Our long-standing commitment to building California’s microlending sector is the force behind many of our recent programs: Kiva and Accion Texas partnerships, the training series last year, Claudia’s many successes in building resources for lending, to name a few. Our MicroLenders Forum is a crucial part of that effort. This year it’s on next week on January 26 at the Federal Reserve Bank of San Francisco.

Our Excellence in Lending (EiL) survey focuses on the program elements needed for a high-quality loan fund poised for growth. Using Kiva’s Field Partner metrics as a starting point, we created an assessment that included:

- Marketing

- Product Design

- Technology Use

- Portfolio Management

- Underwriting

- Approval Process

- Servicing

- Risk Management

- Earnings, Liquidity, Capitalization

- Delinquencies and Collection

Fourteen of our members lenders filled out the survey and we’ve compiled the aggregate data. This is the second year that we’ve conducted the survey, so we will be able to make a comparison. The survey will be the basis for a rich discussion at our 2016 MicroLenders Forum at the Federal Reserve Bank of San Francisco next week on January 26.

Fourteen of our members lenders filled out the survey and we’ve compiled the aggregate data. This is the second year that we’ve conducted the survey, so we will be able to make a comparison. The survey will be the basis for a rich discussion at our 2016 MicroLenders Forum at the Federal Reserve Bank of San Francisco next week on January 26.

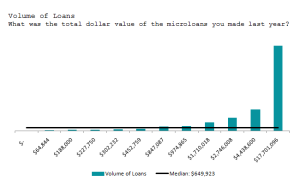

While, we’re still crunching the results, we can report an increase in microlending activity! The median number of loans increase from 28 to 30 over the reporting organizations and the top four lenders increased the number of loans they made by 19 percent and the loan volume by 50%. Not surprising, staff are going into the field more often to do business, as the median time spent in the field went from 25% to 35%.

During the morning session at the Forum, participants will discuss what they think of the results: Are there areas that the industry as a whole should address or improve? Are there areas where establishing performance metrics make sense? What needs to be in place for a CDFI to successfully scale up to, say, 200 loans per year? We’ll also discuss new research on CDFIs point to some interesting national trends that relate to CDFI sustainability. What does the research say and what does it mean for your organization? We’ll discuss what policy choices need to be made for meeting a CDFI’s mission; and how to work in efficiency and scale within those parameters.

We look forward to our members’ participation in this discussion to digest the results and plan future direction for meeting the need for small and microloans in California.

In the afternoon, we turn to the hottest topic in microlending… how to respond to the biggest online lending segment for small business loans – the Merchant Cash Advances (MCA). MCAs outweigh SBA lending by a factor of five. Ami Kassar, a prominent thought leader in the online lending sphere, will give us his insights on current and future trends in online lending.

Ami is founder and CEO of Mutlifunding, an online loan broker, a nationally known small business lending expert, and a prolific writer (e.g. Inc., The New York Times.) He is committed to ensuring that small business owners have the best possible access to the capital they need to help grow and manage their businesses.

How should CDFIs position themselves within this landscape? What is the Borrower’s Bill of Rights, why it’s important, how could our industry respond? How can we work with our bank sponsors to ensure small businesses receive the most appropriate funding.

Join us for our MicroLenders Forum! It’s going to be thought-provoking, challenging, and of course fun ;)