Summary

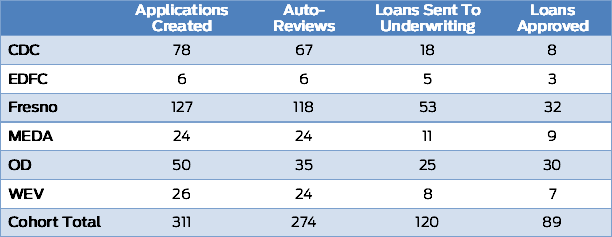

Six organizations participated in the MMS cohort during the first half of 2016: CDC Small Business Finance, Economic Development & Financing Corporation, Fresno CDFI, Mission Economic Development Agency, Opening Doors, and Women’s Economic Ventures. They have received a combined total of 311 applications so far this year, and funded a total of 89 loans.

CDC Small Business Finance left the cohort at the end of July, and is developing an in-house model for processing and handling loans. Thank you to everyone who participated in the cohort, and especial thanks to Carla Ulloa, who was one of our first MMS users and ran the CDC MMS program until its end. We’ll miss you, and look forward to working with you in the future.

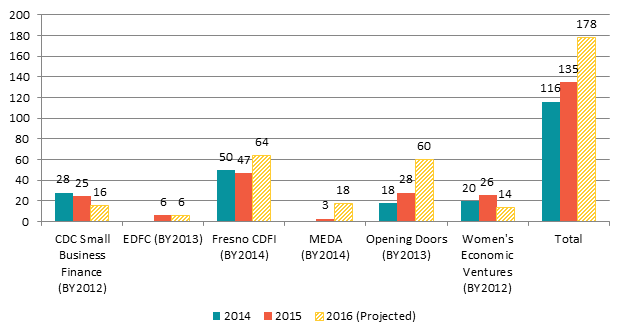

Loans Approved

Total lending activity has grown by an estimated 32% across the entire cohort over 2015, and 43% over 2014. Half of the participating organizations saw their number of loans rise by between 36% and 500%. Fresno CDFI, as an established lender, is making steady improvement under the MMS system, and Opening Doors is expected to more than double their previous lending volume after hiring several new staff members. MEDA’s loan program started when they joined the cohort, so their activity took a large spike over the previous year, but should settle down to more sustainable growth in the next few years.

Of the other three organizations, EDFC held steady. CDC Small Business Finance saw their activity decline after a robust first quarter as they moved to exit the cohort. WEV has restaffed most of their loan program, but is anticipating a stronger second half of the year as their new hires start to gain traction.

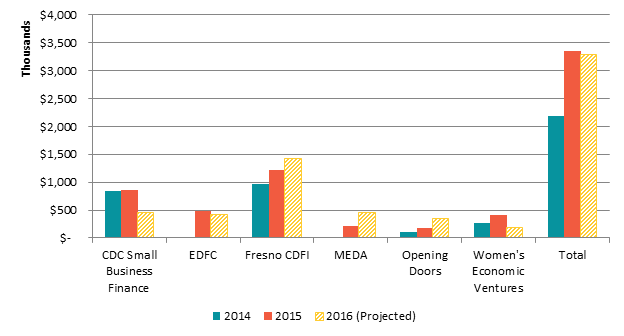

Loan Volume

Loan volume has been more variable than loan activity, with half of the cohort growing their portfolio, and the other half reducing it. Number of loans increased more quickly than volume, however, as organizations continue to reduce their average loan size.

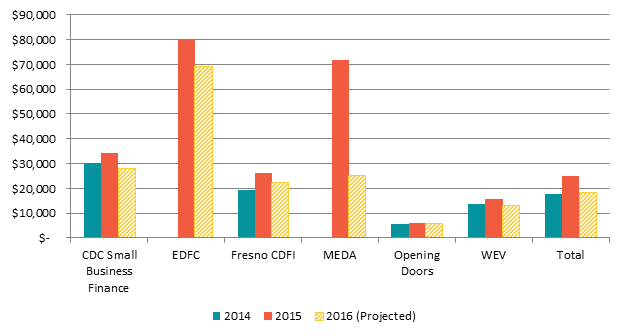

Average Loan Size

As expected, loan size has decreased across the board as MMS enables organizations to fund smaller volume loans; organizations saw their average loan size decrease between 4% and 64% over 2015, and the cohort as a whole reduced their average loan size by 26%. EDFC and MEDA saw especially steep declines in average loan size as their programs get up to speed; both programs made one or two larger loans in their first year of operation, and have started to shift to a larger portfolio of smaller loans. Even more established organizations saw their average size decrease, as MMS underwriters will often suggest a smaller loan size over denying an application outright.

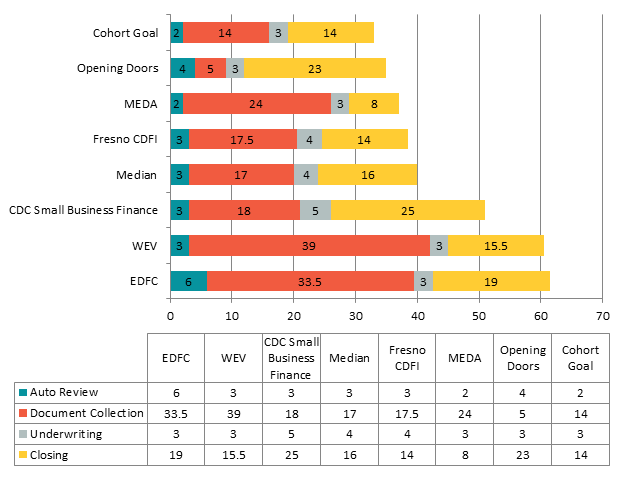

Days per milestone

CAMEO has set a benchmark goal of 33 days to completely process an application: 2 days to receive the application and run Auto Review, 14 days to collect all the necessary documents, 3 days to underwrite the application, and 14 days to close the loan and disburse payment. No organization has currently achieved this goal, although Opening Doors and MEDA have come closest, with median processing times of 35 and 37 days, respectively. The cohort takes a median 40 days per application, with the bulk of that time spent collecting documents from the borrower. Four organizations are close to the benchmark for closing an application, with only CDC Small Business Finance and Opening Doors taking more than 16 days to close an application.