|

Hi {FIRST_NAME|Friend},

The MLA newsletter is chock-a-block with articles, resources, technology, success stories, interviews, and big picture ideas on all Lending Academy features. This edition focuses on capacity building and lists several opportunitties for training, whether they be peer calls, webinars or tools you can use. In this Issue…

|

Take Action: Increase Capital Access for Microbusinesses

We are co-sponsoring SB 197 (Block) with Opportunity Fund. The bill will allow California's microlenders to pay referral fees to consultants, non-profits (e.g. TA providers), and others who refer successful loans. It will give your clients more information about affordable lending products and enable microlenders to more easily compete with online alternative lenders.

We are co-sponsoring SB 197 (Block) with Opportunity Fund. The bill will allow California's microlenders to pay referral fees to consultants, non-profits (e.g. TA providers), and others who refer successful loans. It will give your clients more information about affordable lending products and enable microlenders to more easily compete with online alternative lenders.

The hearing is April 29th in front and we need your letters of support if you haven't send them in already!

Download the SB 197 Support Letter Template and put it on your letterhead. Edit appropriately, then email to: Senator.Block@senate.ca.gov, and cc Eileen.Newhall@sen.ca.gov and me by April 21, 2015!

For more information check out the Must Know from February 19, 2015.

Excellence in Lending Step Two – Definitions

Our Excellence in Lending (EiL) program, focuses on the elements needed for a high-quality loan fund poised for growth. Using Kiva’s Field Partner metrics as a starting point, we created an assessment that was the basis for a rich discussion at our 2015 MicroLenders Forum at the Federal Reserve Bank of San Francisco in mid-January.

Our Excellence in Lending (EiL) program, focuses on the elements needed for a high-quality loan fund poised for growth. Using Kiva’s Field Partner metrics as a starting point, we created an assessment that was the basis for a rich discussion at our 2015 MicroLenders Forum at the Federal Reserve Bank of San Francisco in mid-January.

Susan Brown said of the assessment:

The reception of the assessment went beyond my expectations. I was so happy to hear several people say that they wanted to revisit the assessment and have quarterly peer meetings to discuss, address issues revealed in the reports.

Our discussion revealed the need to better define some terms so that organizations measure performance in the same way. Other issues that arose included creat benchmarks and operational standards and how to add sustainability and scale while reducing risk. Once determined organizations' key ratios can be valuable to better position microlending to funders and policy makers.

There was so much food for thought that we're holding our first EiL Peer Call on April 2 from 1:30-2:30pm.

Read Susan Brown's blog post about what the assessment measured and what topics showed a wide variety of standard of practice.

Technology: MMS Update – Peer Calls

Speaking of peer calls, one of the benefits of joining the MMS cohort are peer calls to help get the most out of your lending program. Our first call for 2015 is on April 30th to talk about MMS reporting capacity. MMS has some horse power that we haven't tapped. We will have a couple of sample reports and walk you through the report creating process. For example, we can use MMS to look at demographic information about loan applicants or build reports on how your referral partnerships are working.

Speaking of peer calls, one of the benefits of joining the MMS cohort are peer calls to help get the most out of your lending program. Our first call for 2015 is on April 30th to talk about MMS reporting capacity. MMS has some horse power that we haven't tapped. We will have a couple of sample reports and walk you through the report creating process. For example, we can use MMS to look at demographic information about loan applicants or build reports on how your referral partnerships are working.

We'll also talk about future Peer Learning topics such as: your individualized underwriting grid, application fees, staffing to maximize MMS, and identifying loan delay points.

To keep you updated on the progress of the MMS cohort — they made 92 loans for a total of $1.58 million for the program-year-to-date, and they are on pace to make an estimated 133 loans for $2.28 million, a 50% increase over last year.

Contact Susan Brown if you're interested in learning more or participating.

Success Story: VEDC – 36 Deals Per Staff

VEDC’s microloan program has surpassed all its California CDFI peers in staff efficiency, averaging 36 loans closed per FTE staff person last year.

