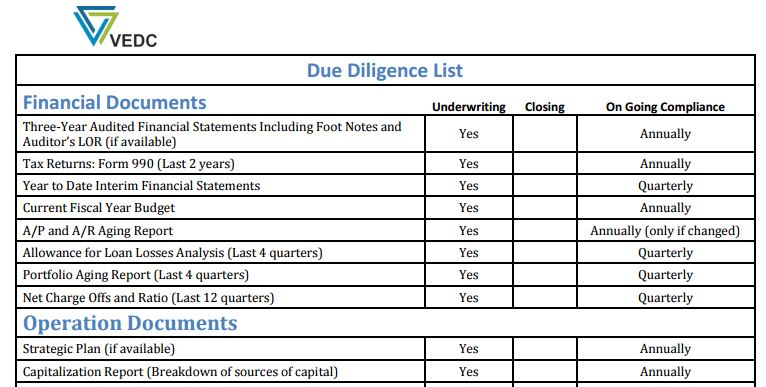

So what are the eligibility requirements? Applicants must have three years lending experience, with defaults under 10%, a full-time loan-origination staff and sufficient unrestricted funds to make the loan payments. Loans made with NMF capital cannot exceed $100,000 and half of the NMF capital support loans to women, minorities and low-income individuals.

NMF loans can range from $250,000 – $500,000, with interest starting at 3 percent, a draw down period up to 2 years and a 7 year maturity. Applicants will need to supply various financial, operations, and corporate documents. Download an application, document list, and letter of introduction.

Research: SmallBiz Perspective on Online Lenders

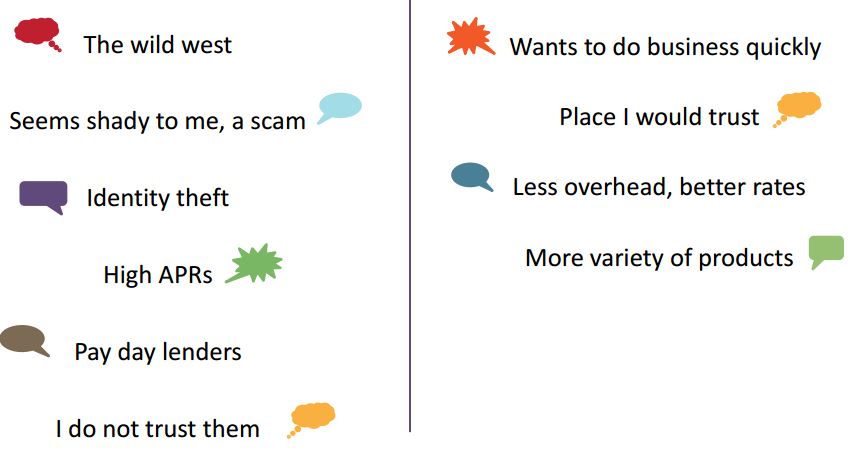

Technology and online platforms are changing virtually all small business lending processes from underwriting, to loan pricing, to loan delivery, to loan servicing. To help shed light on this growing, crowded, and potentially confusing marketplace, the Federal Reserve's Connecting Communities program held an online focus group of small businesses that are potential online borrowers. They were asked about their perspectives and understanding of this relatively new marketplace. See the graphic below for some of their comments.

News

- The California Department of Business Oversight (DBO) announced an inquiry into the growing marketplace lending industry.The DBO sent an online survey to 14 marketplace lenders requesting five-year trend

data about their loan and investor funding programs. - Frank Rotman, a venture capitalist who focuses on marketplace lending and an ex-banker, has a unique vantage point on the competition for small-business loans between banks and Web-based upstarts, as well as on both sides' strengths and weaknesses in his newest white paper: "The Battle for Supremacy in Small Business Lending."

- Why Online Small Business Loans Are Being Compared To Subprime Mortgages.

- Kickfurther, a Colorado based startup, aims to help businesses fund purchase orders and product inventory through peer-to-peer lending.

- JPMorgan Chase, the biggest U.S. bank, and OnDeck Capital are partnering to provide loans to Chase's 4 million small-business customers. Last MLA we noted that Intuit and OnDeck teamed up to make loans available through Quickbooks.

- It's all about OnDeck… Ami Kassar writes in Inc. that borrowers should be cautious about OnDeck even though Shark Tank's Barbara Corcoran has lent her name to the alternative lender.

- SBA lending reaches new heights: "More than $23.6 billion by 7(a) Program; Community Advantage Reaches $100 Million and Recruits 100th Lender."