The MLA newsletter is chock-a-block with articles, resources, technology, success stories, interviews, and big picture ideas on all Lending Academy features.

In this Issue…

- MMS Year 2 Sees Rapid Growth

- MMS Lessons Learned

- MMS Success Story: Nikki Daley, HEAT Culinary

- Small Business Responsible Lending Coalition

- Excellence in Lending: Opportunity Fund, Scaling for the Mission

- Research: Peer to Peer Lending

- Microlending Legislation: SB 197 Signed and Microloan TA

- News

Technology: MMS Year 2 Sees Rapid Growth

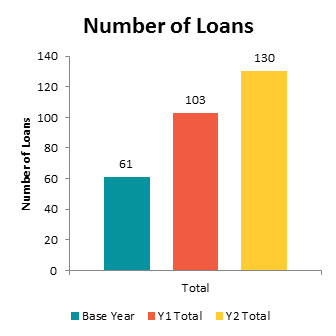

Every member of the cohort grew their lending; by anywhere from 5% to 35%. The cohort as a whole grew by 26% over last year, and 113% over the base year, more than doubling the number of loans made (see graph left). Working Solutions especially has seen substantial growth in the past two years, almost tripling its lending activity.

Every member of the cohort grew their lending; by anywhere from 5% to 35%. The cohort as a whole grew by 26% over last year, and 113% over the base year, more than doubling the number of loans made (see graph left). Working Solutions especially has seen substantial growth in the past two years, almost tripling its lending activity.

Other organizations are primed to grow; Opening Doors has brought on a new management team to replace the retiring Phyllis Guillory, and Women’s Economic Ventures has hired a second loan officer to cover their Santa Barbara service area. CDC Small Business Finance has been pleased with the performance of the loans they’ve sent through MMS, and will submit their entire microloan portfolio through the system. Previously, they had capped applications at $20,000 and limited the geographic region served by the program. Robert Villareal of CDC said, “We are going to expand our use of MMS to all our SBA microloans to increase speed, efficiency and cost.”

Three new lenders have joined – MEDA, Fresno CDFI and Mendocino’s Economic Development Finance Corporation.

Read the entire MMS Year Two Report.

Technology: MMS Lessons Learned

In August CAMEO pulled together the growing MMS tribe in August for discussion, learning and trading ideas. First we asked everyone what they like best about MMS and got some great answers. We also asked what they would like change about the system. Then we turned our attention to shortening the loan cycle with MMS. Read the MMS Lessons Learned post by Susan Brown.

In August CAMEO pulled together the growing MMS tribe in August for discussion, learning and trading ideas. First we asked everyone what they like best about MMS and got some great answers. We also asked what they would like change about the system. Then we turned our attention to shortening the loan cycle with MMS. Read the MMS Lessons Learned post by Susan Brown.

Contact Susan if you’re interested in learning more or participating in the MMS program. MMS, developed by LiftFund (formerly Accion Texas), provides instant risk assessment and fast, quality underwriting to support microlenders in scaling up and maintaining strong portfolio performance.

Success Story: Nikki Dailey, HEAT Culinary

This story comes to us from Women’s Economic Ventures. HEAT Culinary was one of WEV’s first applicants under the Microloan Management System (MMS), and has gone on to great success since receiving a loan from the organization. She’s opened a storefront and a food truck, and has many other projects in the hopper.

This story comes to us from Women’s Economic Ventures. HEAT Culinary was one of WEV’s first applicants under the Microloan Management System (MMS), and has gone on to great success since receiving a loan from the organization. She’s opened a storefront and a food truck, and has many other projects in the hopper.

“MMS has been tremendously helpful for us,” said Devon Johnson, WEV’s Director of Lending. “We’ve been able to grow our program in ways we couldn’t before, and our consistency and turnaround time has improved substantially. MMS’s underwriters enable us to give applicants an answer in days instead of weeks, and offer clear suggestions for technical assistance and credit counseling for those who don’t qualify for a loan.”

Small Business Responsible Lending Coalition

We’ve written a lot about the disruption in small business lending, especially in communities that have been underserved.

We’ve written a lot about the disruption in small business lending, especially in communities that have been underserved.

Because banks have basically abandoned the small business lending space, a number of new players have entered the arena. Merchant Cash Advance companies are now providing six times more financing to small businesses than SBA loans.

This transformation will achieve its potential only if it is built on transparency, fairness, and putting the rights of borrowers at the center of the lending process. To that end, a coalition – Accion, Aspen Institute, Fundera, Funding Circle, Lending Club, Multifunding, Opportunity Fund and Small Business Majority – identified the fundamental financing rights that all small businesses deserve.

