The MLA newsletter is chock-a-block with articles, resources, technology, success stories, interviews, and big picture ideas on all Lending Academy features. This edition revolves around excellence in microlending. What are the key factors of success? What are standards of practice for California microlenders? What can we do to scale microlending to meet the unmet demand resulting from banks scaling back their small dollar loans?

In this Issue…

- Excellence in MicroLending Step One – Assessment

- Success Story: Accion San Diego – Combining Growth and Mission

- MMS Update: Who are the Borrowers?

- Best Practices: Impact Investing to Scale Up Microlending

- Research: Who Are the Credit Invisibles

- News

![]()

Excellence in MicroLending Step One

CAMEO’s long-standing commitment to building California’s microlending sector is the force behind many of our recent programs: Kiva and Accion Texas partnerships, the training series last October, Claudia’s many successes in building resources for lending, to name a few.

CAMEO’s long-standing commitment to building California’s microlending sector is the force behind many of our recent programs: Kiva and Accion Texas partnerships, the training series last October, Claudia’s many successes in building resources for lending, to name a few.

Our latest program, Excellence in Lending (EiL), focuses on the program elements needed for a high-quality loan fund poised for growth. Using Kiva’s Field Partner metrics as a starting point, we created an assessment that will be the basis for a rich discussion at our 2015 MicroLenders Forum at the Federal Reserve Bank of San Francisco this week – January 15. Fifteen lenders filled out the survey and we’ve compiled the aggregate data.

At the Forum, we’ll be asking participants what they think of the results.

- Are there areas that the industry as a whole should address or improve?

- Are there areas where establishing performance metrics make sense?

- What needs to be in place for a CDFI to successfully scale up to, say, 200 loans per year?

Read Susan Brown’s blog post about what the assessment measured and what topics showed a wide variety of standard of practice.

Success Story: Accion San Diego – Combining Growth and Mission

And speaking of excellence- last edition we looked at the three lenders – Opportunity Fund, VEDC and Accion San Diego – who make up 75% of loans made by the CAMEO network of microlenders. Over the next few newsletters, we’ll profile those organizations to see how they grew.

And speaking of excellence- last edition we looked at the three lenders – Opportunity Fund, VEDC and Accion San Diego – who make up 75% of loans made by the CAMEO network of microlenders. Over the next few newsletters, we’ll profile those organizations to see how they grew.

Our first interview was with Elizabeth Schott, CEO of Accion San Diego and CAMEO’s board president for 2015.

“We have averaged 15-30% portfolio growth over the past several years and project continued growth rate for the next five years…. We don’t just make loans. We change communities and local economies,” says Elizabeth Schott.

Susan Brown asked Elizabeth what were the key elements that set the stage for this success in her latest blog post.

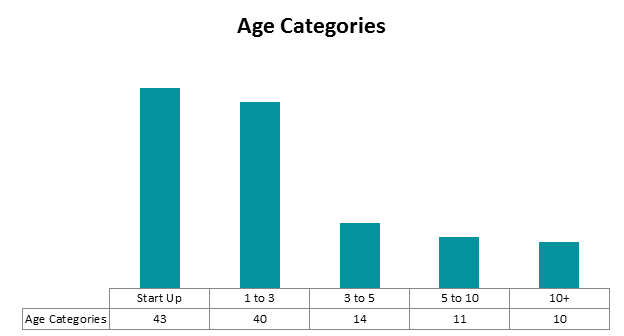

Technology: MMS Update –

Who Are the Borrowers

Three new members are joining CAMEO’s MMS project in 2015 for a total of seven particpating organizations: Mission Economic Development Association (MEDA), the Economic Development & Financing Corporation of Mendocino County, and Fresno CDFI (thanks to generous funding by Union Bank.)

The Accion Texas staff will also rollout a much improved online application. The new version is streamlined and easier for borrowers and loan officers to navigate, and is now available in Spanish as well as English. Entrepreneurs who are interested in applying for a loan can visit CAMEO’s California Microlending Online page for more information.

Now that we have a year of data, we’re wanted to know what MMS borrowers looked like. MMS offers a robust set of demographic tools, and CAMEO will be taking fuller advantage of these program features in the coming year. Check out Andrew’s blog post that summarizes who the MMS borrowers are.

Contact Susan Brown if you’re interested in learning more or participating.

Best Practices: Impact Investments to Scale MicroLending

Access to reasonably priced capital for entrepreneurs who can create opportunity for low-income communities is a well-know problem. The CAMEO network and other microlenders who do provide good terms for small dollar loans are handicapped in the sense that many times these loans are not profitable. Joyce Klein, Director of the Aspen Institute Microenterprise Fund for Innovation, Effectiveness, Learning and Dissemination (FIELD), wrote about the “opportunity to use impact investment to build the strength and scale of market relevant, mission-driven lenders” in a recent Aspen publication.

Access to reasonably priced capital for entrepreneurs who can create opportunity for low-income communities is a well-know problem. The CAMEO network and other microlenders who do provide good terms for small dollar loans are handicapped in the sense that many times these loans are not profitable. Joyce Klein, Director of the Aspen Institute Microenterprise Fund for Innovation, Effectiveness, Learning and Dissemination (FIELD), wrote about the “opportunity to use impact investment to build the strength and scale of market relevant, mission-driven lenders” in a recent Aspen publication.

Research: Who are the Credit Invisibles?

About 54 million people in the United States have no credit standing, i.e. they are “credit invisibles (video). This means that their economic behavior is outside what the three major credit rating agencies measure, not that they don’t participate in the economy. Maybe they’re renters who pay phone bills and utilities – but those activities aren’t looked at by credit agencies. This article examines different efforts by nonprofits, government and social enterprises to bring visibility to the credit invisibles.

In one such effort, Credit Builders Alliance and Experian analyzed the impact of loan repayments being reported to them by CBA members (nonprofit lenders) with positive results. However, microlenders can use more assistance to help report to the credit bureaus.

News

- Our favorite question: To regulate or not to regulate online lenders? One answer: “It’s Time To Rein In Shady Small Business Loan Brokers“.

- Ami Kassar, Founder of MultiFunding LLC and WSJ Guest Columnist, explains what he learned at AltLend, i.e.the rapid evolution of the alternative lending space.

- And to prove case in point – here’s another online lender – Fundera.

- SBA Adocacy report on small business lending.