The Small Business Borrower’s Bill of Rights was created to help small business leaders understand the impact that business loans have on their communities and local economies.

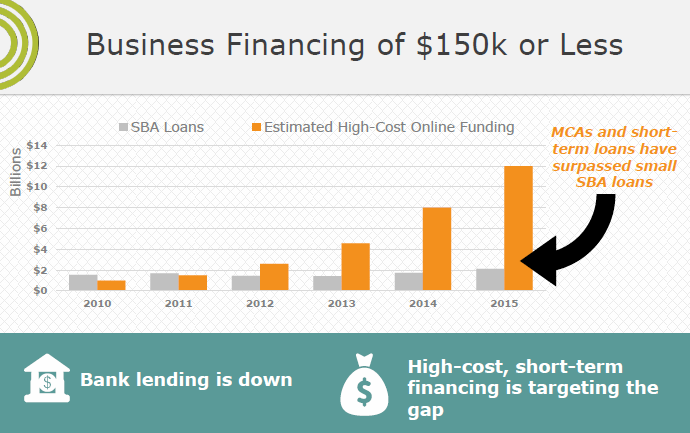

Small businesses have trouble accessing capital to grow their businesses. Traditional banks don’t loan under $250,000 anymore. The biggest online lending segment for small business loans aren’t loans at all, they’re Merchant Cash Advances (MCA). MCAs outweigh other lending by a factor of six (see photo). Often MCAs are high-cost and short-term and can easily put a small business into bankruptcy.

Small businesses have trouble accessing capital to grow their businesses. Traditional banks don’t loan under $250,000 anymore. The biggest online lending segment for small business loans aren’t loans at all, they’re Merchant Cash Advances (MCA). MCAs outweigh other lending by a factor of six (see photo). Often MCAs are high-cost and short-term and can easily put a small business into bankruptcy.

Many times merchant cash advances disguise the interest rate with fees, confusing terms, and come with pre-payment penalties. While quick money might be right in some business conditions, many small businesses get stuck in debt traps, having to borrow money just to make payments on their advances. And as merchant cash advance companies aren’t technically lenders, they are not regulated.

Opportunity Fund released a very important research report, “Unaffordable and Unsustainable: The New Business Lending on Main Street.” Until now, we have been relying on stories to explain what’s happening with online lending. Now we’ve got some data on the loans and cash advances being offered to small businesses by short-term, high-cost alternative lenders. Cliff notes on findings: 94% interest rates; average payment is 1.78x income -YIKES.

Banks decline 8,000 small business loans daily. Who is filling the gap? Easy, fast money from online lenders. But that money is often too good to be true and can really damage a business. –Claudia Viek, former CEO, CAMEO

Small business leaders need to really understand the impact that these loans have on their communities and local economies and need to know what good capital looks. Enter the Small Business Borrower’s Bill of Rights.

The Small Business Borrower’s Bill of Rights (BBOR) includes:

- Transparent Pricing and Terms

- Non-Abusive Products

- Responsible Underwriting

- Fair Treatment from Brokers

- Inclusive Credit Access

- Fair Collection Practices

The BBOR was created by the Responsible Business Lending Coalition (Accion, Aspen Institute, Fundera, Funding Circle, Lending Club, Multifunding, Opportunity Fund and Small Business Majority).

As the voice of California’s very small businesses, it’s our responsibility to let people know about the BBOR; and to let everyone know that there are good lenders out there that have a business’ best interest at heart, like some of the online lenders in the coalition and Community Development Financial Institutions or CDFIs. They offer ‘honest’ capital. We’ve spoken about this with the California legislative delegation in Washington, DC in May 2016 and are holding an informational workshop in Sacramento in August of 2016.

What Can You Do?

CDFI’s are community-based lenders whose mission it is to connect businesses with affordable capital that will help their businesses grow and serve the community. Find a CDFI in California.