Lending is a complicated affair. Most CDFIs start small, with informal, idiosyncratic loan processes that involved much conferring among staff. As an organization grows, there isn’t time or resources for these labor-intensive ways. Yet process, once established, can become entrenched – staff is attached to established practices. It also becomes invisible or normalized to the point where people can’t, initially, even imagine doing things any other way.

In addition, technology marches on, changing established industry norms for customer service, ease and speed, which can render an organization’s process obsolete, or inefficient given new resources.

That process can become entrenched, invisible and obsolete can be daunting to a CDFI director wanting to institute change to increase volume and impact.

Process mapping, which creates transparency and detail, is one solution. It shines a light on existing processes by identifying the specific steps and the amount of time for each step, so that they can be assessed and adjusted to increase efficiency. This concept was the focus of OFN’s May 5th webinar, Efficiencies in Lending, and CAMEO’s peer learning call the following week.

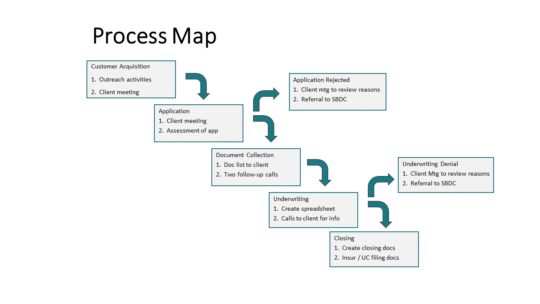

First step is to identify, using the whole team, all that happens to take a loan from initial client contact through servicing. Map out all the major steps, then the specific tasks within each step. Then add the number of days each task takes, and which staff are responsible for each step. (A simplified map is shown below. A complete map would include all the tasks at each step, who does each task and the amount of time for each.)

Here are a few of the many benefits:

- Build morale and teamwork. Creating the process map is a group effort that gets everyone involved and on the same page. It can give everyone a voice in creating a picture of how the organization works now and how it will operate in the future.

- Shed light on big picture. In larger organizations, staff often only see their piece of the pie. Having the entire team participate can help everyone see the entire process and open their eyes to all the issues involved.

- Identify vague problems. Diagramming all the steps and the time it takes for each step can reveal the exact cause of problems that have been perplexing everyone.

- Identify bottlenecks. Once your process is mapped with number of days for each step, your team can compare itself to others. The group can decide what are good comparisons: Our own standards of good customer service? Other CDFIs? Banks? Alternative lenders?

- Create solutions to make process more efficient. This process gets everyone thinking about how it could be different and better. The process map leader can take everyone’s input and design a new process map, enlisting the team to implement it across the organization.

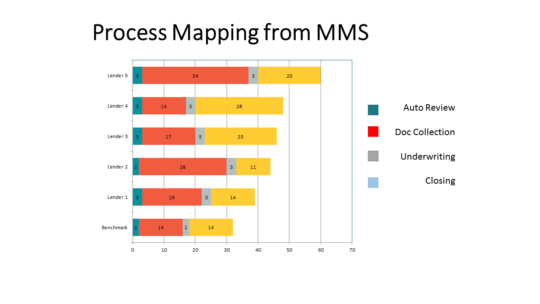

CAMEO’s MMS project creates an abbreviated process map for participating CDFIs. Below is process map for five lenders, showing how many days it takes each organization for four lending steps: Auto Review (automated risk assessment of an application); Document collection; Underwriting; and Closing.

As you can see, the chart allows each CDFI to see how it is performing on each step, compared to four other lenders and compared to a benchmark. The lenders vary in how long it takes them to complete the entire loan cycle (38 days to 60 days) and how long each step takes (one lender takes 14 days to collect documents, another takes 34).

This process map can help a CDFI see its process and decide if it is satisfactory. We have found it can come as a surprise, because, again, the process and the time it takes tend to be invisible. It can startle a CDFI into asking, ‘Why is it taking us 34 days to collect all the supporting documents for a loan, while our colleagues can do it in half the time?’

On the other hand, CDFIs are always balancing efficient transactions with building client relationships. One of the MMS lenders feels that having borrowers present to the loan committee is an important step that builds capacity, connection and commitment — even if it adds 7 to 10 days to the closing process.

The CDFI organizations who presented the OFN webinar committed to efficiency through process mapping, then setting goals and efficiency standards. They changed their processes and who did what. They also made individual and group performance public throughout the organization.

These steps change the culture of an organization, can initially be uncomfortable and can even lead to staff changes. Therefore it takes leadership, teamwork and commitment to see it through. Please let CAMEO know if you would like help with a process mapping project. We are here to support you.