- Take Action: Truth in Lending!

- CAMEO Webinar on Disaster Prep

- Independent Work is the New Normal

- FIELD’s microTracker census is open! Fill it out and treat your staff to lunch. Submit by August 31 and get a free premium membership to microTracker.

- The Goodies – This week’s highlight is: Applications are due for SB TAEP, the Capital Infusion Program, and the Small Business Technical Assistance Program (SB TAP) on August 24, 2018.

Take Action: Truth in Lending!

CAMEO is excited to announce broad support for SB 1235 (Glazer). We’ve been working really hard with the author’s office and many allies (Small Business Majority, Lending Club, Greenlining, CRC, Opportunity Fund, Funding Circle, and CDC Small Business Finance to name a few) to make sure that it is a good bill that will help small business owners understand their financing options. We succeeded!

The bill provides the Department of Business Oversight the flexibility to set disclosure standards for small business lending. This bill would become the first small business truth in lending law in the country! Once again California leads the way. If you remember in October 2016, the JEDE committee hosted CAMEO, Opportunity Fund and Funding Circle for a legislative briefing that was very well attended, but no one thought anything would happen for a long time. So we’re grateful to Senator Glazer for his leadership and desire to support small business. The author has taken suggestions from both industry and advocates and earned our strong support. This bill will support small businesses in their quest for access to capital, growth, and success.

SB 1235 will most likely go to the Assembly floor early next week and then to the Senate floor the next day. You can support this bill by 1) signing on to the SB 1235 coalition letter by sending me your logo ASAP (as in now!) and 2) calling your assembly members and senators and ask them to support. It takes two minutes to call your legislators. Here’s a script.

- SB 1235 would become the first small business truth in lending law in the country.

- It would protect California’s small businesses and economy, support responsible industry innovation, and set the standard for the rest of the country to follow.

- We are very pleased to be able to come out strongly in support of this bill.

Find your California state representatives.

If you need convincing on why to act or resources to help your clients, check out the following:

- The Federal Reserve Board’s “Browsing to Borrow: Mom & Pop Small Business Perspectives on Online Lenders” examines small business owners’ perceptions of online lenders and their understanding and interpretation of the information that online lenders use to describe their credit product.

- CDC Small Business Finance developed a primer for small business who “Want to Get an Online Small Business Loan?” It’s a great resource to share with all your clients!

CAMEO Webinar on Disaster Prep

Our thoughts go out to our friends in Redding, Mendocino, and Lake County – as well as all the other areas that are experiencing the effects of the fires.

We gathered a panel of disaster program experts and CAMEO members that have had to respond to “Declared Disasters” and have experience delivering the appropriate services to their clients that have been affected. Listen to the webinar.

To get an idea of how WEV responded last year, read “The Role of Business Assistance in Disaster Recovery Efforts.”

