Prosperity Now has released the local-level data for their 2019 Scorecard, a comprehensive tool that shows the financial well-being of households in the U.S., measured across five issue areas: Financial Assets & Income; Businesses & Jobs; Homeownership & Housing; Health Care and Education.

The state-level data was released in January, with California ranking at #18 for the general prosperity of its residents but coming in at #24 when looking at racial disparity. Despite being one of the most ethnically diverse states in America, the Scorecard’s data shows that California’s wealth and prosperity gap between white residents and residents of color is wider than almost half of the other states in the country.

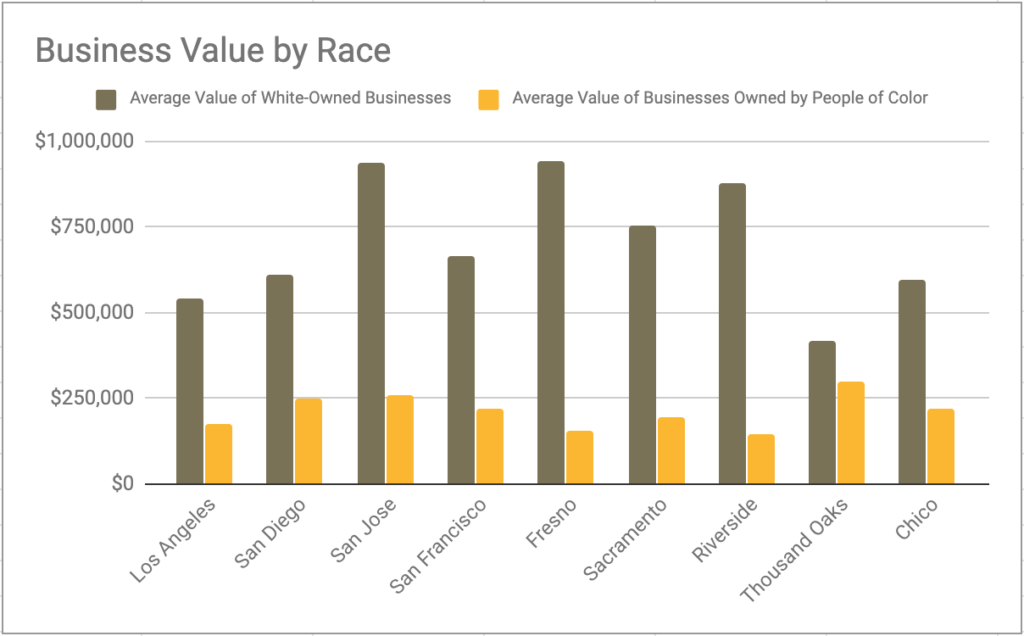

When talking about business ownership data, the Scorecard includes local-level results for Business Value by Race and Business Value by Gender. We looked at the numbers for several cities in each of California’s main regions. In terms of Business Value by Race, the data indicates that a wide racial disparity exists in all cities, whether it’s large metropolitan areas or smaller cities in rural regions. For these cities, the biggest gap was found in Fresno with a difference in business value of 84 percent, while the smallest gap is found in Thousand Oaks with a 29 percent difference. The numbers also show that the average value of businesses owned by people of color tends to hover between $100,000-$300,000, while the value of white-owned businesses varies much more widely but is always higher.