VEDC’s microloan program has surpassed all its California CDFI peers in staff efficiency, averaging 36 loans closed per FTE staff person last year.

“We have an operational plan that has helped us gain efficiency,” says Brandon Napoli, Valley Economic Development Corporation’s Director of Microlending. “We have agreements on who does what and how long each step should take. We can monitor when things get off track.”

So far VEDC has implemented little automation. “We’ve had a pretty manual process up to this point,” says Brandon.

Susan Brown talked to Brandon about how VEDC has scaled and how they plan to expand further in her latest blog post.

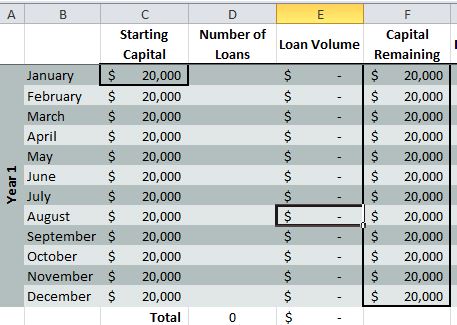

Best Practices: Projecting Loan Capital

CAMEO has developed a tidy 'Loan Capital Projection spreadsheet tool to project how much loan fund capital you will need based on loan volume, interest rate and loan loss rates. Susan Brown, our microlending guru, led a webinar to explain how it works on March 11,2015. We receieved several suggestions on how to improve it to meet your loan fund operational needs and will be updating the spreadsheet. If you are interested in receiving an updated copy, email Andrew Cole, our data guy who created the spreadsheet.

CAMEO has developed a tidy 'Loan Capital Projection spreadsheet tool to project how much loan fund capital you will need based on loan volume, interest rate and loan loss rates. Susan Brown, our microlending guru, led a webinar to explain how it works on March 11,2015. We receieved several suggestions on how to improve it to meet your loan fund operational needs and will be updating the spreadsheet. If you are interested in receiving an updated copy, email Andrew Cole, our data guy who created the spreadsheet.

We even have one member who is using the tool to make the case for more loan capital which has impressed her investors!

Listen to the Loan Capital Projection webinar.

Mark your calendar for more MLA Best Practices Webinars

- May 27: Cash flow Projections will train your staff on projections and give them a format for teaching projections to business clients.

- June 17: Balance Sheet Basics is an introduction to balance sheet accounts, what they mean and how they work together.

- July 8: Balance Sheets Part II will provide an understanding of how management decisions impact the balance sheet so trainers can steer clients in the right direction.

Research: Joint Small Business Credit Report

The Federal Reserve Banks of New York, Atlanta, Cleveland and Philadelphia studied small business lending in 10 states. If we apply what they learned to California, we can conclude that the market for loans under $100,000 is huge.

The Federal Reserve Banks of New York, Atlanta, Cleveland and Philadelphia studied small business lending in 10 states. If we apply what they learned to California, we can conclude that the market for loans under $100,000 is huge.

Eighteen percent of microbusinesses are looking for credit, which means more than 700,000 California businesses are looking for loans. About half of them are looking for less than $100,000. Collectively CAMEO members made over 2,000 loans. A majority of small firms (under $1 million in annual revenues) and startups (under 5 years in business) were unable to secure any credit. The top reason for denials was a low credit score.

To us, this report spells opportunity Opportunity! for microlenders and business assistance providers.

The Federal Reserve will host a webinar – Key Findings from the Federal Reserve's 2014 Joint Small Business Credit Survey – on April 30, 2015 at 12:00pm PT.

News

- Opportunity Fund's Gwendy Brown and Eric Weaver explore the rise of alternative and

subprime business finance and the implications for Main Street business owners. - Lending Club is partnering with what seems like everyone, including Google and 200 community banks.

- Square is getting into small business services including offers of small Merchant Cash Advance products (usually $4,000 to $10,000) to small businesses that use Square.

- And a new infographic compiled by the Federal Reserve, Pepperdine University and online lending company FundWell aims to shed light on what small businesses can do to optimize their financial health.