Listen to the webinar

Independent Work is the New Normal

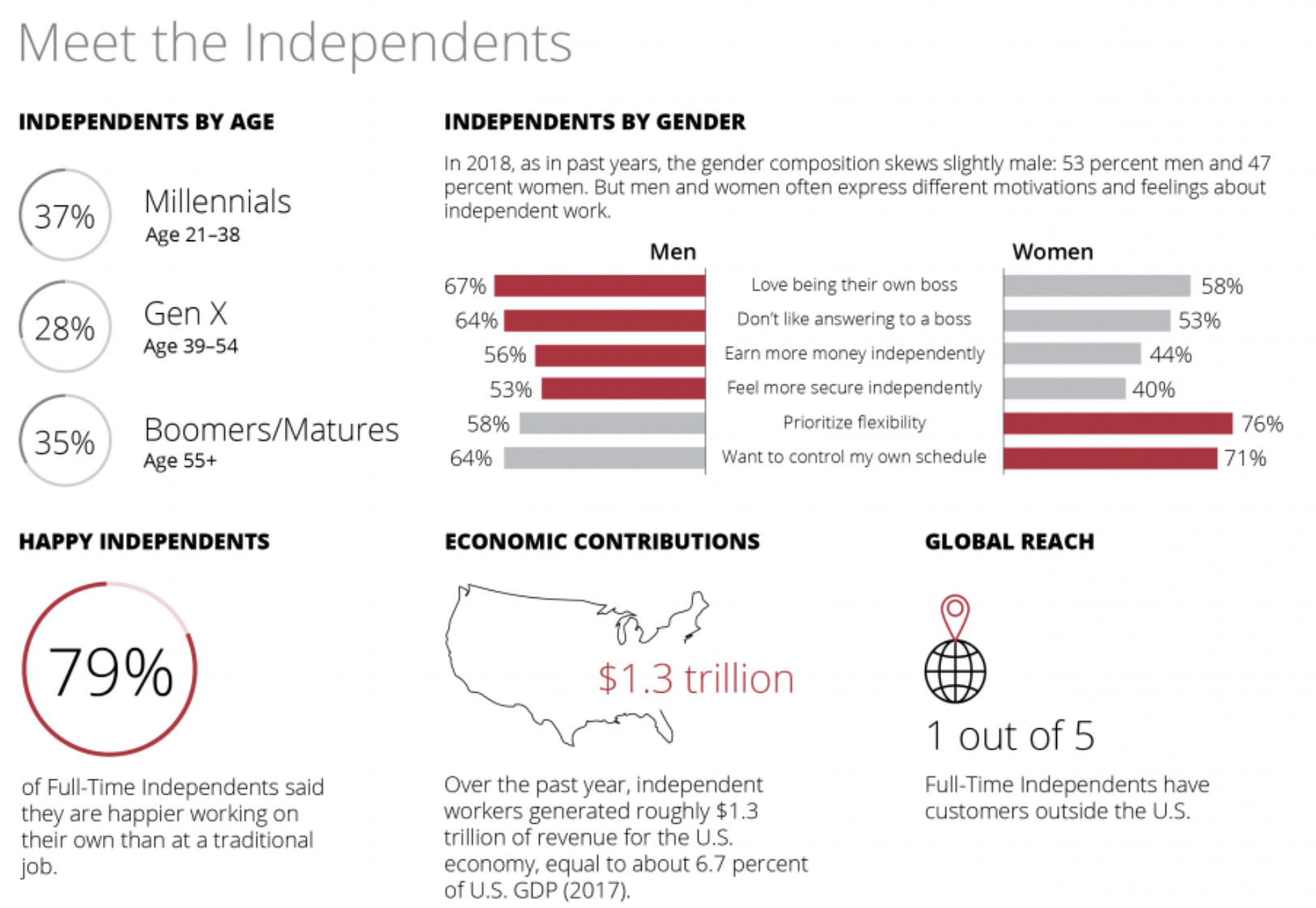

Well, we all know that! Since 2011, our friends at Emergent Research have published the “MBO Partners State of Independence in America” study, which offers insights into the growth of the independent workforce. (Click on the picture for to enlarge.) Here are some highlights:

Well, we all know that! Since 2011, our friends at Emergent Research have published the “MBO Partners State of Independence in America” study, which offers insights into the growth of the independent workforce. (Click on the picture for to enlarge.) Here are some highlights:

- Traditional jobs aren’t going away.

- Full-time independent work is becoming increasingly attractive for those with highly sought-after skills.

- There’s an uptick in people seeking this type of work, especially as a side gig.

- Combining traditional with independent work is the new normal.

Find out more on our blog – Independent Work is the New Normal.

Also, read Daniela’s post from last week about how tax reform is hitting small businesses – “The Effects of The Tax Bill Are Starting To Show.”

The Goodies

New opportunities for training, conference information, funding, scholarships, and other information that have crossed our desks since the last Must Know. I have posted a running tab of current Industry Goodies on the CAMEO website that lists items that were in past emails. Check it out to make sure you’re not missing anything, like grants whose deadlines are still alive!

Member Kudos: Opportunity Fund recently announced a campaign to identify, educate, mentor, and provide access to capital for women-owned small businesses. Opportunity Fund Empowering Women (OFEW) offers an affordable and responsible working capital loan that rewards borrowers with 2% off the annual interest rate when they apply for free mentoring.

For Your Clients: Greenlining invites you to take the 2018 Survey of U.S. Latino Business Owners. Every year, the Stanford Latino Entrepreneurship Initiative (SLEI) surveys thousands of Latino business owners across the country to measure the critical impact Latino entrepreneurs have on the U.S. economy. Let your clients know that if they fill out a survey, they will have a chance to win a $50 Amazon gift card (for completed surveys).