The Small Business Borrowers’ Bill of Rights outlines six key rights that all borrowers should have. If a lender chooses to adhere to the criteria, the CEO signs the bill of rights and ensure compliance. The six key rights are:

- The right to transparent pricing and terms, including a right to see an annualized interest rate and fees.

- The right to non-abusive products, so that borrowers don’t get trapped.

- The right to responsible underwriting, so that borrowers are not put into loans that they cannot repay.

- The right to fair treatment from brokers, so that borrowers are not steered to the most expensive loans that pay the broker the highest commission.

- The right to inclusive credit action, without discrimination.

- The right to fair collection practices, to prevent harassment.

If you’re a small business lender, credit marketplace, or broker, you can sign the bill of rights. If you are another interested party, you can become an endorser. CAMEO has signed on as an endorser.

The coalition members decided that rather than hold their breaths for regulation that they would define responsible lending and educate small businesses. They’re also hoping to put market pressure on lenders to adopt more responsible lending practices.

Participate in a conversation about BBOR and learn about the ways it can help you educate borrowers and promote responsible lending practices on October 15, 2015 at 11:00am PT // 2:00pm ET.

Excellence in Lending: Scaling for the Mission

The goal of our Excellence in Lending program is to digest big picture topics important to our CDFI members: the frameworks, processes and goals that underlie programs and lead to greater success. These calls are for the big picture thinker at each CDFI, to support greater competitiveness, volume and efficiency.

The goal of our Excellence in Lending program is to digest big picture topics important to our CDFI members: the frameworks, processes and goals that underlie programs and lead to greater success. These calls are for the big picture thinker at each CDFI, to support greater competitiveness, volume and efficiency.

At the end of August, Opportunity Fund talked about scaling to reach more underserved businesses. The big take-away was Opportunity Fund’s willingness to reflect on its process, question the sacred cows of lending, conduct fresh analysis on its own portfolio performance and then, undertake the challenge of organizational and process change to improve performance and scale.

–Download the slidedeck and listen to the webinar (67 minutes)–

Their process — which does not use high tech algorithms or online applications — led them to close 1,560 microloans this past year. The business model that allows such scale has elements that all leaders in the CAMEO lending network need to consider.

Research: Peer to Peer Lending

The SBA’s Office of Advocacy details

The SBA’s Office of Advocacy details

Peer-To-Peer Lending (P2P) in a recent issue brief on “Peer-To-Peer Lending: A Financing Alternative for Small Businesses”.

“Imagine that you own a small bakery and you need $15,000 to buy a new oven. There are 15 people across the country, each of whom has $1,000 that they want to invest in a small business. The only problem is

that the likelihood of meeting all of these 15 investors is fairly low—unless you use an online peer-to- peer (P2P) lending platform.”

P2P is a business funding model in which individual investors make small personal loans online to individuals – a kind of a hybrid between crowdfunding and marketplace lending.

The issue brief explains P2P and shows a side-by-side view of P2P and how it stacks up with traditional small business financing options. It also shows how it could affect small businesses in the future, giving them more opportunity for financial growth..

MicroLending Legislation

State

State

SB 197 (Block) was signed by the governor! CAMEO co-sponsored SB 197 with Opportunity Fund and pounded alot of pavement in the Capitol to make it happen!

The bill removes a competitive disadvantage that currently affects licensed commercial lenders in California. In essence, the bill allow CAMEO’s microlenders to pay referral fees to consultants, non-profits (e.g. TA providers) and others who refer successful loans, subject to certain restrictions intended to promote responsible lending. It also will give your clients more information about affordable lending products.

Federal

The Senate is considering legislation passed by the Senate Small Business Committee that would change the SBA Microloan program. While some of the changes are beneficial to intermediaries, counselors, and entrepreneurs, the bill fails to include critical reforms that program participants have requested. For example, the current legislation would allow a waiver from the 25/75 Technical Assistance (TA) requirement to be issued by SBA. This is really unnecessary paperwork and the requirement should be removed all together. Providing business assistance that supports entrepreneurs should be at the lender’s discretion. AEO and CAMEO believe that microloan reform legislation without important changes will not best benefit the program and its users. We urge you to add your organization in support of this letter to tell the Senate to include these reforms in their legislation. If you are willing to sign on, please email our Government Relations team member John Stanford.

News

- Blacks and most other minorities continue to receive surprisingly few small business loans, high-level employment promotions and business contract opportunities. CAMEO colleagues Mark Whitlock and Aubry Stone believe “Bank Data on Diversity Can Help Close Racial Wealth Gap.”

- The Wall Street Journal calls for data to show lenders how they stack up against their competitors, and encourage them to rethink their lending strategies.

- Intuit and OnDeck have teamed up to make loans available through Quickbooks.