In this Issue…

- 2016 MicroLenders Forum Recap

- Education Electeds on Responsible Lending

- MMS Update

- AEO’s Project CUE

- Research: SmallBiz Perspective on Online Lenders

- News

2016 MicroLenders Forum Recap

CAMEO held it’s 7th MicroLenders Forum, co-hosted by the Federal Reserve Bank of San Francisco (thanks Lena Robinson!), on January 26, 2016. It was sold out with over 70 participants that included our microlenders, regulatory friends and other colleagues.

As Claudia said in the beginning, “It’s the engagement, caring, and wholeheartedness that sets our sector apart.” That engagement is as important to CAMEO and the network as it is to your clients. We thank everyone who participated for the rich discussions on sustainability and the landscape of small business lending (click to read more). At the Forum, we introduced the following advocacy effort!

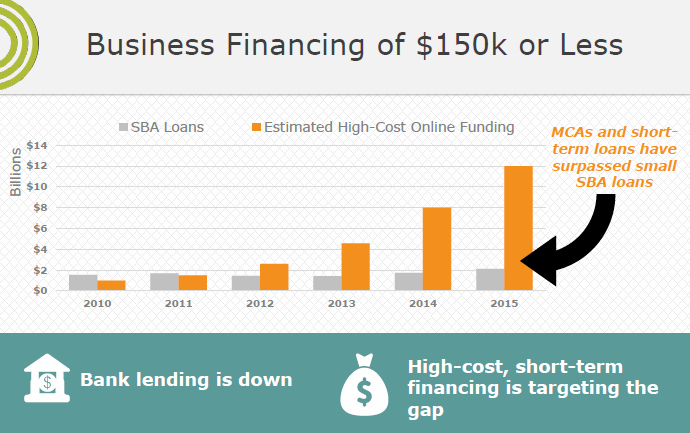

Educate Your Elected on Responsible Lending

CAMEO is launching an educational campaign to inform California’s small business leaders and elected officials on what good capital looks like. We’re asking all of our members to hold district meetings with their California state representatives during the March 18-25 break. We’ll follow up with meetings in Sacramento at our annual meeting. If you can’t make it during those times, please meet with your district staff at your convenience. Legislators welcome visits from constituents. They want to know what’s happening. Here’s some resources to help with your visits:

- Download the District Meeting webinar slides.

- Read our CAMEO Launches Campaign For BBOR.

- Find your California legislators.

- Learn more about good small business lending practices and the Small Business Borrower’s Bill of Rights.

- The Accion Network has a webpage to educate business owners on predatory lending.

Let us know when you are meeting with your legislators and if we can help in any way.

MMS Update: Program Grows and Matures

CAMEO’s innovative aggregate MMS project, started in 2012, continues to grow and evolve with California’s CDFIs.

We have six lenders using CAMEO’s MMS license – Opening Doors, Economic Development Finance Corporation, Mission Economic Development Agency, Women’s Economic Ventures, Fresno CDFI and CDC Small Business Finance.

As can be expected, there will be staff changes over time and CAMEO is stepping in to train the next wave of loan officers. Susan and Andrew welcomed Diana Matei-Golopenta, MEDA’s new Business Lending Manager with a personalized training. Andrew has worked with Jim Claybaugh and Julio Ortiz, Opening Doors’ new lending staff, over the past year.

CDC Small Business Finance has changed their policies, upping the ceiling for their MMS loans from $20,000 to $50,000. We will be checking in soon to see how their expanded MMS portfolio is doing. And we continue to strategize with EDFC on using MMS for their unique community development deals.

As OFN’s Small Business Financing webinar series (see the sidebar for upcoming webinars) and CAMEO’s Microlending Forum emphasize, stepping up on the technology front is critical for CDFIs to stay competitive in face of online lending trends.

Contact Susan Brown if you’re interested in learning more or participating in the MMS program. MMS, developed by LiftFund (formerly Accion Texas), provides instant risk assessment and fast, quality underwriting to support microlenders in scaling up and maintaining strong portfolio performance.

AEO’s Project CUE

Congrats to AEO! They won the U.S. Department of Treasury’s Innovation Challenge. Their proposal – Project CUE: Connecting Underserved Entrepreneurs – seeks to design, test and build a screening and assessment tool to match small businesses declined for loans from banks or online lenders with a CDFI that may be able to meet their needs when other lenders cannot.

Theproject reflects the goal of expanding credit opportunities for small business owners from low-income communities. The ultimate objective of the projectis to finance the development of a technology-driven solution that can be used by all CDFIs in the future and thereby expand access to capital for small businesses operating in economically distressed areas.

Read more about Project Cue.

Read why AEO’s new project that is asking the question,’Where will the proverbial puck be for CDFIs and small business owners 5 years from now?’ (Wayne Gretsky always skated “to where the puck is going to be, not where it has been.”)

Research: ‘CDFI Collaboration’ is The Name of the Game

CDFIs have sometimes worked with one another to fulfill their primary mission of providing affordable, responsible capital, credit, and financial services to low-income, low-wealth, and other underserved people and communities. In recent years, the number and types of CDFI collaborations have increased markedly. Developing and sustaining a CDFI collaboration requires a substantial commitment among all of the partners involved and some collaboration efforts never truly get off the ground. Particularly at the state and regional level, there are CDFIs that are interested in collaborating with their peers but struggle to make it happen. Why are some CDFI collaboration initiatives successful while others are not? This paper seeks to answer this and related questions by studying 12 emerging, ongoing, and completed CDFI collaborations across the industry.

News

- Proposal: make online lenders wait 10 business days from loan application date before distributing funds. Hmm…

- President Obama’s FY 2017 budget demonstrates strong support for CDFIs with this budget, including a $12.4 million increase for the CDFI Fund (the Fund). That puts the total allocated for the CDFI Fund at $245.9 million.

- Women are winners when it comes to crowdfunding.

- And investing local yields profits.