New Resource: Credit Builders Alliance released Achieving Credit Strength: A Toolkit for Supporting Returning Citizen Entrepreneurs.

Professional Meeting: The Federal Reserve Bank of San Francisco, and the counties of Alameda, San Francisco, and San Mateo partnered with two CAMEO members – Working Solutions and Opportunity Fund – to develop a microloan program that provides capital for nail salons to become recognized as Healthy Nail Salons. Learn about the results of the pilot, and hear the story of how unlikely partners came together to promote the health of low-income nail salon workers. Register for “Expanding Access to Capital to Advance Healthy Nail Salons” on Tuesday, August 21, 2018, 10:00am-12:00noon.

Free Webinar: America’s cities are facing an identity crisis. Cities represent both the idealistic promises of economic opportunity and the unprecedented gap between the “haves” and the have-nots.” Join Prosperity Now and the National League of Cities (NLC) on Tuesday, August 21, 2018, from 11:00am-12:00pm PDT for “A Municipal Blueprint for a More Inclusive Path to Prosperity“.

For Your Clients: Join Small Business Majority for “Join the Crowd: Basics of Crowdfunding for Small Business” on August 23, 2018, 10:00- 11:00. Learn about how small businesses and entrepreneurs can utilize crowdfunding to fund their ventures.

Funding Opportunity: You can watch Go-Biz’s Small Business Technical Assistance Expansion Program (SB TAEP) Pre-Bid Webinar. Go-Biz also created a new page on the GO-Biz website that contains the Program Announcements for SB TAEP, the Capital Infusion Program, and the Small Business Technical Assistance Program (SB TAP). Applications are due for the TAEP program on August 24, 2018.

For Your Clients: Small Business Majority is hosting a webinar series discussing workforce and healthcare laws and programs that offer a competitive advantage for small businesses and help retain and attract employees. Register for “California Workplace Benefits Webinar: Healthy Employees, Healthy Bottom Line” on August 28, 2018, 10:00-11:00am.

For Your (Young) Clients: BizWorld is hosting the Girlpreneur competition during the WorldWideWomen Girls’ Festival at Santa Clara University on Sunday, October 6, 2018. The are inviting girls ages 8-18 to apply to pitch their business ideas to our panel of expert judges and compete for the Grand Prize of $1,000! The application deadline is September 2, 2018.

For Your Clients: SCORE and Home Shopping Network (HSN) have partnered up to search for new consumer products to be introduced to HSN’s audience of 96 million households! Encourage your clients who focus on consumer products to submit their product offering for evaluation. The Northern California program begins with a free Informational Event, to be held at West Valley College, Saratoga on September 15, 2018, with the actual product pitches in mid-November. To learn more about this opportunity, download a Score Your Dream Flyer.

Professional Development: Opportunity Finance Network will hold Executive Training for CDFI Board Members on Thursday, September 27, 2018, in Jacksonville, FL. This is an executive-level course designed to strengthen high-performing CDFI board leadership.

Professional Conference: The 34th OFN Conference – “CDFIs: Agents of Change” – takes place October 8-11, 2018 at the Marriott Marquis Chicago.

For Your Clients: The U.S. Small Business Administration is now accepting nominations for its 2019 National Small Business Week Awards, including the annual Small Business Person of the Year. The deadline is January 9, 2019.

Got Federal Funds: The US General Services Administration has changed their policies regarding the online System for Award Management. As of April 27th, all users must submit a notarized letter naming an Entity Administrator to the Federal Services Desk in order to activate their sam.gov registration. Any organization applying for federal or state funding through grants.gov is required to have a current registration with sam.gov in order to submit their application, so make sure to check your account! More information, including a template for the notarized letter, click the link.

New Report: The SBA Office of Advocacy release “One Year of Equity Crowdfunding: Initial Market Development and Trends.”

New Report: The SBA Office of Advocacy Research release “Why Do Businesses Close“, using U.S. Census Bureau data, and found that over the last 25 years, about 7–9 percent of employer firms close every year and a slightly higher share open. Many reasons for closing are personal.

Free Webinar: EARN hosted “Big Data on Small Savings.” Click to download the slides.

Communications Resource: Need images, check out the doodle library.