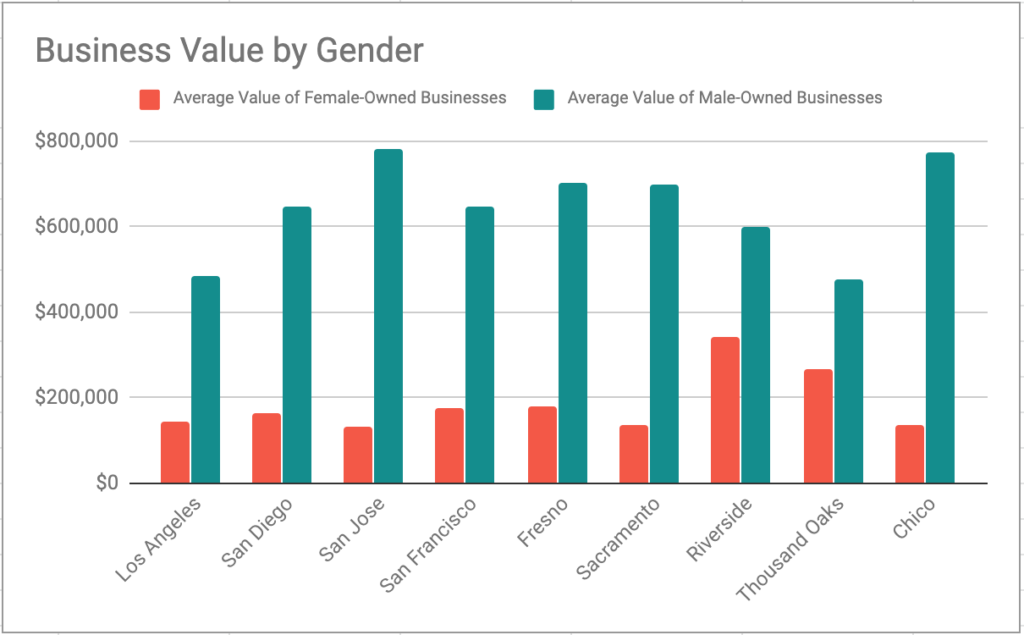

Even though the state-level Scorecard results indicate California is close to reaching parity in terms of business ownership, the numbers regarding business value tell a different and more disheartening story. Male-owned businesses in California are worth almost three times the value of female-owned businesses (2.7:1), and the local-level ratio varies widely, from 1.8:1 in Riverside and Thousand Oaks to 5.9:1 in San Jose.

Prosperity Now also released “A Municipal Policy Blueprint for a More Inclusive Path to Prosperity,” a guide intended to help municipal leaders and local advocates arrive at policy solutions that combat financial inequality and the racial wealth gap by addressing the specific challenges of each community.

The Blueprint outlines four main policy ideas:

- Income Boosts

- Consumer Protections and Debt Management

- Affordable Housing and Development

- Municipal Efforts to Build Assets

In the area of Consumer Protections, the guide offers several policy recommendations to ensure fair lending practices in communities of color. One suggestion is to enact Responsible Banking Ordinances (RBO) to encourage banks to lend in non-White neighborhoods in order to receive municipal deposits. Another suggestion promotes the regulation of predatory small-dollar lending via local laws, which include permanent bans or moratoria on new lenders, caps on the number of lenders within the municipality, use of zoning powers to limit how closely lenders can locate to one another, and requiring distribution of information about non-predatory alternatives.

Small business owners in underserved communities, faced with a dearth of options, often turn to payday loans and other forms of small-dollar lending to fund their businesses. Thus these proposed policies, though created with consumer banking and lending in mind, can also protect low-income entrepreneurs in their search for capital. CAMEO and our partners worked hard on SB 1235, a small business truth-in-lending bill that passed in 2018 and would help business owners better understand their financing options.

Another policy suggestion that aims to increase access to capital for entrepreneurs of color can be found in the Municipal Efforts to Build Assets area of the Blueprint. The guide posits that “municipalities can address inequities in access to capital by ensuring entrepreneurs of color have access to public sector procurement and contracting opportunities.”

Most cities have programs that support small business development by providing affordable loans and expanding procurement and contracting opportunities, especially to disadvantaged businesses. Considering the tremendous barriers that entrepreneurs of color face in accessing the capital, technical assistance and social networks necessary to grow a thriving business, it’s particularly important that these efforts are targeted and tracked for impact on entrepreneurs and city budgets […] These barriers impact business value for entrepreneurs of color. Increasing vendor diversity in procurement, for example, can improve competition and lower costs for city governments. While more research is necessary, preferences for more equitable procurement practices may improve outcomes for entrepreneurs as well and raise tax rolls through increases in employment.

Prosperity Now’s Scorecard and Municipal Blueprint offer great insights into the wealth and prosperity status of American households, as well as thoughtful policy ideas aimed at combatting financial and racial inequalities. The local-level results for California give us a snapshot of how our cities and regions are faring on these issues. Those of us in the microbusiness sector can use this information to advocate for better, data-driven policies that strengthen local entrepreneurial ecosystems and create thriving communities for all.