2016 California Microlending Is Up

New CAMEO Training: MicroLending Essentials, November 7-9 in L.A.

SBA Extends Deadline for Public Comment

Wells Fargo Diversity Community Capital Program

Research: New York Fed’s 2016 Small Business Credit Survey on Startup Firms

New Small Business Credit Survey Needs Your Help

News

2016 California Microlending is Up

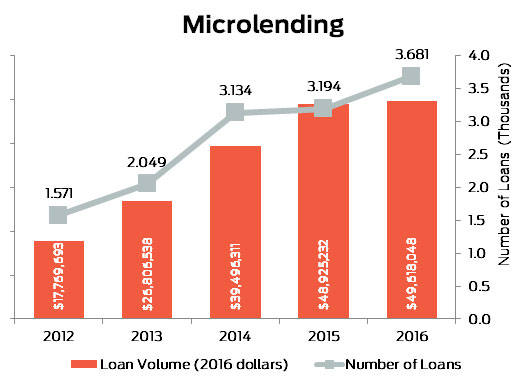

Every year, we survey our members to determine their impact and the landscape of microbusiness development and lending. We’re pleased to announce that in 2016 CAMEO lenders made 3,681 under $50,000 for a total of $49.6 million with an average loan size of $13,480.

Lending increased by 15% from 2015-2016 and by 134% since 2012!

CAMEO is committed to seeing the sector grow and has developed new tools for microlenders to meet that goal.

New CAMEO Training: Microlending Essentials, November 7-9 in L.A.

Join us for

Microlending Essentials on November 7-9, 2017 in Los Angeles.

- Are you looking for microloan underwriting training for yourself or your lending staff?

- Are you an experienced lender looking to start a microloan program and want to build efficiencies into your program?

- Are you a loan packager who wants to create better packages for your clients?

- Are you a business assistance provider who wants to invest in personal development for a possible lateral move into lending?

This new intensive training program is for staff who want to learn the difference between micro and small business lending. For more details, check the registration page.

SBA Extends Deadline for Public Comment

On August 15, 2017, the SBA or published in the Federal Register a request for information

seeking input from the public on identifying which of the Agency’s regulations should be repealed, replaced or modified because they are obsolete, unnecessary, ineffective, or burdensome. That request established a 60-day comment period closing on October 16, 2017. SBA is extending the public comment period for 30 days, until

November 15, 2017.

CAMEO submitted a comment on the 25/75 rules as applied to the Microloan TA program.

“The Microloan TA program requires that that 25% of the technical assistance given to the entrepreneur by the lender be provided pre-loan and 75% post-loan. This formula is inflexible and does not always meet the needs of entrepreneurs seeking capital. We would this requirement to go away….”

We encourage you to submit a comment on this or other issues.

Wells Fargo Diversity Community Capital Program

Congratulations to

Accion, Opportunity Fund, and Working Solutions for being 2017 Awardees of the

Wells Fargo Diverse Community Capital Program. Wells Fargo has committed $75 million to CDFIs across the country. The program makes available $50 million in lending capital and $25 million in grant capital to be disbursed over three years.

Round 4 is now closed. Round 5 will open November 1 with Interest Forms due

November 21. Gallup’s industry-leading report, sponsored by Wells Fargo, provides insight on

lending to diverse small business owners.

Research: New York Fed’s 2016 Small Business Credit Survey on Startup Firms

The

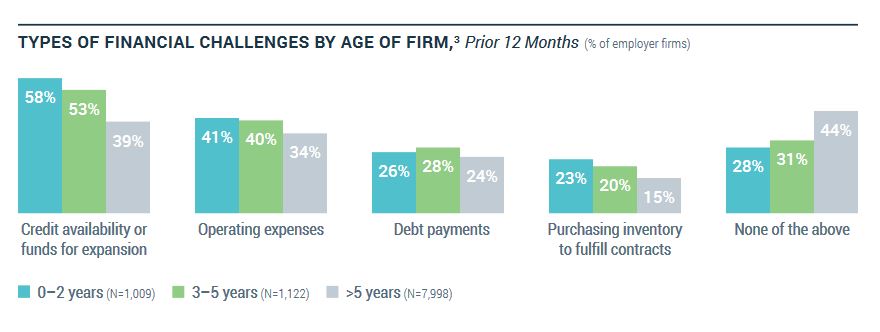

2016 Small Business Credit Survey: Report on Startup Firms, released this month by the New York Fed, investigates this question and several other borrower-related ones to better understand startups’ needs for and access to capital. Some key findings include:

- Startups have strong demand for financing yet neeedsmaller financing needs than mature firms. 63% of startup applicants sought $100,000 or less in financing, compared to 49% of mature applicants.

- Financing challenges for startup firms are more common than for mature firms, even at comparable credit risk scores.

- Credit cards are important financial products for startup firms.

- More than half of startup nonapplicants are either avoiding debt or are discouraged from applying.

New Small Business Credit Survey Needs Your Help

That great report that you just clicked on above is expanding. CAMEO is partnering with the

Federal Reserve on a Small Business Credit Survey for both pre-start and existing businesses to

help business service providers and lenders understand real-time business conditions.

Reports planned for 2017 include: reports on minority-owned, women-owned, micro, and rural firms.

Right up our alley and important to our field! Help the Federal Reserve, the sector, and the clients you serve.

We are asking you to send an email to your client and have provided a draft below. Feel free to edit as necessary.

SUBJECT LINE: “How is your business doing?” Or “Small Business Owners: Make your voice heard!”

Dear Business Owner or Manager,

As a CAMEO member, [MYORGNAME] is partnering with the Federal Reserve on a Small Business Credit Survey for both pre-start and existing businesses, and we’d like you to participate. Your answers will help business service providers and lenders understand real-time business conditions. This short survey takes less than 9 minutes to complete. Individual responses are confidential and summary results will be shared with you.

Take the survey today!

Questions? Contact SmallBusinessResearch@atl.frb.org.

If you have problems with the link above, copy and paste the following URL into a new browser window: https://frbatlanta.co1.qualtrics.com/jfe/form/SV_0pQZOEEPPnpFNlj?orgid=CAMEO&parentid=&reserve_bank=SF.

News

]]>

Every year, we survey our members to determine their impact and the landscape of microbusiness development and lending. We’re pleased to announce that in 2016 CAMEO lenders made 3,681 under $50,000 for a total of $49.6 million with an average loan size of $13,480.

Lending increased by 15% from 2015-2016 and by 134% since 2012!

CAMEO is committed to seeing the sector grow and has developed new tools for microlenders to meet that goal.

Every year, we survey our members to determine their impact and the landscape of microbusiness development and lending. We’re pleased to announce that in 2016 CAMEO lenders made 3,681 under $50,000 for a total of $49.6 million with an average loan size of $13,480.

Lending increased by 15% from 2015-2016 and by 134% since 2012!

CAMEO is committed to seeing the sector grow and has developed new tools for microlenders to meet that goal.